Why Does (Did) It Cost $400 Per Week to Rent a Toyota Camry for Uber and Lyft in NYC?

For many drivers and outside observers, the weekly rental rates for NYC 'TLC-ready' vehicles seem high. TLCMKT attempts to demystify TLC rental rates.

Let me first start off by explaining the (Did) in the headline. Pre-COVID the average weekly rental rate for a less than four year old Toyota Camry (or similar vehicle) was between $375 to $425 per week, but that rate has dropped 20% to 40% and rates now typically range between $250 to $325 per week. The impact of the pandemic on rental rates and the overall NYC ridehailing industry though is not the focus of this post. I want to focus on the question so many drivers have always wanted an answer to: Why does it (did it) cost so much to rent a Camry?

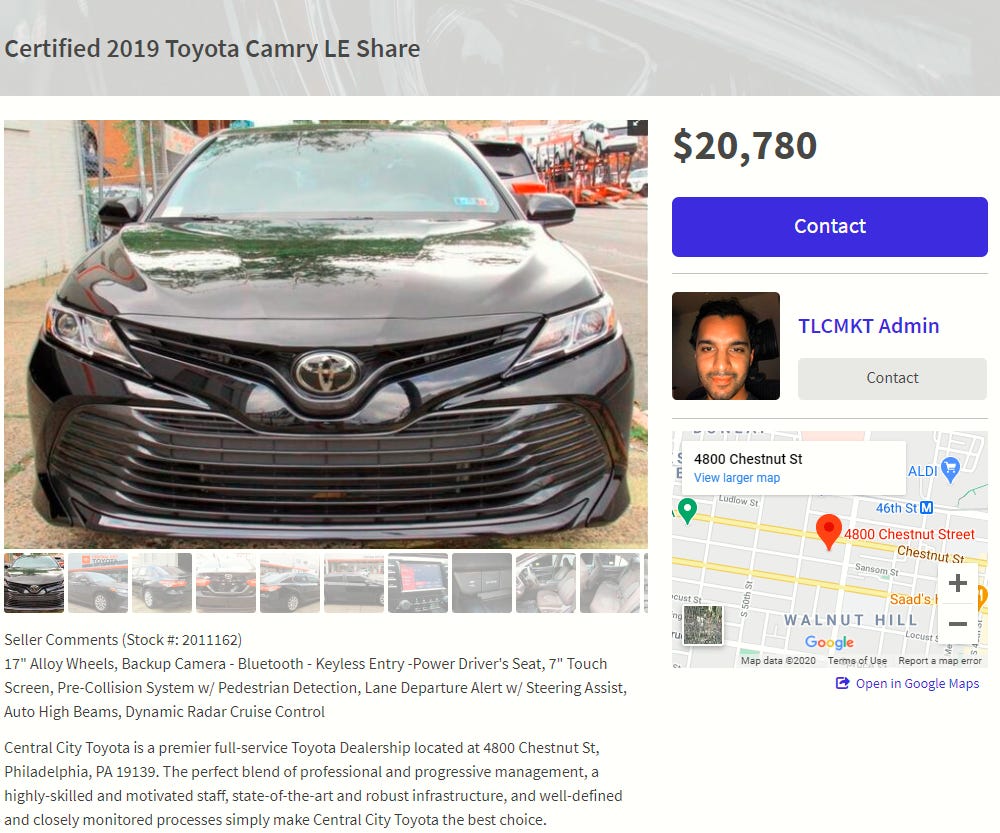

Buying a Camry

As most drivers and passengers can attest to there are several commonly used cars in NYC’s for-hire transport market. However, the Toyota Camry is undoubtedly the most popular, used by a large portion of drivers and fleets due its comfort and legendary reliability. Therefore, for the purposes of this exercise we are going to assume that we buy a one year old certified pre-owned Camry (Note: many drivers buy brand new cars which we advise against). So to start off, let’s search TLCMKT for a great deal and this is what we find - a low mileage 2019 Camry for $20,780 or about 20% cheaper than what the car was likely purchased for a year earlier.

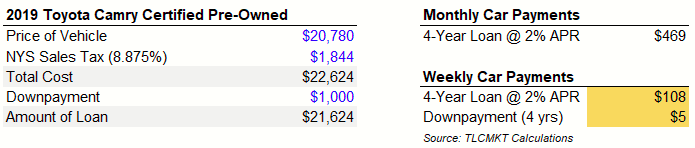

Let’s assume good credit (if you need credit repair help click here) resulting in 2% APR financing for 5 years (60 months) with $1,000 down. However, we likely want to pay the car off in 4 years (2 TLC inspection cycles), as the vehicle will have accumulated well over 150,000 miles after 4 years if used full-time for Uber and Lyft in NYC. So, we run our calculations below on a 4-year loan.

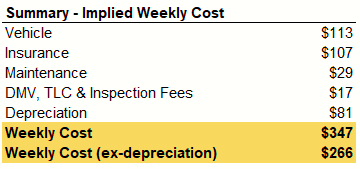

The implied cost of this vehicle, if purchased, would be $113 per week (excluding depreciation, which we will address later) over four years. The story doesn’t end here though. Now we move on to insurance.

Insurance

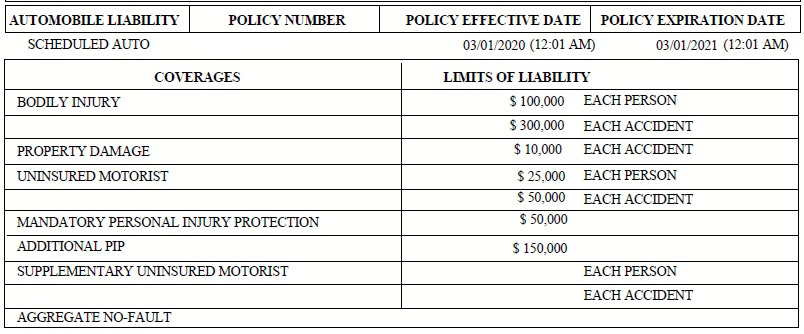

All vehicles used in NYC’s for-hire transport industry are required to keep commercial liability insurance providing, at minimum, $100,000 per person / $300,000 per accident liability coverage and $200,000 personal injury protection (PIP). This insurance does not provide comprehensive collision coverage though, only liability coverage. For example, if you are involved in a collision that resulted in physical damage to the car, the cost to repair the damage is not covered by the liability insurance and would only be covered if the other driver was at-fault.

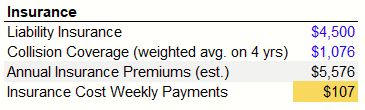

The cost of liability insurance can vary greatly based on a driver’s record. For example, at-fault (even 50/50 fault) accidents can increase an individual’s annual premium by over 25% (if you want more information on this click here)! Most drivers’ annual premiums will be somewhere in the range of $3,500 to $5,500 per year. So, we’ll assume a $4,500 annual liability insurance premium. Since the car also has financing it would be wise (not necessarily required) to buy a high deductible comprehensive collision policy. The annual premiums on these policies are usually 8% of a car’s value. Using these assumptions, we estimate the weekly insurance expense below.

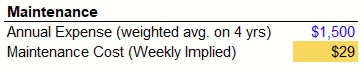

Maintenance

The cost of maintenance is always a tricky thing to estimate, especially over an extended period. Many people may not appreciate the wear and tear cars go through driving for Uber and Lyft in NYC. If a car is proactively maintained perhaps the only service it will ever need are oil changes every 3,000 to 4,000 miles plus new tires and brakes every 12-18 months. Sometimes though maintenance can get costly, especially when a car has transmission or engine issues. For this exercise we will assume weighted average maintenance costs of about $1,500 per year over 4 years, which we believe is a conservative estimate (i.e. oil changes, tires, brakes and normal wear and tear costs).

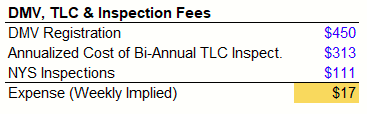

DMV, TLC & Inspection Fees

These costs are straightforward and regulatory in nature. Every for-hire vehicle needs to pay the following:

~$450 annual DMV registration fee

$625 biennial NYC Taxi & Limousine Commission (TLC) inspection fee

$111 for three $37 NYS inspections every 4 months

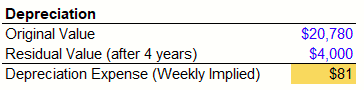

Depreciation & Residual Value

Unlike other asset classes, such as real estate, almost all cars lose value with time and use. In this example, when the Camry was acquired it was worth $20,780, the purchase price, and by the end of 4 years it is likely worth around $4,000 given its use as a ‘Taxi’ and high mileage (>150,000 miles). The difference between the starting value of the car and its ending residual value is referred to as depreciation. It is a non-cash expense, but nonetheless an expense that must be accounted for as you will eventually need to replace the vehicle. Below we calculate the weekly depreciation expense.

Other Considerations & Summary Breakdown

In the above exercise we made assumptions on many things that are variable in nature. For example, we assumed we had good credit and could get 2% APR on a car loan. We also assume the car wouldn’t experience any major maintenance issues. Finally, one also must remember that rentals give drivers the flexibility to return the car with usually 1 or 2 weeks notice, while owning a car is a longer term commitment, but results in asset ownership.

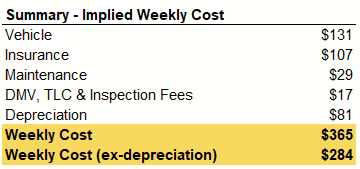

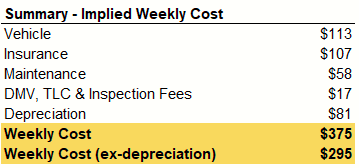

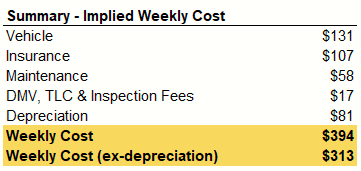

Below we provide a range of what the implied weekly cost of a Camry would be using 4 cases. We also use an ex-depreciation value to give a cash-only cost figure.

Case 1 (base case): Outlined above.

Case 2 (credit): 10% APR vs. 2% APR, all else base case.

Case 3 (maintenance): Assumes $3k vs. $1.5k expense, all else base case.

Case 4 (credit + maintenance): Combines cases 2 and 3.

Case 1 (base case)

Case 2 (credit): 10% APR vs. 2% APR, all else base case

Case 3 (maintenance): Assumes $3k vs. $1.5k expense, all else base case

Case 4 (Case 2+3)

Sales Tax on Rentals

There is another point worth mentioning and that is sales tax considerations for rentals. While the specific sales tax law regarding vehicle rentals in New York’s ridehailing industry is still in a gray area, at minimum a lessor must pay 8.875% (long-term rentals) and perhaps even as much as 19.875% (short-term rentals) sales tax on a large portion (i.e. insurance costs should be excluded) of the collected rent.

Conclusion

We hope you found this analysis of the costs associated with a for-hire vehicle rental in New York City useful. Rental companies could argue that $75 to $125 per week cash profit per car is fair given the risks they take on, including:

Losing vehicles to crashes and the financing being underwater (i.e. insurance payout less than remaining loan on vehicle).

High driver turnover resulting in weeks where the car in unoccupied.

Not receiving rental payments (i.e. bad debt).

Administration related to driver parking tickets, E-ZPass and TLC summons.

Unexpected maintenance costs arising.

Covering the cost of overheads.

On the other hand, a driver could argue that the implied profit seems excessive if he or she has:

A longer term contract.

Clean driving record and no history of accidents.

Good overall credit and consistent record of timely payments.

No incidences of parking tickets, E-ZPass violations or TLC summons.

Proactively taken care of car, lowering probability of large maintenance events and increasing ultimate residual value of car.

Used the car for more than 4 years.

Been paying maintenance expenses to rental company-owned service shop.

As a final note, what you are seeing now in the market is many fleet owners storing plates or asking for insurance relief due to COVID, as current rental rates are essentially at and sometimes even below breakeven.

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

PS,.

The prices have gone up by a lot since this post.

Can we please revisit the rental gouging in nyc?? I know there are other things going on but I feel like not enough is said or done about these rental companies stealing ppls money only because TLC doesn't want to issue license plate. Look I get why they are doing that, but does it mean thag these rental companies can prey on drivers trying to make a living. I may be new to the taxi/tlc rideshare business being that i started a yr ago the end of this month but i am very experienced in knowing when I'm being taken advantage of. So please Automarketplace, can we look at what these rental companies, at least Buggy TLC, are doing. I'm as well as a lot of other drivers are hurting because of their practices and policies. Thank you.