☂️👀 Chair Do Says NYC TLC Insurance Rates Are "Artificially"...Low!?

During City Council testimony NYC TLC Chair David Do says for-hire liability insurance rates are "artificially" low, citing Uber's lawsuit against American Transit. He might be right, we explain

During City Council testimony, NYC TLC Chair David Do was asked about the rising cost of NYC for-hire transportation (TLC) liability insurance

Chair Do stated NYC TLC liability insurance rates might (counterintuitively) be “artificially” low, even with this year’s 20%+ premium increases

Do cited Uber’s recent lawsuit against TLC insurance giant American Transit, who we estimate has an over 60% industry market share

Recent actuarial assessments of TLC liability insurance providers American Transit and Maya Assurance imply both are in serious trouble

In a surprisingly intellectually (and actuarially) honest answer, NYC TLC Chair David Do stated what is likely an inconvenient truth - NYC for-hire transportation (TLC) liability insurance rates are probably “artificially” low.

Yes, even with TLC liability insurance rates up 10% to 30%+ for most NYC drivers and fleets this year, the rates could still be too low 😤. Many people might be astonished (even angered) by Do’s statement, especially after this year’s renewal season, but he’s probably not totally wrong (or he’s more right than he is wrong).

“Artificially” Low

We’ll first share the relevant discussion from today’s City Council hearing between Council Member Lincoln Restler and NYC TLC Chair Do. Note, we’ll cover the remaining TLC testimony to City Council in a separate article that will be published in the coming days.

NYC Council Member Restler: Are you finding any issues in your review of the actuarial rates…in your conversations with the [New York Department of Financial Services (DFS)]?

NYC TLC Chair Do: I think this is a little bit counterintuitive to what you’re thinking…you’re saying the [TLC insurance] rates are high, we’re saying the [TLC insurance] rates are artificially low…

Uber’s Lawsuit Against American Transit

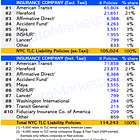

There’s a lot to unpack in Chair Do’s testimony above and we’ve also covered a lot of the associated details recently. Notably, Do mentions Uber’s recent lawsuit against American Transit (“ATIC”), the largest provider of NYC TLC commercial liability insurance, which we estimate has an over 60% industry market share.

Uber alleges the insurer has a consistent pattern of failing to honor coverage for NYC TLC-licensed drivers who get into accidents.

“American Transit Insurance Co.’s “unreasonable practices” handling claims has resulted in 23 lawsuits brought against Uber and its drivers over crashes involving bodily injuries, leaving the ride-share giant to pay “substantial amounts” to defend itself, according to the complaint filed late Friday in federal court in New York.”

- Bloomberg (Uber Sues Insurer for Refusing to Cover NYC Drivers in Crashes, by Robert Burnson, February 17, 2024 at 10:41 AM EST)

In his testimony above, Do is basically implying that American Transit is not properly paying out insurance claims. In turn, by not paying out claims as it should, ATIC can then offer “artificially” low rates to drivers and fleets in a way other insurers, who properly payout claims, cannot.

We wrote about this market dynamic recently, we paste a relevant excerpt below.

“[In] our article about Uber suing American Transit we mentioned a 2021 S&P Global report that questioned whether TLC insurance giant American Transit was solvent (i.e., can they payout the claims they owe or prospectively owe?)…

For example, another way to think about the situation at American Transit is if a long time industry player, with an extremely dominant market share (60%+) and deep industry expertise, cannot profitably operate how can a new entrant, that will have a much smaller market share initially, succeed?

Furthermore, if the dominant player can continue to operate with razor thin margins for years (or is indeed effectively insolvent), that is a nightmare competitive backdrop. Right now, our guess is Warren Buffett-controlled GEICO is probably not interested in the NYC taxi insurance market.

American Transit might be too big to fail. Or said another way, impossible to effectively compete with.

This is why the TLC insurance market lends itself to an incumbent monopoly or duopoly market share structure, at the moment. The exception perhaps being offshoot self-insured fleet “captives” of large TLC rental companies that might be large enough to experiment with self-insurance, at least for a couple of years.”

- AutoMarketplace (February 27, 2024)

Article continues after advertisement

Is American Transit Insolvent? Maya Assurance In Trouble?

Recently, an AutoMarketplace friend flagged two purchasable reports, accessible in the National Association of Insurance Commissioners (NAIC) database, about both #1 TLC liability insurance provider American Transit and #5 provider Maya Assurance.

The professional actuarial opinions can be summarized as follows:

American Transit Has A $644 Million Deficit!

Ronald T. Kuehn of Huggins Actuarial Services, Inc. concludes American Transit has underestimated its provisions for losses and expenses by $690 million and currently has a $644 million deficit 👀, as of December 31, 2023

Mr. Kuehn states that American Transit fails to meet the requirements of New York State insurance laws

Mr. Kuehn was also referenced in S&P Global’s 2021 report on American Transit

NOTE: Mr. Kuehn’s report represents his professional opinion and he was appointed by ATIC’s Board of Directors to conduct a 2023 actuarial review to satisfy the requirement of NAIC

Maya Assurance Also In Trouble?

Allen Rosenbach of ACR Solutions Group concludes Maya Assurance has underestimated its provisions for losses and expenses in a way that fails to meet the requirements of New York State insurance laws

NOTE: Mr. Rosenbach’s report represents his professional opinion and he was appointed by Maya’s Board of Directors to conduct a 2023 actuarial review

Uber Advocacy Against “Lawsuit Lending” Industry

Another nuance in discussing the NYC TLC insurance industry is whether the market itself presents a viable commercial opportunity for companies. In other words, can an insurance company make the financial math practically work in the NYC for-hire transportation commercial liability insurance market? For example, if the “real” rate an insurer needs to charge is $12,000 per policy, per year then it’s not practical. Many TLC drivers and fleets won’t be able to afford that rate, given their earnings.

Therefore, it sometimes makes sense to go after any underlying market dynamics that make the market so hard to insure, in the first place. Uber’s recent advocacy for regulating the New York State “lawsuit lending” industry is a great example of this.

Driver Pay Formula Needs To Change

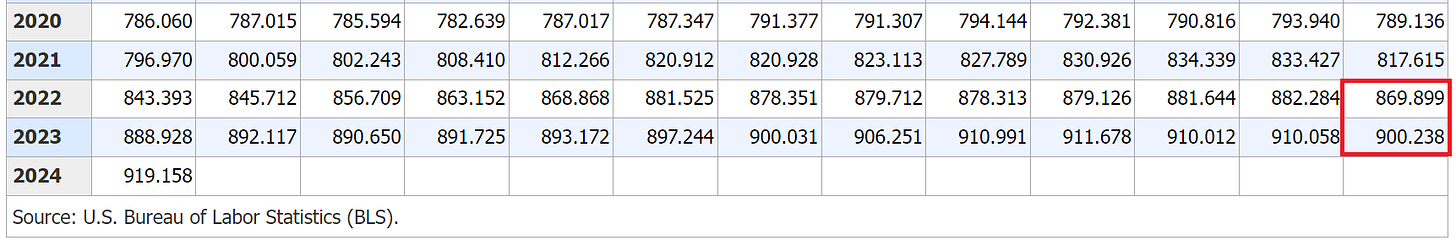

Finally, based on our understanding, TLC uses the CPI-W inflation index for the NY-NJ-PA metro area. This index relates to Urban Wage Earners and Clerical Workers for the NYC metro area.

“CPI-W is designed to measure price changes faced by urban wage earners and clerical workers. Population coverage is the only difference between the CPI-U and CPI-W.”

- U.S. Bureau of Labor Statistics (BLS)

Looking at the change in the CPI-W index from Dec 2022 to Dec 2023, we get 3.49%, which exactly matches TLC’s minimum driver pay increase in 2024. For those who want track the CPI-W index for New York-Newark-Jersey City, NY-NJ-PA click here.

Insurance expense is a major cost center for both drivers and fleets in NYC. The cost of commercial vehicle insurance is often a driver or fleet’s largest (or second largest) yearly business expense. The TLC’s ~3.5% CPI-inflation adjustment to driver minimum pay clearly doesn’t accurately reflect the increased cost of doing business as a NYC TLC driver or fleet.

This is easy to understand when one accurately weights NYC TLC driver-specific expenses as a % of their costs vs. using a regional inflation index that measures a general basket of goods and services. To be simple, if you’re an NYC taxi driver, inflation related to TLC insurance, vehicle maintenance, car repairs and the cost of new & used vehicles are going to impact you much more than it would an individual who works from home.

This is why we also believe Uber and Lyft should be subject to a NYC TLC-specific inflation index, so the TLC driver minimum pay formula would more accurately reflect the cost of doing business. We were encouraged to hear that the TLC might be considering this, when Chair Do briefly mentioned (see testimony in above video) engaging with the New School to reassess the TLC’s minimum driver pay calculation that Uber and Lyft must follow (only “high-volume” bases in NYC currently).

Is it even worth it being a Taxi driver in NYC anymore?