Discover more from AutoMarketplace

☂️🚕 2024 NYC TLC Insurance Industry Overview: Rates, Claims & Your Three Pages

In Part 1 of our 2024 TLC insurance industry overview, we go over how TLC liability rates look this year, what's causing them to increase so much & what those three insurance pages are!

Part 1

NYC TLC (ex-taxi) liability renewal rates for 2024 (March 2024 to March 2025) have generally increased between 10% to 30% for drivers and fleets

Individual liability rates in 2024 are mostly between $4,000 to $5,500 per year

Fleet liability rates in 2024 are mostly between $6,000 to $9,000 per year

Fleet “CAP” policy rates are mostly between $8,000 to $11,000 per year

NYC TLC insurance claims can be best understood in four categories: No-Fault (PIP), Bodily Injury (BI), Property Damage (PD) and Uninsured Motorist (UM)

Many leasing companies face “going concern” issues, including liquidation, as fleet “CAP” policy increases cannot be passed along to customers

Conversations with INSHUR Co-Founder & CEO Dan Bratshpis & Next Century’s Gavriel Gavrilov provide insight on what’s driving TLC insurance rate increases

Part 2 details are at bottom of article

Today, we are sharing an updated 2024 version of our 2023 piece overviewing the NYC for-hire transportation (TLC) liability insurance market ☂️🚕. As many of our readers know, the annual TLC insurance renewal period is underway with many policies expiring on March 1st.

Insurance can be a technical subject, but at a high level it’s fairly easy to understand what might be causing auto insurance rates to increase. For example, fixing a vehicle is getting more expensive from parts to technician labor rates to the cost of new & used vehicles. Simply put, when a vehicle gets into an accident, it’s costing more to repair it, which directly impacts car insurance rates.

In NYC’s for-hire transportation (TLC) market, the cost of claims has also increased due to the unique nature of the insurance risk (i.e., transporting passengers over multiple trips per day in NYC) and New York State being a “no-fault” state.

“No-Fault, also called Personal Injury Protection (PIP), is designed to pay promptly, regardless of who is at fault or whether there was any negligence, for economic losses (meaning medical/health expenses, lost earnings, and certain other reasonable and necessary expenses related to injuries sustained)…to the driver and all passengers injured in your car as well as any pedestrians injured by your car, because of its use or operation in New York State.”

- New York Department of Financial Services (DFS)

TLC Insurance Primer

We thought it would be helpful to provide a quick primer on the NYC TLC liability insurance market that shouldn’t take more than ten minutes to read through. It’s important for TLC-licensed drivers, fleets and the regulator to understand insurance basics, before jumping to conclusions about what may or may not be wrong with the market. We also think having more knowledge about the TLC insurance industry, is generally important, as drivers and fleets manage business risks.

Four Categories Of Insurance Claims

The best way to think about insurance claims in the NYC TLC market, and New York State in general, is by grouping them into four categories.

No-Fault (PIP): Medical expenses, lost earnings, and other reasonable and necessary expenses (does not cover auto body or property damage). This is generally more objective and based on medical invoices and income history.

Bodily Injury (BI): Bodily injury sustained by any person in an accident. This is generally more subjective, relating to “pain & suffering”. For example, someone gets rear-ended and they claim Whiplash now requires them to get physical therapy indefinitely and has impacted their quality of life. This may or may not be the case but it’s a subjective matter, or hard to quantify and based on opinion.

Property Damage (PD): Damage to another party’s car or property.

Uninsured Motorist (UM): Injuries as the result of negligent actions by an uninsured vehicle or hit-and-run motorist (does not cover auto body or property damage).

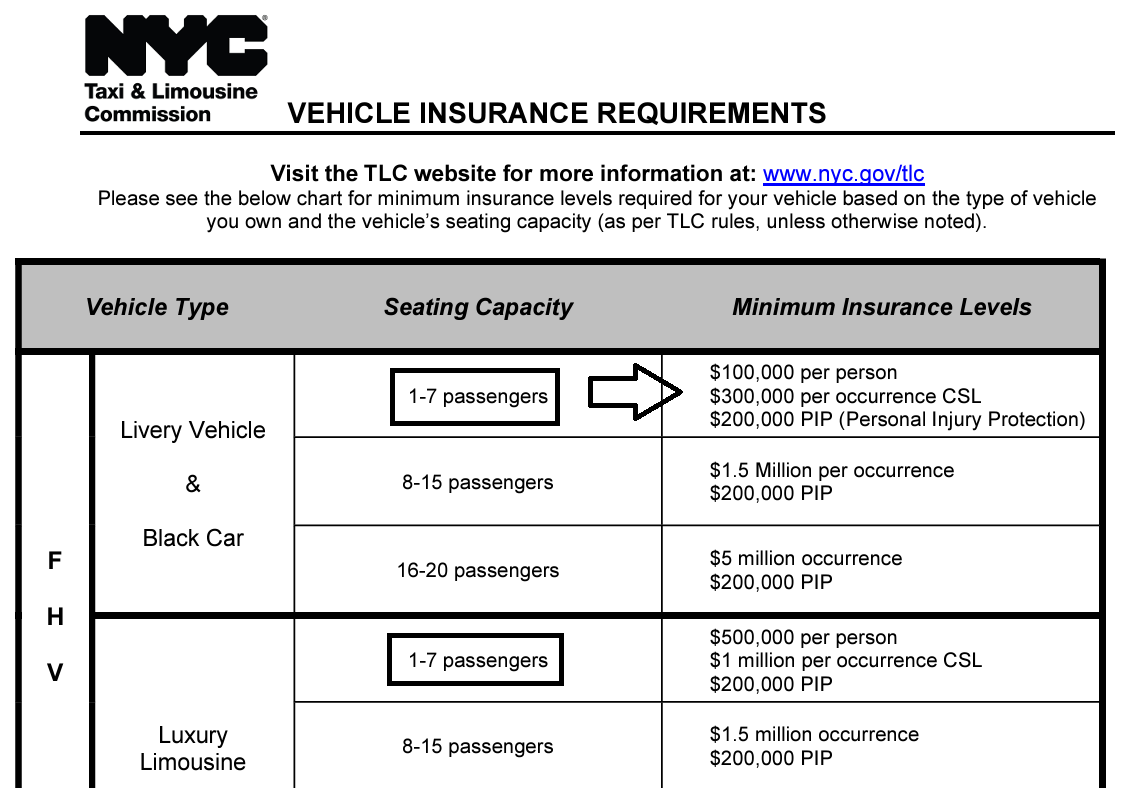

NYC TLC Insurance Requirements

Now that you know the four claims categories, it’s important context for the next topic: insurance requirements for NYC TLC-plated vehicles and yellow cabs.

As you can see from the charts below the requirements for 1-7 passenger vehicles (or 1-8 including the driver) are:

$100,000 per person

$300,000 per occurrence CSL*

$200,000 PIP (“no-fault”)

Many people refer to the above coverage as “100/300”.

*CSL stands for combined single limit, a reference to the maximum dollar amount that covers any combination of injuries or property damage in an incident

Understanding Your Three TLC Insurance Pages

Every TLC-licensed driver or fleet usually receives three insurance pages.

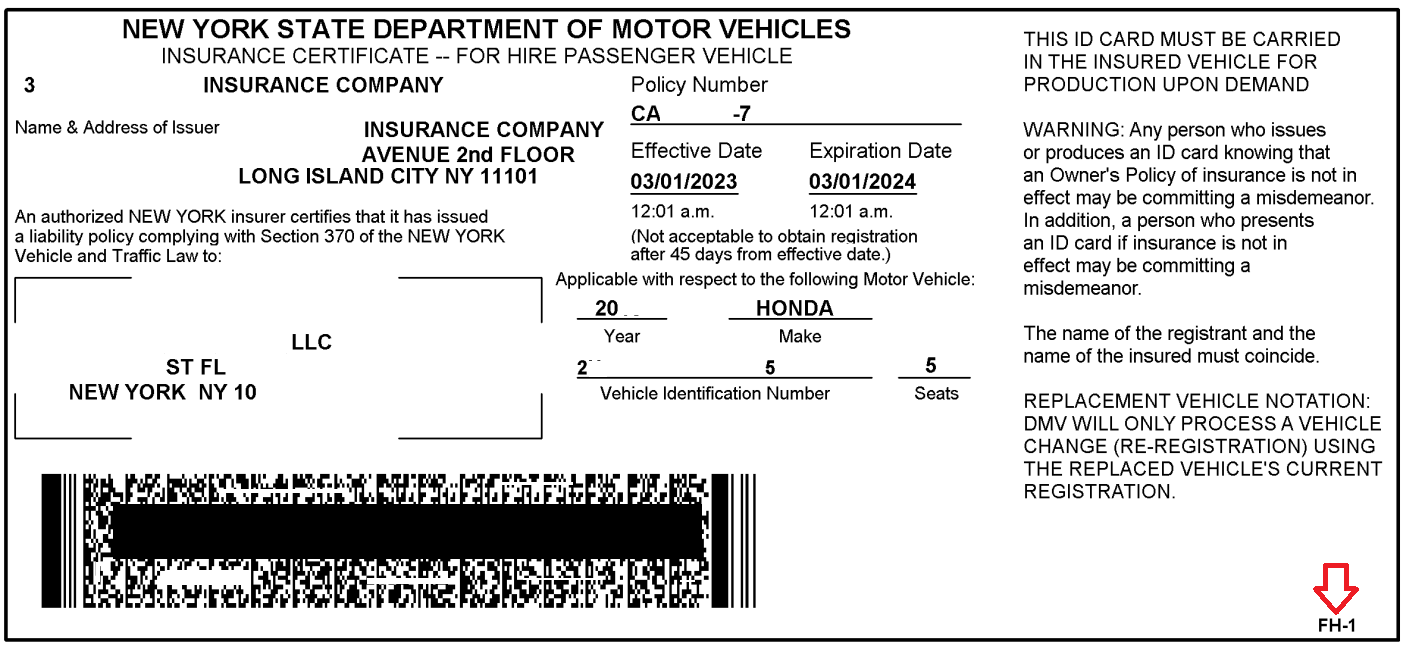

Page 1: FH-1 (“Bar Code” Page)

The FH-1 certification page has a bar code and shows basic insurance coverage information, including your policy number, the name and address of your insurance company, who’s insured, the effective and expiration date of policy, year, make and model of your vehicle and VIN. This is the page the DMV scans and keeps for their records, if you make an in-person appointment.

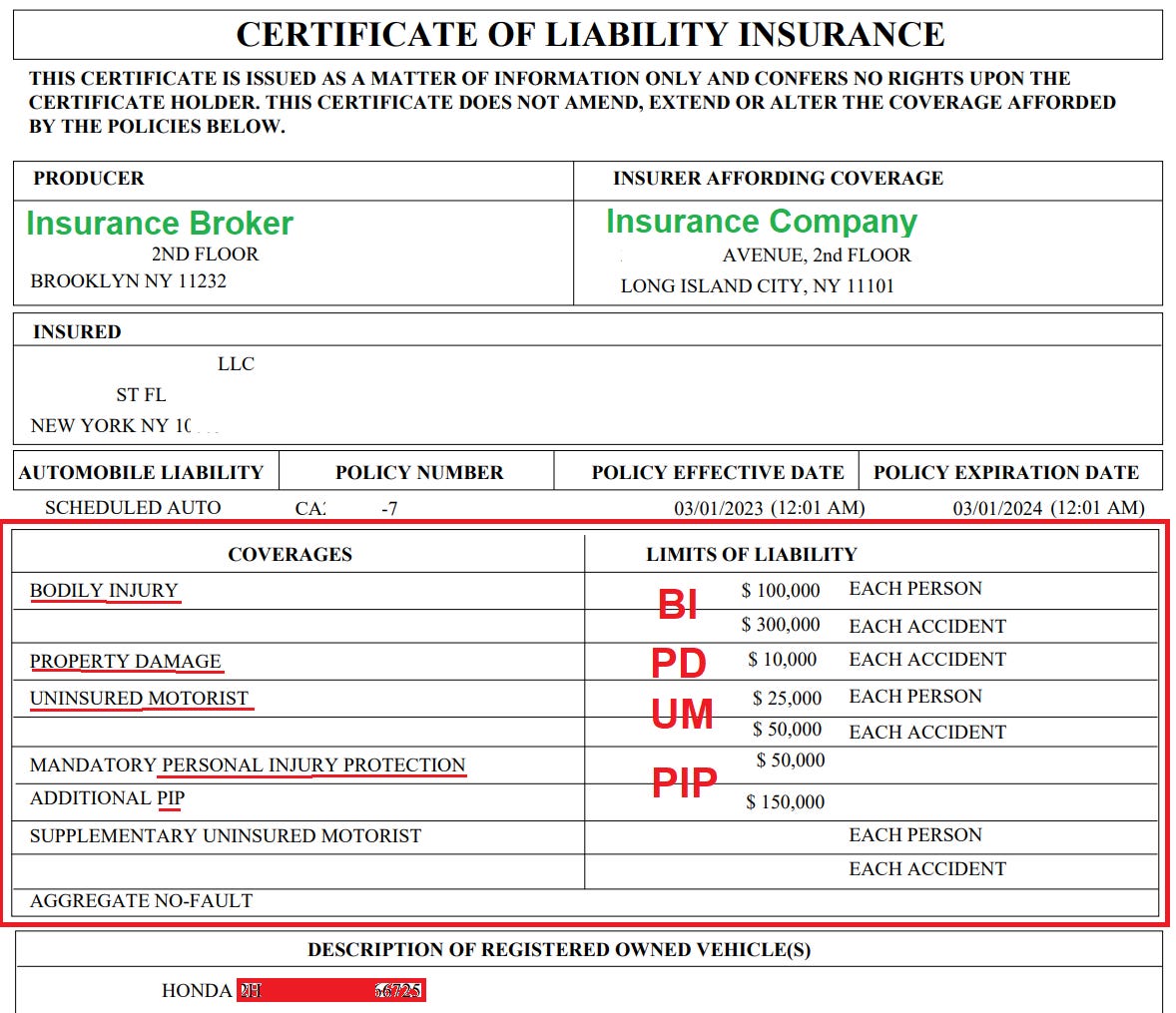

Page 2: Certificate of Liability (CoL)

The Certificate of Liability (CoL) page repeats a lot of the information included in the FH-1. It also lists the name and address of your insurance broker (“Producer”) and coverage levels for the four claim categories we overviewed above.

You’ll notice the coverage limits abide by the TLC insurance requirements mentioned previously.

**NYC TLC LIABILITY COVERAGE LIMITS**

No-Fault (PIP): $200,000 ($50,000 + 150,000)

Bodily Injury (BI): $100,000 per person / $300,000 per accident

Property Damage (PD): $10,000 per accident

Uninsured Motorist (UM): $25,000 per person / $50,000 per accident

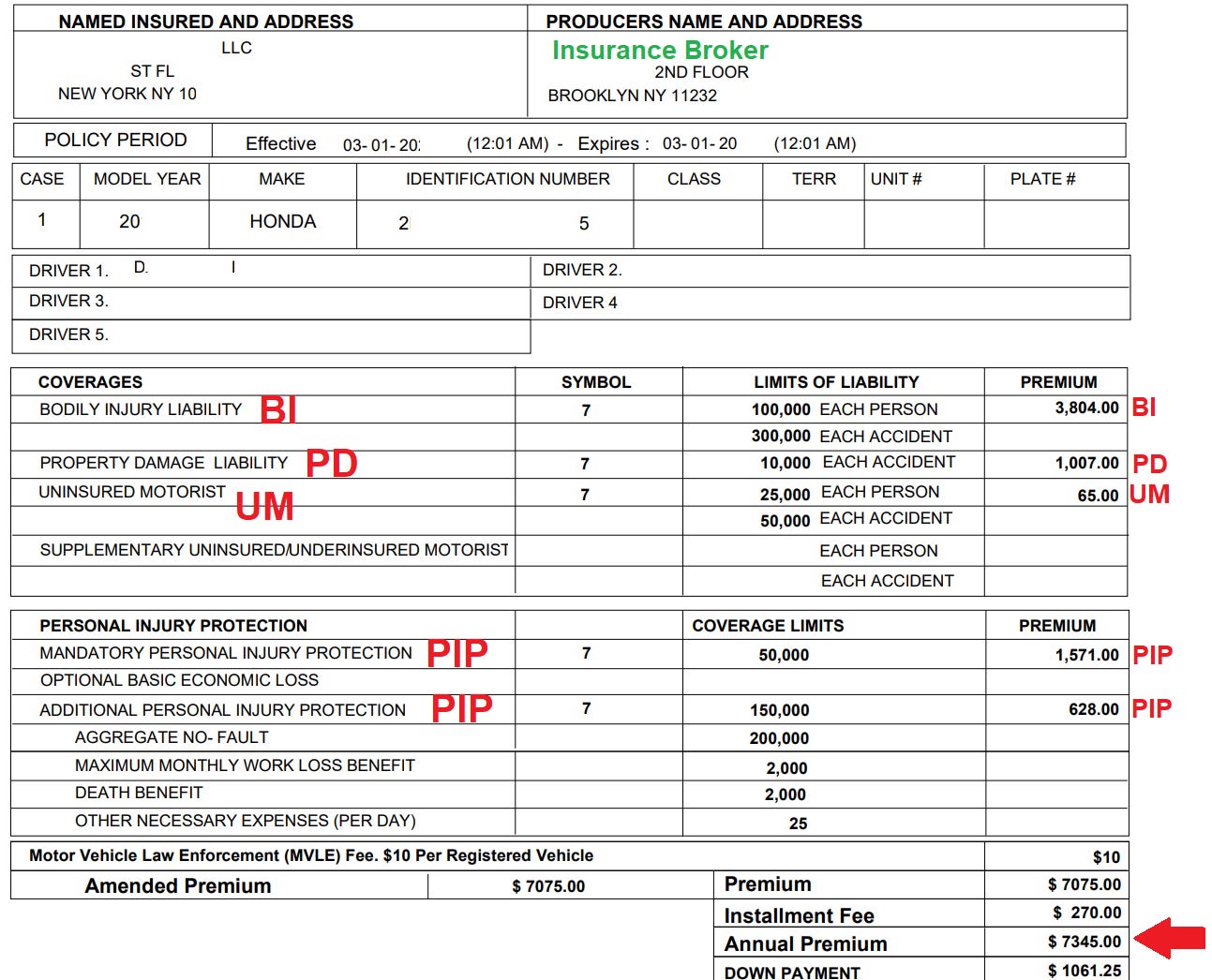

Page 3: Declaration Page (“Dec” Page)

The remaining insurance page a TLC driver or fleet receives is the Declaration Page (“Dec” page). This page restates information from the FH-1 and CoL. However, it also makes clear who the insured driver is, gives the cost breakdown of the insurance premium and a cost breakdown by the four coverage categories.

For example, the below policy has a $7,345 annual insurance premium (TLC liability-only) and its cost can be broken down as follows.

No-Fault (PIP): $2,199 (30% of premium)

Bodily Injury (BI): $3,804 (52% of premium)

Property Damage (PD): $1,007 (14% of premium)

Uninsured Motorist (UM): $65 (<1% of premium)

Installment fee: $270 (4% of premium)

It should be noted these figures will vary by policy, but your Declaration Page will give you a breakdown of how your liability policy premium is constructed. This premium breakdown by the four coverage categories is likely a proxy for where most TLC insurance claims stem from (i.e., Bodily Injury & PIP claims).

How Are TLC Liability Premiums Determined?

Your final liability insurance rate can be determined by a lot of different factors, including (but not limited to):

Years you’ve had a DMV and/or TLC license

Number of active DMV points on your record

Record of accidents, including pedestrians and bicyclists

Whether accidents are at-fault or not at-fault

If your policy is in an individual name or corporate entity

If you have an “undisclosed driver” claim or a claim when the person listed on the policy is different than the person driving the vehicle when an accident occurred

The age of your vehicle

The weight of your vehicle

Whether you’ve taken a Defensive Driving Course (DDC)

What rate increase the State insurance regulator approves

Loss run history

Article continues after advertisement

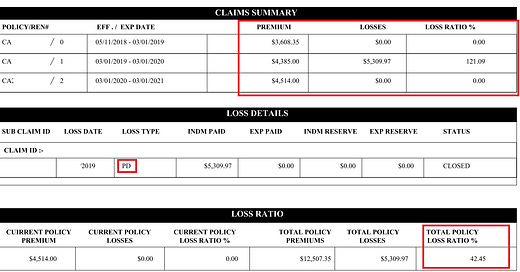

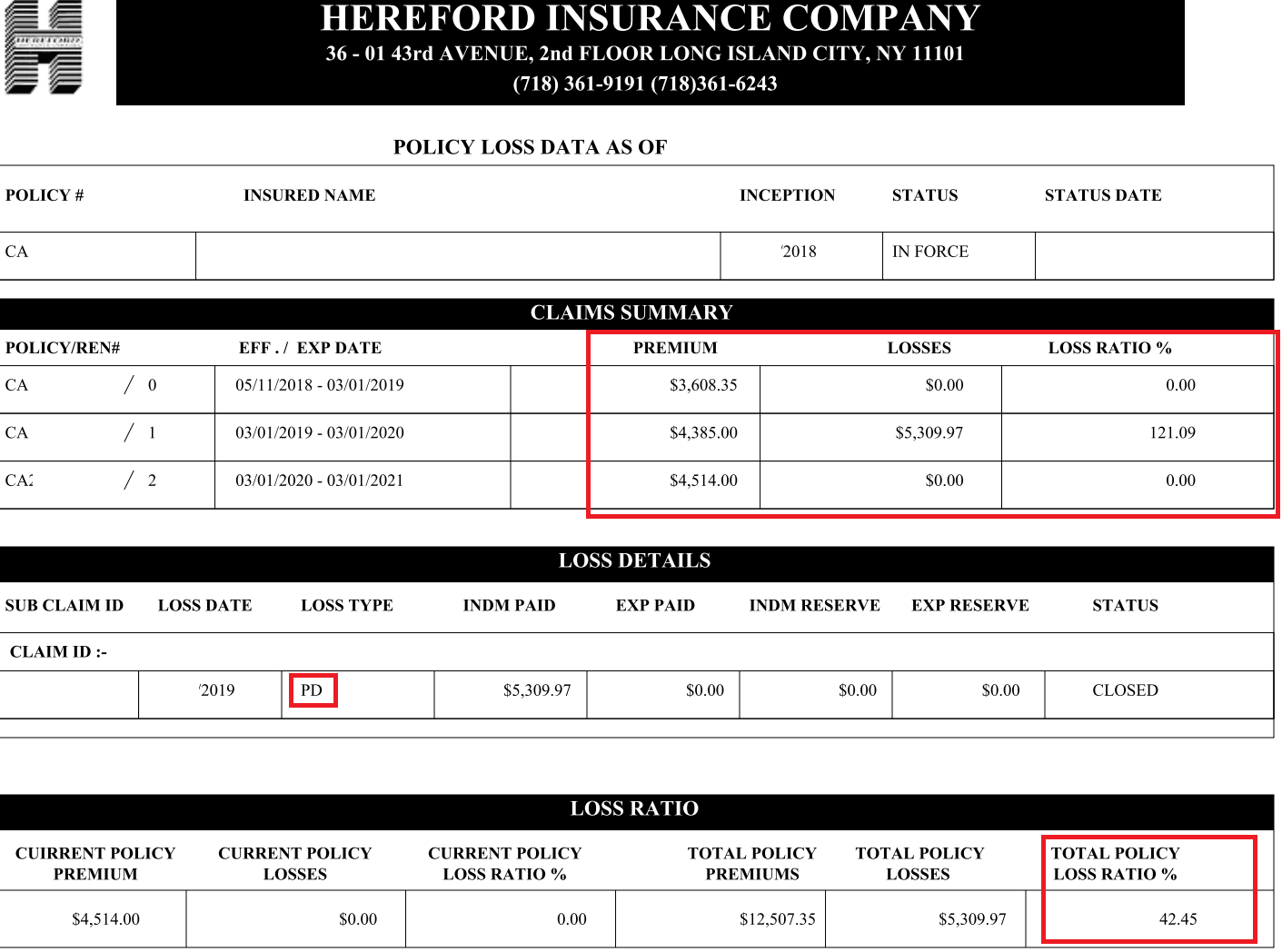

Thinking In Loss Runs

Outside of insurance premium increases due to more general factors (i.e., vehicle repair costs, inflation), loss runs are an important way to think about your insurance record and costs. Loss runs are a history or record of claims.

A loss run report is analogous to a CARFAX report or Experian credit score report, but just focused on insurance claims. For example, if you paid $25,000 of TLC insurance premiums over the last five years, but had claims against your policy of $100,000, that’s deeply unprofitable for an insurance company. Conversely, if you had no claims and paid $25,000, you’re a very profitable insurance customer.

Once again, for NYC TLC policies we should think about loss runs in terms of the four claims categories.

In the example below, the loss run report very clears lays out ~$12,500 of premiums were paid over roughly three years and a $5,300 Property Damage (PD) claim was paid out in one of the years. Therefore, the policy has a “loss ratio” of 42% or $5,300 of claims divided by the $12,500 of premiums paid.

🗄️ If you haven’t already done so, ask your insurance broker for a history of your loss runs (once a year) and keep them on file. Whether you are a driver or fleet you’re running a business, this is a good business practice.

What Are 2024 Rates Looking Like?

This year NYC TLC commercial liability rates are generally up between 10% to 30% 👀. Obviously, some might experience different increases or decreases, but we believe the below ranges capture where the majority of policies are priced.

Individual liability rates in 2024 are mostly between $4,000 to $5,500 per year

Fleet liability rates in 2024 are mostly between $6,000 to $9,000 per year

Fleet “CAP” policy rates in 2024 are mostly between $8,000 to $11,000 per year

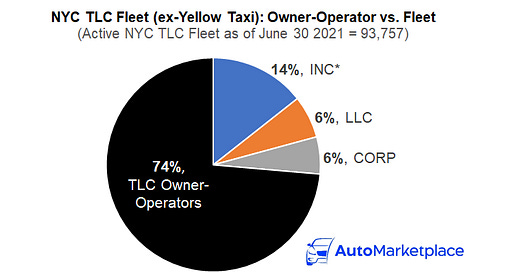

A “CAP” policy basically allows a NYC TLC fleet to have one policy for multiple vehicles and drivers. In the TLC fleet industry, a CAP policy often arises when multiple “undisclosed driver” claims happen. An insurance company wants to reduce the risk related to incorrect drivers being listed on an individual vehicle policy by creating one policy for all vehicles and drivers.

NYC TLC Fleets On Edge

Of particular note, NYC TLC fleets, who aren’t large enough to self-insure, face rate increases (20% to 30%) that now put many of them into “going concern” territory. In other words, they might not be able to pass along the increased costs to their customers (TLC drivers who lease vehicles) as they’ve (1) already been demonized as “predatory” and (2) faced the shock release of 10,000 *new* EV TLC Plates over just three months, which turn has hit their occupancy levels hard and suddenly, ahead of them needing to pay insurance deposits.

TLC Chair David Do’s dangerous use of the word “predatory” to stereotype the entire TLC leasing industry might actually have a real impact on these businesses, who generally make between 5% to 10% net profit margins. His reckless language and policy, might now bankrupt many of these businesses, who employ other New Yorkers, pay taxes and are locally-owned. As we’ve discussed at length, there were several better and more civil ways to address any concerns of “predatory” leasing.

We do also want to note, many of these fleets have carelessly managed (i.e., undisclosed drivers) their fleets and/or were the victim (i.e., delinquent and reckless drivers) of certain abusive TLC-licensed drivers. Due to these dynamics as well, many of these fleets face increased insurance costs related to bad loss runs.

Why Are Rates Going Up So Much?

Outside of the previously mentioned points re. increased cost of automotive repairs and New York being a “no-fault” state, we think the below discussions with INSHUR Co-Founder & CEO Dan Bratshpis & Next Century Insurance’s Gavriel Gavrilov, provide good, specific insight into why NYC TLC insurance rates continue to climb.

Notable quote:

“I would say what makes the cost particularly high in New York City is the fact that no-fault insurance, or sometimes called personal injury protection is a big part of the equation…

So in New York City, all TLC vehicles are required to have $200,000 of PIP coverage. That particular line of coverage is rife with massive amounts of fraud…And you kind of have an industry of bad actors…that not only try to extract as much money from this PIP coverage as possible from the insurance company, but also there are tons of…personal injury firms that represent potentially injured, potentially not injured, parties…[that try] to extract as much money as possible from the insurance company…so all of that just adds to the cost…

…what may look like a fender bender to a particular TLC driver could actually cost you know $200,000 of PIP and $100,000 of bodily injury coverage…”

- Dan Bratshpis, Co-Founder & CEO of INSHUR

Notable quote:

“Just to jump into why the rates are what they are now or what they're becoming is we have to understand that the black car industry from what it was in the beginning of the 90s till today, drastically evolved.

So back in the 90s, in the 2000s, pre Uber, your average black car driver was doing five to eight jobs a day, those five to eight jobs a day made enough for them to go home…

So the classification…has been a classification of black cars and car services. But it took a lot of time for insurance companies to understand that a lot of this work that exists now is no longer your traditional black car, it's more car service.

And the simplest way of explaining this is the number of trips per day.”

- Gavriel Gavrilov, President of Next Century Insurance (TLC insurance broker)

**to be published in coming days**

Part 2

American Transit dominates TLC liability insurance market with 63% share, followed by Hereford (21%), Affirmative Direct (6%), Accident Fund (4%) & Maya (3%)

Note: TLC insurance data has discrepancies with NYC Open Data, but provides directionally correct market share data

Limited insurance options in TLC marketplace might continue and steps drivers & fleets can take to manage insurance costs and related risks

TLC driver pay increase of 3.5% does not reflect increased driver insurance expense

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️