Discover more from AutoMarketplace

🤔 Is Taxi Medallion Debt Forgiveness A Taxable Event?

It's unclear whether taxi medallion debt forgiveness would be a taxable event. Definitive guidance hasn't been given on whether medallion owners would face large tax bills related to a debt workout

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️

⚠️ DISCLAIMER: This article should NOT be taken as legal or financial advice but rather a presentation of our thoughts, research and findings on whether taxi medallion debt forgiveness could trigger a tax obligation.

With the official passage of the Medallion Relief Program (MRP) for those that have loans with Marblegate, the largest medallion lender, it got us thinking about something.

Is taxi medallion debt forgiveness a taxable event? 🤔

This dynamic might surprise people but, to be simple, reducing one’s debt via a lender writedown can technically be viewed as a lender paying someone (their own borrower in this case) to pay off part of their debt. Therefore it can be viewed as taxable income.

In fact, this very topic recently surprised many, as it related to President Biden’s recent federal student debt forgiveness announcement. In some States it was determined it would not be treated as taxable income, while it’s unclear in others. Anyone who’s lived in New York State for more than a minute can probably guess which side of the “taxable” or “not taxable” fence the State tends to default to.

However, to be fair, it does appear New York State politicians can even recognize that taxing student debt forgiveness might not sit well with much of the voting public.

Is Taxi Medallion Debt Forgiveness Taxable?

Similar to the student debt forgiveness situation outlined above, taxi medallion loan forgiveness presumably would need some official clarification(s) from tax authorities on whether it’s taxable or not 🤷♀️. Remember, if State & Federal tax authorities determine that medallion debt forgiveness is taxable that could result in large one-off tax bills for many medallion owners.

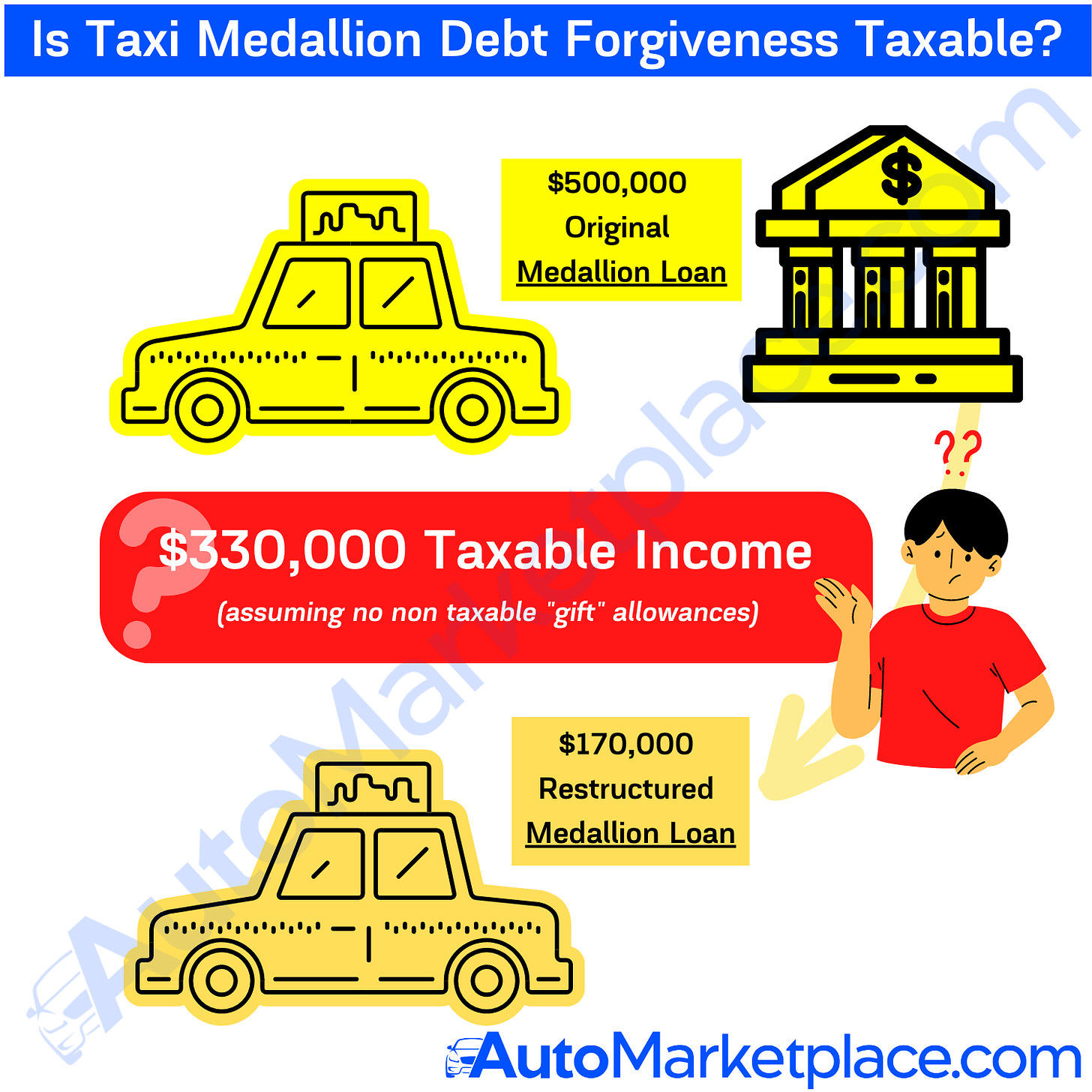

A simplistic illustrative example could look like this.

Our Current Understanding & Political Action

Unless a clear determination exists that has eluded our research (very possible), at the moment, it seems like there is A PROPOSAL (NOT PASSED) in front of the federal government, that would ensure debt forgiveness related to taxi medallions would not be treated as taxable income.

“Congressman Gregory W. Meeks (D-Queens), with support from the entire city’s Congressional delegation, elected state and city leaders, the New York Taxi Workers Alliance, and Signature Bank, on Friday announced federal legislation that, if passed, will ensure taxi medallion owners are not taxed for debt forgiveness.”

PoliticsNY (January 21, 2020)

H.R. 2077 was reintroduced in March 2021, but has not yet passed.

“This bill removes the obstacle of a high tax liability, making way for our members to achieve real debt forgiveness.”

- Bhairavi Desai, Executive Director of the New York Taxi Workers Alliance

“It would be tragic if, in the course of working with lenders to draw down debt, these owners get walloped with a tax bill on top of everything else.”

- Ron Sherman, President of the Metropolitan Taxicab Board of Trade

H.R.2077 - Taxi Medallion Loan Forgiveness Debt Relief Act of 2021 (Introduced NOT Passed)

American Bankruptcy Institute (ABI) Piece on Taxi Medallion Debt Forgiveness

Interestingly enough, the American Bankruptcy Institute (ABI) published a very relevant case study on NYC taxi medallion debt forgiveness and taxable income implications. The case mentioned in the article is imperfect in that it involved the medallion owner surrendering the medallion to the bank. Long story short, IT’S UNCLEAR if taxi medallion debt forgiveness would be treated as taxable income.

“IRC § 108 provides that if an individual or an entity is relieved of indebtedness, then that indebtedness is deemed to be ordinary income to the debtor or taxpayer, and they must report that income on their tax return. There are two exceptions to this rule; first, if the taxpayer/debtor files for bankruptcy protection, then the relief of indebtedness income is not picked up; and second, on a balance sheet basis, if the individual’s liabilities exceed their assets and they are insolvent, then they do not have to pick up the income.

In many of our taxi medallion workouts, we engage in the workout to avoid a personal bankruptcy filing by the taxi medallion owner, so the bankruptcy filing exception to IRC § 108 does not apply.”

- American Bankruptcy Institute (ABI)

To be clear, none of the above should be taken as legal or financial advice but rather a presentation of our thoughts, research and findings on whether taxi medallion debt forgiveness could trigger a tax obligation. One could reasonably assume if a Congressional Bill is specifically being proposed to definitively exclude taxi medallion debt forgiveness as a taxable event, then the current law is unclear on the matter.

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️