Discover more from AutoMarketplace

☂️🥊 Uber & Lyft Join Forces To Fight New York "Car Accident Loan" Industry

Rising insurance costs, partially tied to "lawsuit lending", is creating an existential threat to Uber, Lyft, yellow cabs & all NYC TLC drivers. We share our own experience with a $50,000,000 claim

Uber and Lyft have joined Consumers for Fair Legal Funding (CFLF) which seeks to prevent abuse in NY’s “lawsuit lending” market that many blame for driving increased auto insurance rates across New York State

“Lawsuit lending”, also known as “litigation finance” or “car accident loans”, is often characterized as usurious and dishonest

We share our own fleet experience with a $50,000,000 insurance claim

Uber, Lyft, yellow cabs, FHV fleet owners and all NYC TLC drivers depend on affordable insurance coverage being available

In a rare instance of working together, rideshare rivals Uber and Lyft have, according to Insurance Business magazine, joined a “coalition of New York community groups, business interests and social justice organizations in a push to reform the third-party litigation finance sector”.

“The unchecked lawsuit lending industry is driving insurance costs up, consuming an ever-larger share of fares, and making it harder for drivers to earn a living. Lawmakers need to establish some simple rules to reign in lenders and protect hard-working individuals statewide.”

- Hayley Prim, senior policy manager at Uber

“If we can curb – or better yet, reduce – these costs, the savings are going to go directly back into drivers’ pockets and help lower fares. Without putting in place some common-sense regulations, the lawsuit lending industry will continue to boom, and consumers and hard-working New Yorkers will pay the price.”

- Megan Sirjane-Samples, director of public policy at Lyft

The coalition Uber and Lyft are joining is led by Consumers for Fair Legal Funding (CFLF), which focuses on reforming what it calls an “unregulated and predatory lawsuit lending industry.” Specifically, CFLF wants to pass legislation in Albany to regulate lawsuit lending practices.

What Is “Lawsuit Lending” or “Car Accident Loans”?

Imagine you get into an accident and believe, correctly or incorrectly, you are owed some money and/or need money to pay bills or fix your car. In some instances, it’s clear (i.e., you get rear-ended) the other party is responsible, or at-fault, and their insurer will provide a relatively quick payout. In addition, as we covered recently: (1) If the other party doesn’t have insurance, your policy will have uninsured motorist (UM) coverage and (2) New York is a “no-fault” (PIP) state.

Basically what no-fault (PIP) coverage intends to provide is financial protection against being unreasonably beholden to an insurance company or an insurance claims process. For example, if an accident’s at-fault determination or claim is taking a while to work through (accident investigation), PIP coverage allows all parties to quickly receive money to prevent any serious personal finance issues.

This, one could argue, is the very reason no-fault insurance (PIP) was created and mandated in New York State. Good intentions, the government trying to protect New Yorkers from an insurance claim flipping their personal finances upside down.

“No-Fault, also called Personal Injury Protection (PIP), is designed to pay promptly, regardless of who is at fault or whether there was any negligence, for economic losses (meaning medical/health expenses, lost earnings, and certain other reasonable and necessary expenses related to injuries sustained)…to the driver and all passengers injured in your car as well as any pedestrians injured by your car, because of its use or operation in New York State.”

- New York Department of Financial Services (DFS)

Good Intentions, Road To Hell?

Let’s say an accident resulted in a serious injury and/or is very contentious where the at-fault (or % at-fault) determination is unclear. It might take months (maybe years) to actually work through the claim before anyone receives money that they believe they are owed. In addition, a person might need to hire a lawyer(s), which often require some sort of upfront fee (“retainer”), that can be difficult for many to afford.

For low or middle income New Yorkers, living paycheck-to-paycheck, this can be a legitimate issue. They feel the PIP payout isn’t sufficient and they believe, correctly or incorrectly, they’re owed more money for the “pain and suffering” they’ve experienced, and continue to experience, from an accident.

Article continues after advertisement

“Litigation lending”, also called “lawsuit lending” or “car accident loans”, is often targeted at people who find themselves in the situation described above. As with many things, sometimes the intent is genuine and legitimate and other times it’s not. How it often works is a law firm will help finance a legal claim in return for a % of any ultimate settlement.

Just to be clear, there are legitimate reasons the “lawsuit lending” industry should exist. For example, an insurance company might improperly deny a claim knowing a person likely can’t afford to fight them further. However, like the Payday Lending industry, a lot of bad or perverse financial incentives can be created for lawyers to pursue frivolous cases or sue other parties for amounts that are unreasonable.

We actually have a real life example to share with you.

Dealing With A $50,000,000 Claim

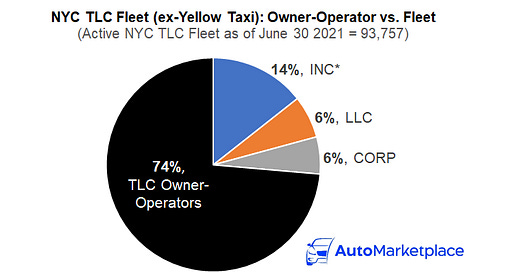

As we’ve mentioned many times, we started out in the NYC TLC industry running a small fleet that focused on drivers who work on the Uber Black (premium) platform. We’re not only journalists, we’re operators, which we believe distinguishes us.

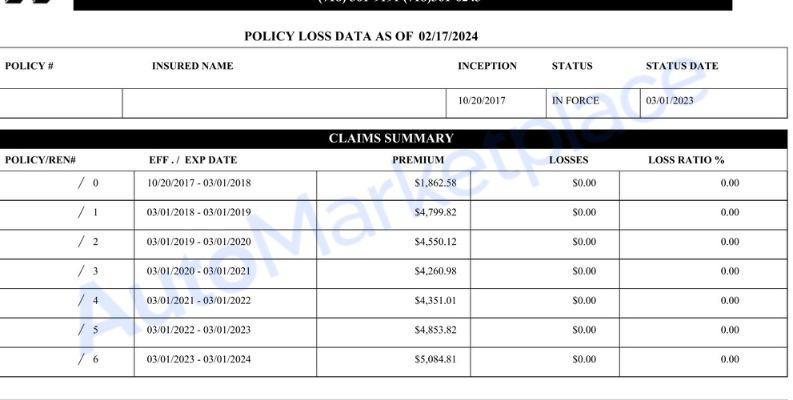

Since we started the fleet business in late 2016, we’ve learned a lot of lessons and have built a very strong loss run (claim payout) history. For example, several of our policies have zero or near zero loss runs (claim payouts) doing NYC for-hire transportation work over the last ~7 years. We screen TLC-licensed drivers who lease our vehicles stringently, treat them well (fairly and with respect) and charge them competitive rates for nice vehicles.

In a leasing setup, a fleet manager and a driver are equally responsible when trying to create a strong insurance track record. That record also impacts both the fleet & the driver and future insurance rates offered.

Anytime a claim comes up, as long as our lessee informs us, which they almost always do, we document everything. From video footage to pictures to filing reports to submitting statements, we’ve gained somewhat of an expertise in claims processing and providing information to our insurance company about any claims that arise. Ultimately, you aim to have no claims, but that’s a near impossible task in NYC, so you want to make sure you can defend your company, your insurer and a driver against any claims that might arise.

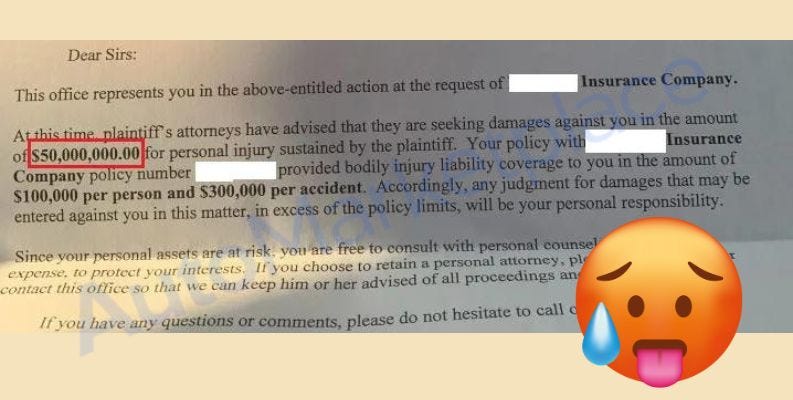

So, with this operating mindset and background, when we received a letter a few years ago suing our small leasing company for $50,000,000 !!! (👀), it was shocking. It was also (obviously) well above our $300,000 liability insurance coverage. In addition, it could result in our insurance company paying out $300,000, which is a huge claim payout for them. This, in turn, could negatively impact our young business’ relationship at the time and any future insurance rates offered to us. It had the potential to destroy our leasing business and reputation we’d just started to build.

So, the obvious question is what did the claim relate to? Did someone die? Was someone paralyzed?

Let’s get a little technical for a minute to provide full context. A leasing company is often protected from vicarious or excessive liability claims by the Graves Amendment (topic for another day). For example, if Hertz rents a car to someone who then runs a red light and kills someone, holding Hertz responsible is unreasonable (as long as the driver they rented the car to was appropriately screened and the vehicle appropriately maintained).

However, our insurance company was still on the hook for up to $300,000 and any major claim could impact future insurance rates offered to us (if even offered). Furthermore, the driver could also be sued. We needed, working with our insurance company and TLC licensed lessee, fight this, in our opinion, ridiculous $50,000,000 claim!

Here is the email we sent, at the time, to our insurance company after catching up with our lessee. We’re not going to fully litigate this 3.5 year old claim in public, but this is the email we wrote so you can understand our perspective better and some details.

“Yes, [we] caught up with the driver as well. [They] told [us] [they were] slowly backing up [and] someone banged on [their] trunk ("I'm walking here sort of thing"). According to the driver, nothing happened and the only reason the pedestrian had the driver's info was [our driver] stopped and exchanged it. [They] asked the pedestrian (according to [the driver]) if they needed to call an ambulance and they said it wasn't necessary (so at the moment of the accident an ambulance wasn't even called? Is this your understanding as well?). In addition, this happened in front of a store, so the store would have had a camera too if something major happened.

This seems like a complete gimmick of claim as no ambulance was called at the moment of the incident (that's why no police report exists or anything to [our] knowledge). Happy to get on the call ASAP with your team. [We, ourselves] only found out about this claim probably a few months after it occurred because [our] driver didn't inform [us] and thought nothing would come of it (that's why [we] couldn't get the video footage, as [we] didn't even know an incident happened). In addition, if the collision was above a certain G-Force the [company] camera would have triggered an accident and nothing like that happened.

[We] don't want to overstate here, but this could be a case of insurance fraud, where the claimant might have needed surgery otherwise. Let's see what all the facts are.”

- Text of email from our leasing company to our insurer

What happened?

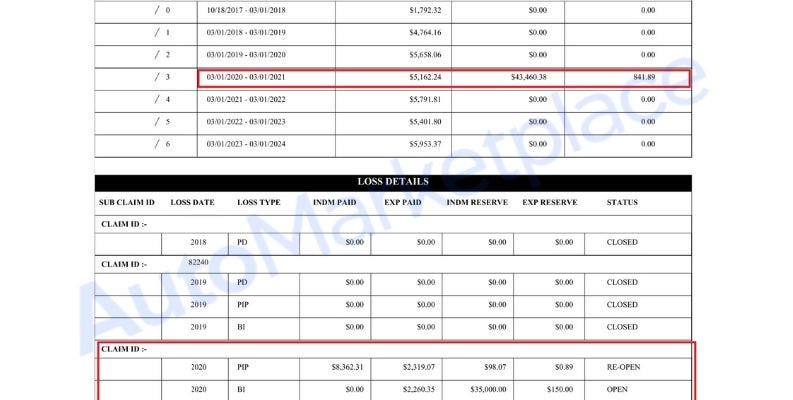

Since several years have now passed, what have the loss runs (payouts) related to this claim looked like? What has the insurance company reserved for (future potential claims)? This will be very telling of how legitimate the $50,000,000 (!!!) claim was. Although the incident is now nearly four years old, it remains “open”, with the following claim payouts and reserves listed.

~$11,000 in no-fault (PIP) payouts

~$2,260 in Bodily Injury (BI) payouts with ~$35,000 reserved

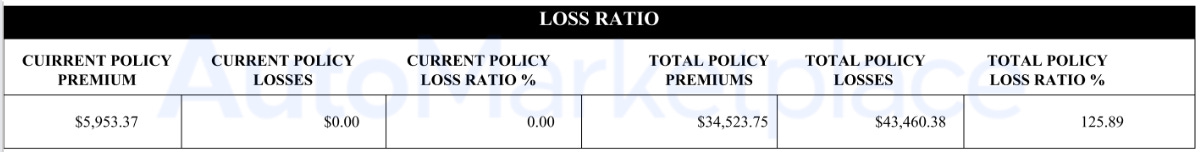

So, to be clear, ~$13,260 in actual claim payouts and a ~$35,000 reserve (or potential future claim payouts). Nowhere near the $300,000 liability limit and nowhere near the $50,000,000! But look how it impacted our policy record (Note: the unpaid estimated reserves (payouts) still show up as losses on an insurance policy, which is understandable 👇).

It’s a good thing our fleet didn’t have a single claim for the next 3.5 years on this policy and that the overall fleet generally performed very well.

Finally, and as it relates to this article yes, a law firm that describes itself as a “powerhouse” personal injury law firm, was involved on the other side. Was lawsuit lending involved?

We don’t know, but these sorts of cases are likely representative of an instance where a lawyer finances an essentially frivolous $50,000,000 (!!!) claim, that otherwise might not have existed, in hopes of getting a large piece of a large settlement that they helped finance. You throw (file) 1,000 of these darts (lawsuits) and a personal injury lawyer only needs a couple to hit - perhaps that’s the exact idea! Perhaps that’s how they afford all those strategically placed billboard ads 🤔.

“With no limit in interest rate caps, lenders can charge up to 100% – or more – and borrowers can end up owing most or all of their eventual settlement or jury award to a lender, ending up with very little of their settlement or even in debt”

- Consumers for Fair Legal Funding (CFLF)

All that being said, do certain insurance companies not payout like they should? Yes. In fact, this is why Uber is suing NYC TLC insurance giant American Transit, in addition to the insurer not (allegedly) adequately providing Uber protection against claims. However, is a group of lawyers acting like Payday Lenders the solution to what’s wrong with insurance payouts in New York? We don’t think so.

Ultimately, if insurance companies have to face too many unreasonable lawsuits, that take up a lot of resources, it will increase insurance premiums for everyone in New York. It will increase insurance premiums for all New York drivers, including all NYC TLC-licensed drivers across all sectors, including yellow cabs. We support Uber and Lyft’s efforts in joining CFLF to promote legislation that creates the necessary guardrails for the “lawsuit lending” industry.

NYS Rideshare Insurance vs. NYC TLC Insurance

The last point we want to quickly mention is the uniqueness of the NYC for-hire transportation (TLC) market vs. all other North American markets Uber and Lyft operate in (including New York State, outside of NYC). NYC is the only market that required Uber and Lyft’s standard service offering (i.e., Uber X) to be subject to the same commercial insurance requirements as the existing taxi, black car and livery industries. This is another way to conceptualize why all NYC for-hire vehicles (FHVs) that work on the Uber and Lyft platforms, need TLC Plates.

This is unique because the cost of commercial liability insurance mostly falls on NYC TLC drivers and fleets. In all other non-NYC markets, Uber and Lyft are generally paying for the cost of for-hire commercial liability coverage when a driver is working on their apps (from driving to pick-up a passenger to when a passenger(s) is in a vehicle). In those markets, their “take-rate” (commission) is partially justified because they pay for the insurance. In other words, a non-NYC Uber or Lyft rideshare driver’s “normal” (GEICO, State Farm, Progressive, Allstate) car insurance will not generally provide coverage if an incident happens when their logged into a rideshare app.

In NYC this is simply not the case, so to take 25% to 30% of a TLC drivers trip earnings in commission, doesn’t really seem justified. The quick response from Uber and Lyft will be that they are subject to the TLC Driver Minimum Pay standard, which should capture TLC insurance inflation. We strongly disagree, given the recent ~3.5% CPI-inflation adjustment to TLC Driver Minimum Pay announced (see below). The regulator should understand the true cost of doing business for NYC TLC drivers & fleets and use a different inflation index that accurately reflects the skyrocketing cost of NYC TLC insurance.

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

Interested in advertising with us? Please email info@automarketplace.com

Uber should be responsible for all the liability. They get most of the money for every ride. They cheat the drivers out of what they should be paid. The stock holders are the ones that are laughing to the bank! The drivers should all quit and leave the garbage part of this industry to the stock holders!!!