Discover more from AutoMarketplace

🤝 As Manhattan Congestion Hearings End, City Confirms Taxi Medallion Debt Deal. Why It's A Landmark Event

Mayor Adams, NYC Taxi & Limousine Commission (TLC) Chair David Do & the New York Taxi Workers Alliance (NYTWA) finalize debt deal to restructure over 3,000 medallion loans

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️

About ten months after its initial announcement, Mayor Eric Adams, newly appointed TLC Chair David Do and the New York Taxi Workers Alliance (NYTWA) have managed to cross the finish line 🏁 on a broad based taxi medallion debt restructuring deal with the industry’s most consequential investor - Marblegate. The deal, which is slightly enhanced from the original announcement, is set to impact over 3,000 medallion owners. Given 13,587 medallions exist, that’s over 20% of the entire NYC yellow cab 🚕 industry!

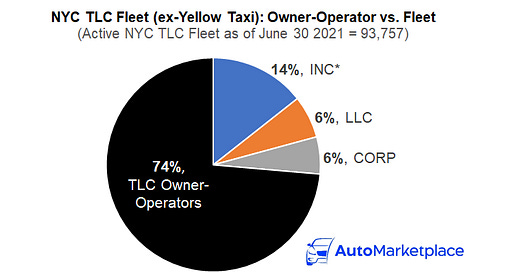

Outside of the obvious importance to taxi medallion owners and drivers, other TLC drivers may shrug at this announcement🤷♀️. Especially as many of those TLC “Uber & Lyft” drivers, along with yellow cab drivers, concentrate (we’ll have more coverage on that soon as well) on the final day of congestion pricing public hearings. So, why do we think, in this moment, it’s actually really important to pay attention to the finalization of a taxi medallion debt restructuring deal?

In a nutshell, three words - CITY LOAN GUARANTEE.

Announcement of initial deal in November 2021 👇

City Loan Guarantee

If you read the City’s official announcement, published yesterday, a who’s who of prominent local and national politicians, including US Senate Majority Leader Chuck Schumer, wanted to make sure their official statements were in the record 📜. To be fair, it’s quite an achievement for all parties involved, including the New York Taxi Workers Alliance (NYTWA). To get this fairly complex deal over the finish line is no easy feat. Political credit and commendations are genuinely due 👏.

For the curious reader, in several of those statements a “city-backed guarantee” or “the city guaranteeing their loans” is mentioned. So what does that exactly mean and why do we think it’s important?

🌆 What Is A City Guarantee?

In simple terms, if a medallion owner cannot pay their debt, the City (using government finances if need be) will make sure their lender, in this case Marblegate, is paid. This City Loan Guarantee is a financial backstop that helps taxi medallion lenders, such as Marblegate, get comfortable and to the negotiating table. After all, why would Marblegate be willing to write off $300,000+ of individual medallion debt? 🤔

Although it’s hard to feel sorry for a hedge fund 🐊 🥲 like Marblegate, one must wonder, even for curiosity sakes, how they are not losing a ton of money for their investors with a large loan write off like this? Alternatively, how would you incentivize Marblegate to even consider such a write off, when they simply could just claim the medallion collateral that backs the loan they own? Finally, if they reclaimed the medallion, who’s to say that that even has any value left or could be leased out or sold in a way that results in a financially acceptable outcome?

📘 Debt Restructuring Case Study

You have to remember a few dynamics when thinking through this.

Marblegate, and this is NOT a crime, likely bought the taxi medallion debt (& actual taxi medallions) at a steep discount to face value (or underlying taxi medallion value) AFTER doing their due diligence. Remember, this was a VERY RISKY bet. We are talking taxi medallions & medallion debt at the height of their pre-pandemic collapse…and Marblegate is putting their investors (& likely own) capital at risk in that moment? 😑

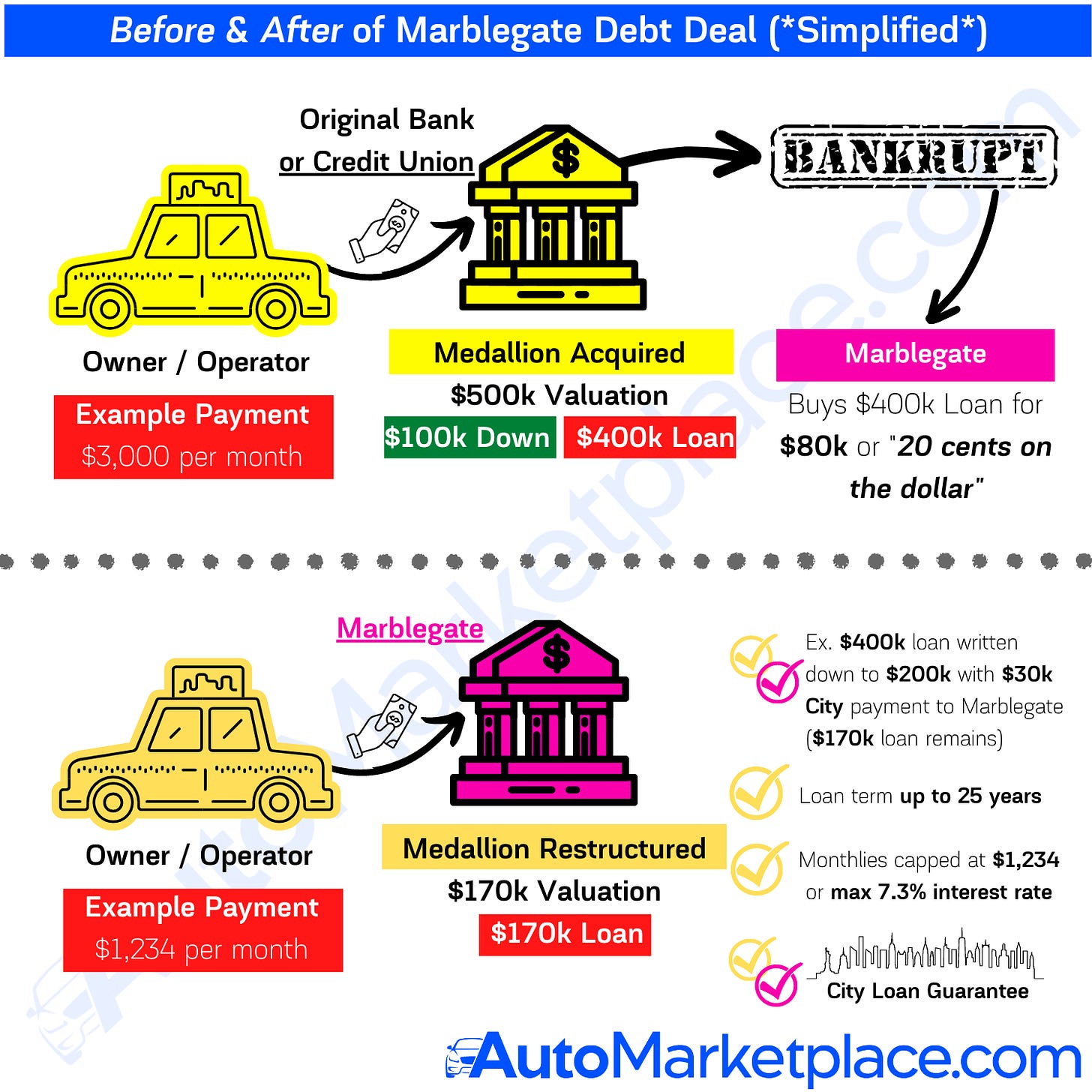

On the taxi medallion debt side it might have looked something like this:

Marblegate would have acquired medallion debt for 20 or 30 cents on the dollar of the original loan amount from financially distressed credit unions and other institutions that faced dire prospects of recovering even 50 cents on the dollar of their original loan(s).

Imagine you’re Melrose Credit Union and sitting on a $500,000 taxi medallion loan in 2017, whose underlying taxi medallion collateral is plummeting and fast 📉📉.

You are prepared to sell that loan for a steep discount to just get any sort of recovery, as your borrower (NYC taxi driver or fleet) can’t make the loan payments anymore AND the medallion collateral is also significantly devalued - it’s a VERY BAD situation for everyone.

Remember though, Marblegate is still owed the face value (original loan principal) of the loans they acquired. The firm simply acquired the debt from the original financial institution at a discount. The obligation of the borrower (NYC taxi driver or fleet) does not change though. While this sounds like a shady 🕵️♂️ financial deal, Marblegate, in fact, can be viewed as a sort of lifeline. They might be more constructive as the new owner of the loan, which they bought at a discount. The original lender has booked a massive loan loss and either walked away learning tough lessons or went bankrupt

So that’s a simplified illustrative setup to how Marblegate may have been positioned PRE-PANDEMIC. Then a pandemic hits and all bets are off, the 20 cents on the dollar discount for some months even looks like a bad deal as medallion values continue to plummet. Borrowers (NYC taxi driver or fleet) legitimately can’t make any payments and now you’ve gone from being the clever hedge fund buying distress debt for 20 cents on the dollar, to facing your own crisis 😰. This is all easy to look back at and say everything worked out AFTER THE FACT, but I’m sure there were some sleepless nights for not only taxi drivers, but Marblegate investors and investment professionals.

Without getting into even more granular illustrative dynamics (remember we don’t know the exact details, but can hypothesize) of the debt restructuring and the multiple factors that caused the taxi medallion crisis, which we’ve covered in previous pieces (be sure to search 🔍 our archives), what does the final medallion debt restructuring deal with Marblegate look like? We are also assuming most other medallion lenders, the handful that survive, will follow Marblegate’s lead.

Below, we provide a simplified infographic, which will bring us back to why the City Loan Guarantee is very conceptually important to understand.

Impact on Congestion Pricing Exemptions, ‘TLC Plate Cap’ & The Entire TLC Industry

Let’s go back to first principles here. The City had two broad choices.

Let the taxi medallion system die and suffer the consequences from lawsuits to drivers being pushed to financial ruin, OR

Make sure the taxi medallion industry is stabilized and sufficiently protected

As recently as 2014, medallion auctions netted the City hundreds of millions for its budget. Outside of reducing congestion, one can say another main driver of central Manhattan tolling relates to the dire financial circumstances of the MTA. While the MTA is a State & City controlled organization, it might have been nice to have a mechanism where one could raise hundreds of millions of dollars by auctioning a handful of medallions 🤔. Instead the taxi medallion is classified as a distressed asset. We believe over time, several years from now, the NYC government will reclaim this financial mechanism, via medallion auctions or FHV license lotteries, for raising money.

The City Loan Guarantee essentially OBLIGATES the City and Taxi & Limousine Commission to protect the value of the NYC taxi medallion franchise. This doesn’t mean medallions are going to be worth $1 million again, but it also means it can’t be worth nothing (or specifically lower than ~$170,000 base line of the Marblegate deal).

So, how does this all tie together with congestion pricing exemptions, the FHV license determination (aka TLC Plate Cap) and the future of the entire NYC for-hire transportation market?

We believe the following will play out.

The MTA will exempt yellow cabs from congestion pricing tolls. It would be shocking to us if they did not. FHVs will also not be double taxed, but yellow cabs will have preferential treatment given their street hail rights as well.

The TLC will effectively determine that no more TLC plates (exception being wheelchair accessible vehicles (WAVs)) will be allowed for years. Although the once every six month determination is a good market mechanism, the yellow cab market is a far way from recovery as we recently wrote about.

The TLC will increase taximeter rates (a hearing on this already occurred) and perhaps lease caps. Both will be positive for medallion values.

Yellow cabs will soon debut on the Uber app in NYC, helping medallion trip volumes recover and making it more a 5 borough option vs. Manhattan only.

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️