Discover more from AutoMarketplace

New TLC Office Will Regulate NYC Taxi Medallions. What This May Mean for Medallion Values (& TLC Plates)

In 2020, NYC Council approved (Vote of 49-0) the creation of the TLC Office of Financial Stability. The Office, which becomes active in November, will oversee the financial stability of Medallions

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

Back in November 2020, Bronx Councilman (now US Congressman) Ritchie Torres sponsored a bill aimed at bringing financial stability to the NYC taxi medallion market, which passed the NYC Council by a vote of 49-0. The bill created an Office of Financial Stability within the TLC. Each year, starting in November 2021, the new TLC Office is required to issue a report including details about its activities, an assessment of the financial stability of the NYC taxi medallion industry, and any recommendations regarding the financial stability of the NYC taxicab industry. In addition, it also requires annual financial disclosures from any person with any interest in a NYC taxi medallion.

At the time, and as reported by the NY Daily News, Councilmember Torres was concerned by the “growing presence of private equity” in the taxi medallion market. Torres, was making an interesting (often ignored) observation that can be lost in the current medallion industry narrative - in the event that a medallion recovery takes place would another medallion financial bubble arise (yes, hard to imagine right now given where values are!). He was likely seeing the outsized bet “smart money” investment funds, such as Marblegate, were making in the medallion industry and gaming out their investment thesis.

“We cannot afford to have the TLC auction off medallions at speculative prices…We cannot allow the TLC to approve medallion transfers with speculative loans…I do not take for granted that there could never be a medallion bubble again…I hope for the best but I prepare for the worst.” - Ritchie Torres, former Bronx Councilman and current US Congressman

A Bailout Followed by a Bubble?

With the FHV License Pause (aka ‘TLC Plate Cap’) now entering its 4th year, medallion restructuring funds secured (TBD on final amount and terms), a potential City guarantee on distressed medallion loans (i.e., in the event of a loan default the City would pay unpaid medallion debt owed by a driver-owner) and the City recovering from a (hopefully) once in a century pandemic - trip demand and NYC for-hire vehicle supply could come into balance quickly.

In fact, as my Twitter interaction with Taxi Medallion Owner (@NYC_TMODA) shows maybe medallion values are actually set to rebound soon - “Are medallions the ultimate deep value play?” play as they put it. Yellow medallion cabs can actually now do street hails AND pre-arranged trips/e-hails in NYC via the Curb Mobility App. “Normal” TLC-plated cars continue to be banned from doing street hails, which is the exclusive right of yellow medallion cabs. It’s actually a fairly underappreciated and major structural advantage yellow cabs have over other non-medallion TLC-plated cars (not including the exclusive ability to sell advertising space on top a car, which Firefly Systems has recently made a bet on).

Remember, the current medallion crisis is really a debt crisis, not necessarily a trip demand crisis. Yes, yellow cab trip demand was significantly impacted by Uber/Lyft, but that’s not what has directly caused the current medallion financial crisis (indirectly there is a correlation though).

Remember, the current medallion crisis is really a debt crisis, not necessarily a trip demand crisis…The legacy debt load taken out by drivers/fleets as medallion values soared in the early 2010s (i.e., average of ~$500,000) is really what the crisis is more about

What do I mean by this? In other words, if a driver/fleet owns/owned his or her medallion free and clear (i.e., no debt), they could likely still earn a livable wage with hopes of medallion values recovering, especially given the FHV License Pause (TLC Plate Cap). The legacy debt load taken out by drivers/fleets as medallion values soared in the early 2010s (i.e., average of ~$500,000) is really what the crisis is more about. Solve the debt crisis, and then you’ll actually have a much more stable market where its Apps vs. taxis in a battle for trip market share. While the NYC yellow cab industry did lose significant market share to the ridehailing apps over the last several years, they still comfortably hung onto about 25% of total NYC trip demand pre-pandemic. In fact, yellow taxis still have about 15% market share of total for-hire trips in NYC with roughly half the cabs that were active pre-pandemic.

While the NYC yellow cab industry did lose significant market share to the ridehailing apps over the last several years, they still comfortably hung onto about 25% of total NYC trip demand pre-pandemic. In fact, yellow taxis still have about 15% market share of total for-hire trips in NYC with roughly half the cabs that were active pre-pandemic

AutoMarketplace Take

With the ongoing news, politics and negotiations around the federally funded medallion relief program, the first ever report by the TLC Office of Financial Stability is definitely something to look out for. As I’ve written previously, the ongoing medallion crisis combined with the continued FHV vehicle license cap (including the recent removal of the EV exemption), indicates the supply of for-hire vehicles in NYC will effectively be capped for at least several years.

The ongoing medallion crisis combined with the continued FHV vehicle license cap (including the recent removal of the EV exemption), indicates the supply of for-hire vehicles in NYC will be effectively capped for at least several years

Uber and Lyft were essentially able to disrupt the NYC for-hire industry, not only via e-hail technology, but through their ability to add cars via the pre-arranged “black car” for-hire vehicle segment, which historically had no cap (i.e., pre-smartphone and e-hailing become ubiquitous). After tens of thousands of new vehicle licenses were issued, the City Council / TLC announced an FHV License Pause, which has been in place, as mentioned earlier, since August 2018.

Recently, the latest biannual FHV License Review Report and Determination concluded that there was a sufficient number of for-hire vehicles on the road to meet demand. Although the wheelchair-accessible (WAV) exemption remains, we (1) believe the TLC will actively track WAV numbers, especially related to large fleets adding WAVs and (2) do not foresee the TLC opening up plates anytime soon for the following reasons:

New York State and NYC want to reduce traffic congestion. In fact, in March 2018, New York State passed a law that puts a new surcharge on rides in Manhattan below 96th St in taxis and for-hire vehicles. This was then followed up by NYC becoming the first American city to impose congestion pricing (passed in April 2019). One of the primary goals of congestion pricing is to reduce traffic in Manhattan’s Central Business District (CBD) and raise funds for the MTA (i.e. mass transit). While the congestion charge was set to go in effect in 2021, the pandemic / federal government delayed its implementation to 2022/2023. However, implementing the already passed NYC congestion legislation has become a political priority now.

Protecting the value of the medallion is very much about ensuring there is a not an oversupply of for-hire vehicles (i.e., too many cars chasing a finite amount of fares). If the City Council and TLC are focused on protecting the medallion’s value (especially if a City guarantee is in place on medallion debt), we don’t see how this wouldn’t directly be correlated to ensuring for-hire vehicle supply is very strictly limited. This can already be seen in the bi-annual FHV License Determination process and reports published by the TLC.

The TLC minimum pay requirements placed on high-volume for-hire services, such as Uber and Lyft, has forced them to effectively limit the amount of drivers on their platforms. In fact, before the pandemic both Uber and Lyft were not accepting new drivers in NYC (something I believe will begin again as driver supply and trip demand comes back). So, let’s hypothetically say the TLC “unpaused” the TLC plate cap. While drivers, especially those that rent cars, may rush to plate new cars, what would also likely happen is other drivers may just “plate” cars in the hope one day they can get onto the Uber and Lyft platforms. In essence, thousands, if not tens of thousands of plates, would be added, completely disrupting the supply and demand balance, and the TLC likely knows that’s what would play out.

Value of Non-Medallion TLC Plates?

While I will cover this topic more in depth there also seems to be another nascent market for “TLC plates” that are not Medallions? The first point I want to make is TLC plates themselves are non-transferable as a individual/company simply has the right to a specific FHV license (aka TLC plate).

TLC plates themselves are non-transferable as a specific individual/company simply has the right to a specific FHV license (aka TLC plate)

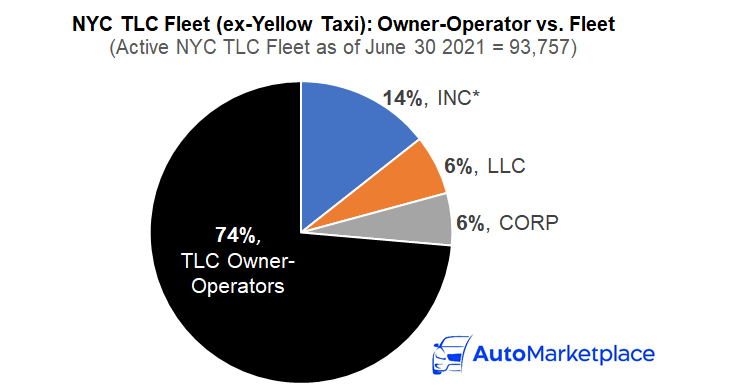

For example, if Omar A. has a FHV License under his name he cannot transfer that right to another person (i.e., he cannot sell the TLC plate). That being said, if you own a TLC plate in a corporation you could sell your company, but that transaction in my opinion, is more akin to selling a business than transferring FHV License(s) (it is a gray area though to be fair). Finally, given the large majority (about 75% from our calculations) of TLC plates are driver-controlled (i.e., registered to a person), even the ~25% of corporate -registered TLC plates, which could be sold via business sales, should not greatly impact Medallion values in the future. Furthermore, yellow cab medallions have the right to hand hails AND pre-arranged e-hails (plus advertising) so their values will be calculated separately from corporate owned TLC plates, given the greater rights medallions have.

Yellow cab medallions have the right to hand hails AND pre-arranged e-hails (plus advertising) so their values will be calculated separately from corporate owned TLC plates, given the greater rights medallions have

A thought I had was perhaps the TLC will ask for any business sales involving corporate registered TLC plates to be reported, to ensure a few entities do not gain a monopoly or duopoly position in the TLC leasing industry or engage in speculative sales to individual TLC drivers. This is perhaps a key point, an individual driver is unlikely to be the buyer of 10, 20 or 50 car fleet so the market will be limited to dealings between businesses. I’m not sure how business sales can practically be banned, but they may be regulated. I’ll have a separate article on this dynamic, but wanted to briefly mention it as it relates to the medallion industry and values.

Future Value of NYC Taxi Medallions

Given all the dynamics described above, I believe then Councilmember Torres was thinking about the industry/its dynamics in the right way. Within a few years (hopefully) as NYC recovers and grows post pandemic, you could see financial speculators enter the medallion industry again. My best guess (and this is truly a guess) on medallion values is they will break $200,000 again within a few years. After that, values may start retracing the cycle we saw in the early 2010s. It almost seems impossible today, but as Uber taught everyone, things can change much quicker than most people expect.

Let me know your thoughts? Do you think Medallion values will rebound? What do you believe the fair value of a NYC Taxi Medallion is today? 5 years from now?

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️