⛈️⚡🚕 Tesla & EV NYC TLC Comp & Collision Is Either Unaffordable Or Impossible To Get

Comprehensive & collision insurer Adriatic doubles rate for TLC-plated Teslas as others stay away. Getting full coverage insurance for NYC for-hire EVs is either unaffordable or impossible to get

Tesla, and other electric vehicles (EVs), remain difficult for many NYC for-hire transport (TLC) comprehensive & collision insurance providers to underwrite

Kingstone, a leading TLC comp & collision insurer, no longer insures Teslas (they do insure other EVs)

Transit General, after providing coverage for the Model 3 and Y, appears to have stopped comp & collision coverage for TLC-plated Teslas

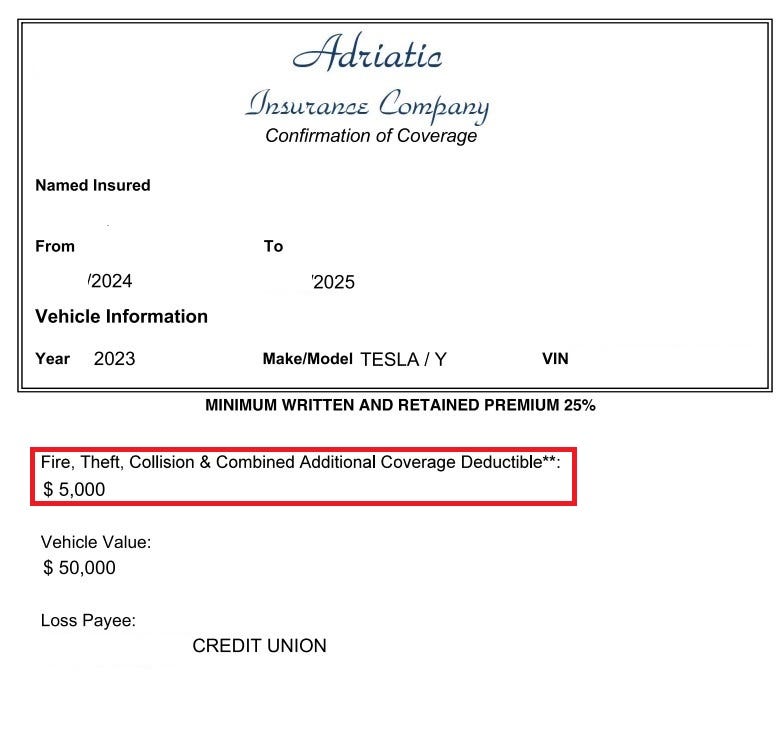

Adriatic recently doubled its comp & collision rate to insure Teslas and only offers a policy with a $5,000 deductible

Many TLC drivers have auto loans that require comp & collision coverage and regulator must take note and reflect cost in NYC driver minimum pay formula

AutoMarketplace’s Dawood Mian provides a video overview of NYC TLC comp & collision insurance market dynamics

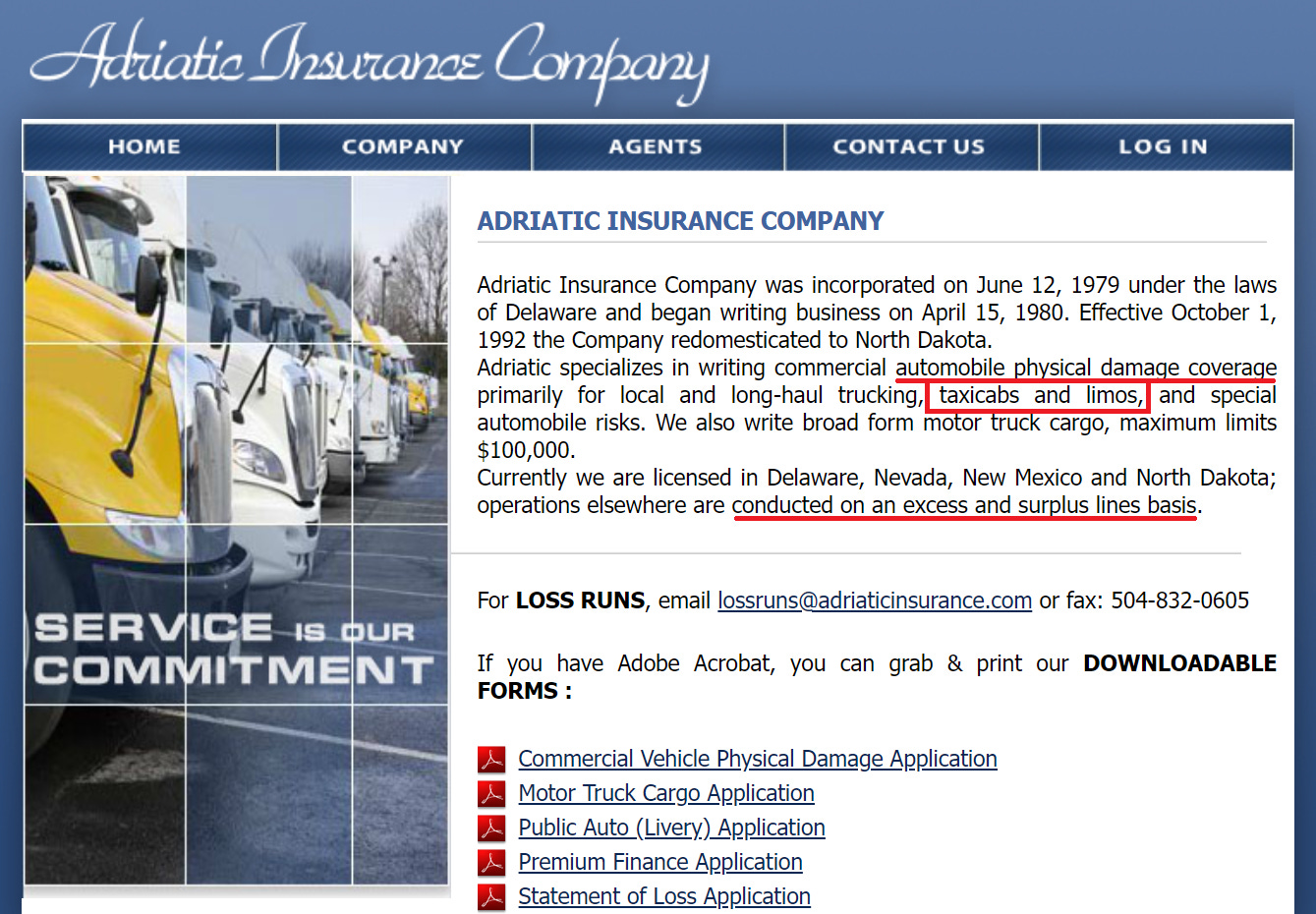

Adriatic Insurance Company (“Adriatic”) is one of a handful of insurance companies that provide comprehensive & collision insurance coverage for vehicles in the NYC for-hire transportation (TLC) market. Along with TLC liability insurance leaders American Transit and Hereford, Adriatic, INSHUR, Transit General and publicly-listed Kingstone ($KINS) provide comp & collision coverage for NYC for-hire transportation drivers and fleets. TLC drivers and fleets often use the term “full coverage” to refer to comp & collision insurance. Technically, the term full coverage describes a driver having the required liability policy plus a comp & collision policy.

Based on our research, which included speaking with several licensed insurance brokers and studying recently written TLC comp & collision policies, Adriatic and INSHUR appear to be the only insurance companies willing to underwrite comp & collision policies for TLC-plated Teslas.

What is Comp & Collision Insurance?

Comprehensive (“Comp”) covers damage to your vehicle from unexpected non-collision incidents like theft, animal damage, falling trees, and weather damage.

Collision covers damage to your vehicle that results from a collision with another vehicle or object.

If someone finances or leases their vehicle, a lender may (often does) require a person to carry a comprehensive and collision policy to prevent loan losses if an accident occurs (i.e., lender is owed more money than the vehicle they are financing is worth, also known as an “underwater” or “upside-down” auto loan).

Although many non-commercial NYC drivers have comp & collision insurance, NYC TLC drivers often just keep liability-only insurance policies for several reasons. It also doesn’t help that comp & collision insurance is prohibitively expensive for NYC TLC drivers due to the nature of the insurance risk (i.e., NYC for-hire vehicle driving 8 to 12 hours per day is tough 😓 insurance to underwrite).

Article continues after advertisement

Adriatic Comp & Collision Is Aggressive Insurance, But You Probably Can’t Blame Them

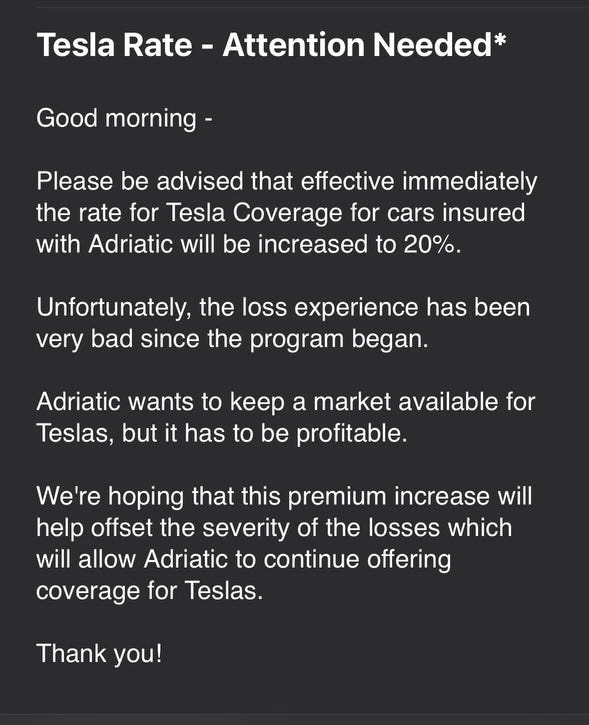

Before we share our video overview below, speaking about NYC TLC comp & collision insurance market dynamics, we think it’s important to provide specific context. Below, we share a screenshot of a recent email that Adriatic sent to its TLC insurance broker partners.

We also attach (see below) a redacted screenshot of a recent Adriatic NYC TLC comp & collision policy for a 2023 Tesla Model Y. Of particular note is the $5,000 (👀) deductible listed on the policy (typically an insurance deductible is $2,000 or less). Combining the $5,000 deductible with the disclosed premium increase to 20% of a vehicle’s value (listed at $50,000 in the below policy), if anything were to occur during the course of the one year policy, a driver might be out of pocket up to $15,000 before the insurance kicks in!

Video Overview

AutoMarketplace’s Dawood Mian provides a video overview of NYC TLC comp & collision insurance market dynamics.

*TABLE OF CONTENTS (YouTube)*

(Note: In YouTube video description you can skip around the video at these time marks)

👋 00:00 - Intro ☂️ 01:26 - Tesla & EV NYC TLC comprehensive & collision insurance ❓ 06:13 - What is comp & collision insurance? 👀 10:36 - How expensive is Tesla TLC comp & collision insurance? ❓ 15:40 - Why and when did Kingstone stop underwriting TLC-plated Teslas? ❓ 17:04 - Why is EV comp & collision so expensive or tough to underwrite? 🚕 19:57 - Drive Sally's Tesla yellow cab collision incident (case study) 🤔 22:24 - How do NYC TLC drivers get auto loans without comp & collision? ❓ 24:58 - Is warranty voided if vehicle is TLC-plated? ⚡ 28:35 - Hertz experience with EVs 🏃 33:18 - Transit General steps in & then steps out of Tesla TLC coverage 🗽 36:00 - Is NYC TLC driver pay formula accounting for insurance costs?