🚕 Marblegate Plans To List Taxi Medallion Holdings Within Months

Marblegate was granted shareholder extension to list sizeable NYC taxi medallion holdings. If successful, listing should attract attention to market in need of investment & liquidity

Back in March we reported that Marblegate, a Greenwich, Connecticut-based investment firm, was preparing to publicly list its sizeable taxi medallion holdings on the Nasdaq Stock Market. The well known distressed debt investor planned to list its holdings through an already publicly-traded “blank check” company GATE (GATE 0.00%↑ ), known as a special purpose acquisition company (“SPAC”).

Extension Granted, Q3 Closing?

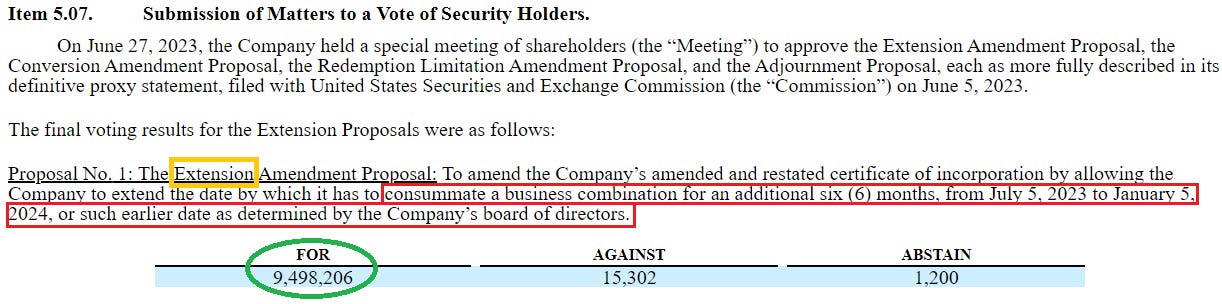

In an SEC filing published on July 3rd, Marblegate’s SPAC confirmed that it had successfully extended the date to complete its proposed taxi medallion holdings transaction (i.e., “business combination”). In fact, it had until July 5th (i.e., today! 👀) to complete the transaction or would be forced to wind up its SPAC. On June 27th, GATE 0.00%↑ shareholders voted for an extension to January 5th, 2024.

Based on other recent SEC filings, Marblegate indicated that it planned to close the transaction in Q3 2023 (i.e., July 1 to September 30).

Deal Background

$750 Million & Management Agreement

The proposed Marblegate deal still seems to be based on a valuation of $750 million 👀. We don’t know how many medallions or medallion loans that includes, but we should get further details in the coming weeks (hopefully). We do know that Marblegate’s holdings of Chicago and Philadelphia medallion-related assets make up less than $18 million in value of the $750 million - so the majority of value relates to NYC.

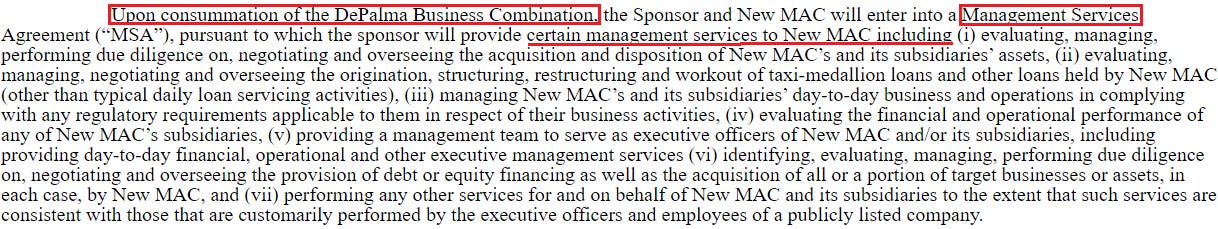

In addition, the SEC filings reveal a Management Services Agreement (MSA) proposal where Marblegate might still be involved in managing the assets, similar to a taxi medallion garage. Marblegate is likely not completely exiting their investment, but is rather planning to realize some proceeds and create liquidity (i.e., tradeable stock) for its investors.

Why Is This Important?

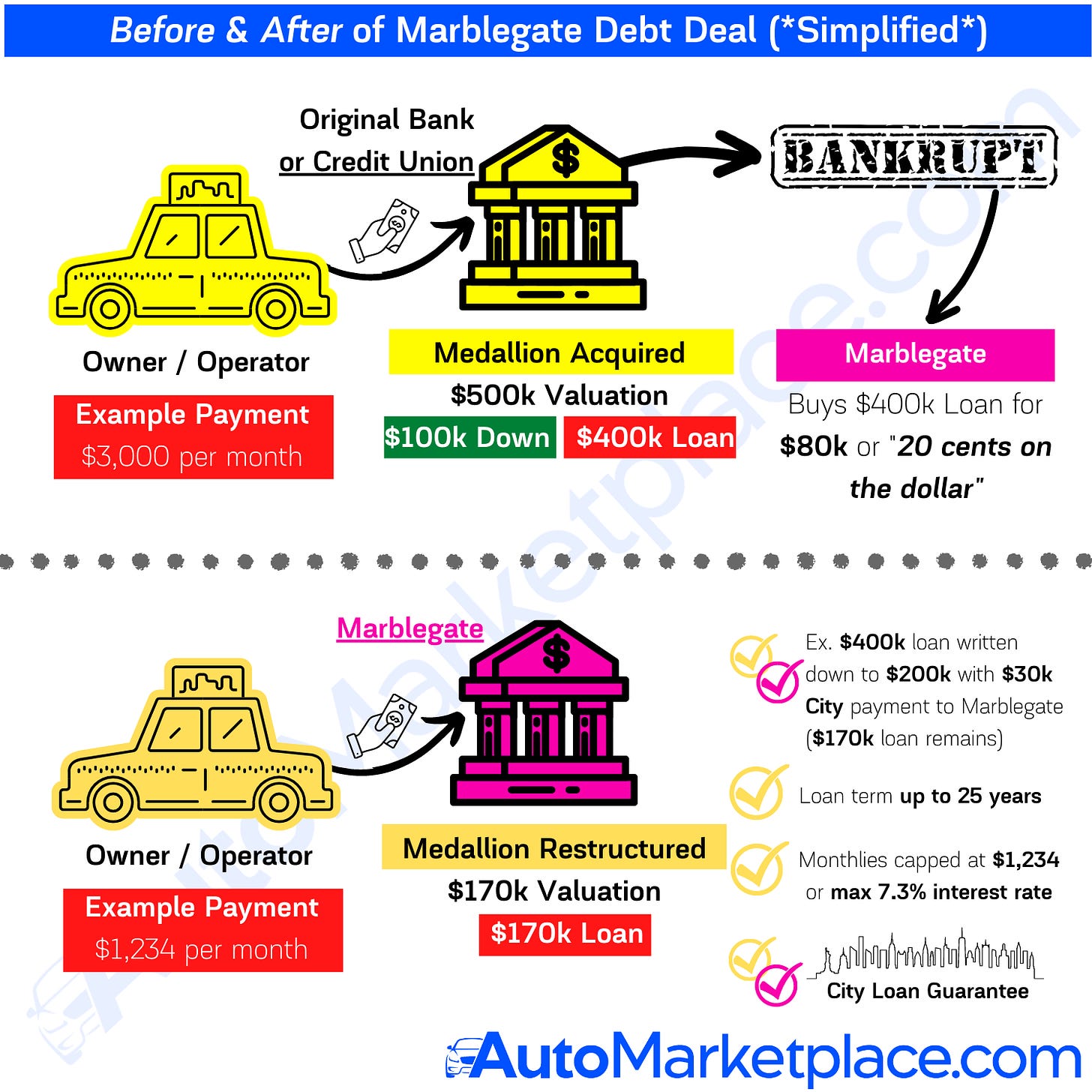

We’ve covered Marblegate’s involvement in the NYC yellow taxi medallion sector in depth over several previous articles. Long story short, they started investing in the industry when it was in distress 📉 pre-pandemic (i.e., medallion loan is being sold for 20 cents on $1), by acquiring both taxi medallion loans secured by medallions and the taxi medallions themselves.

After sticking with their investment through the pandemic (i.e., extreme distress 📉📉 when medallions fell as low as $75,000 😞) & being a key player in helping push through the historic taxi medallion debt restructuring - they are probably ready to realize some return.

At this point, some of our readers might be thinking 🤔🤔…GREAT, a hedge fund wins again, makes millions…how does this impact my life?

Ahead of officially listing its NYC taxi medallion assets, Marblegate is going to need to publicly explain its whole thesis, including in-depth market analysis of the taxi medallion sector and the overall NYC TLC industry, to investors. If they do a good job at explaining their thesis, investors are going to (re)educate themselves on the “left for dead” NYC taxi industry. This, in turn, could begin to restart interest and investment flows into the entire TLC market.

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

stock ticker "GATE"

warrant ticker "GATEW"

Warrants look very cheap, not sure why they arent trading ~$1.25 or so