Discover more from AutoMarketplace

🌂 Full Coverage Insurance Not Available For TLC-Plated Teslas

Largest NYC TLC-focused comprehensive & collision insurer will NO LONGER accept Teslas. Given Tesla popularity, individual owner-drivers may opt for other EVs or delay switching to electric

At a recent NYC Taxi & Limousine Commission (TLC) public hearing on April 19th, the first speaker, NYC TLC driver Damon [Sturdivant], interestingly went off topic and spoke about his Tesla.

Given the recent *NEW* EV TLC Plate release AND Tesla's dominant electric vehicle (EV) market share, the commentary was interesting and related to collision & comprehensive insurance (e.g., covers damage related to flooding, theft, physical damage caused by an uninsured motorist, which is different than liability coverage).

Damon, who stated he is a TLC driver, recently bought a $100,000+ Tesla and was having difficulty getting “collision insurance”. Note, liability coverage PLUS collision & comprehensive coverage = FULL COVERAGE.

AutoMarketplace researched Damon's claims more and we share our findings and some thoughts below.

What Is “Collision Insurance”?

Without fully restating a previous article (link below) published in September 2021, “collision insurance” refers to additional vehicle insurance protection beyond required auto liability insurance coverage.

Although most non-commercial drivers have collision insurance, many NYC TLC drivers just keep liability-only insurance policies. It also doesn’t help that comprehensive & collision insurance is prohibitively expensive for NYC TLC drivers due to the nature of the insurance risk (e.g., NYC for-hire vehicle driving 8 to 12 hours per day is TOUGH 😓 insurance to underwrite).

However, if a NYC TLC driver’s vehicle has a loan attached to it the auto lender will often REQUIRE full coverage insurance. In practice many auto lenders do not check, but that doesn’t eliminate the risk posed to TLC drivers that don’t have this coverage.

We understand Damon’s frustration in his testimony, but the NYC for-hire vehicle insurance industry is a very niche, difficult and regulated market to underwrite (e.g. Why do you think GEICO or State Farm doesn’t offer TLC insurance?).

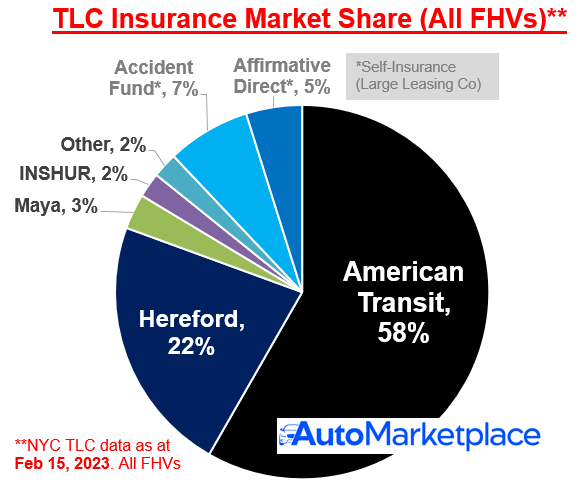

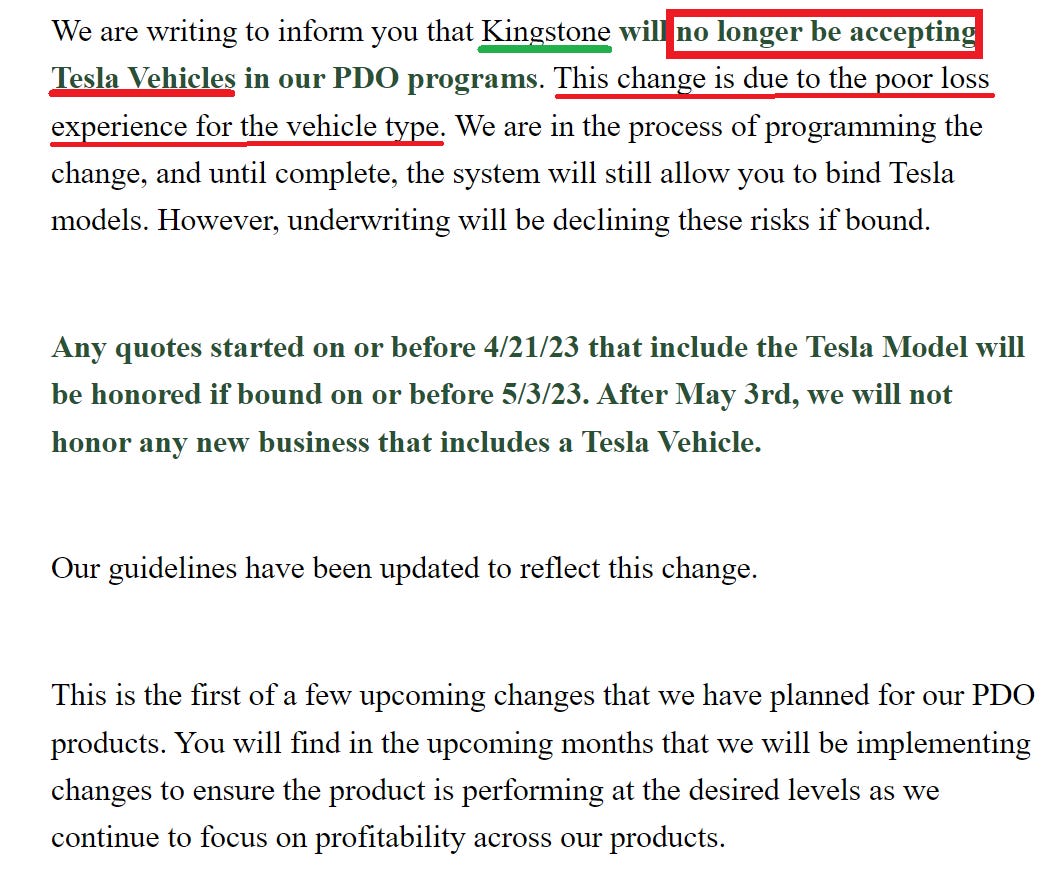

If insurers have chosen NOT to underwrite Teslas (or other EVs), it’s NOT conspiracy, it’s likely based on their experience with actual claims. Based on our discussions with NYC TLC insurance brokers, the major collision insurance providers in the NYC TLC market - Kingstone, Hereford and Adriatic - are either not underwriting Teslas any longer or are extremely hesitant.

In addition, as other non-Tesla brand EVs become more popular, insurance companies may reach the same conclusion if their claims experience is similar. For example, is the lack of third party EV service infrastructure and parts making it difficult to reasonably service insurance claims related to EVs or causing claim turnaround times to be unusually long.

The regulator (a/k/a TLC), drivers and other industry participants need to understand that this is quite technical and based on actuarial math.

$100,000+ EV For NYC TLC Market?

This brings us to another point. As we’ve stated previously, before starting AutoMarketplace we operated one of the largest luxury (e.g., UberBlack) for-hire vehicle leasing businesses in New York City. Our fleet consisted only of BMWs, Mercedes’ and Cadillacs.

Because of our operating experience, we understand the dynamics and costs (e.g., cost per mile, total cost of ownership) of operating vehicles in the NYC for-hire transport industry.

To be blunt, purchasing a $100,000+ Tesla Model X for the NYC TLC industry is not a well thought out financial decision. We hope other TLC drivers do not make similar decisions.

Drivers, certain non-technical journalists and others often rail 😡, sometimes correctly to be clear ✅, against the “TLC Leasing Mafia”. The accusations often revolve around predatory leasing rates (e.g., “$475 per week for a Camry!”).

Firstly, as we’ve laid out previously, most of the rates aren’t as predatory as publicly presented. Secondly, and we’ve seen this time and again in our experience, some (not all) NYC TLC drivers unfortunately DO NOT do the critical financial math related to the cost of operating a TLC-plated vehicle. This causes some to be upset about things they do not actually fully understand (yes, we’re not going to gain fans by saying that, but it’s the truth 🤷♂️).

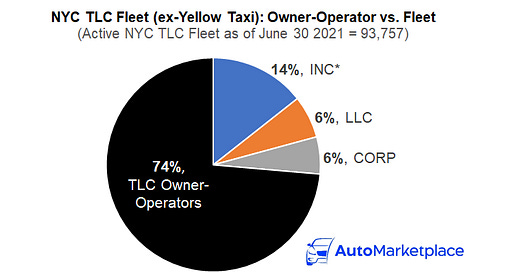

Finally, and we’ve also discussed this in another article, while we respect the TLC’s role as a regulator and its electrification goals, it doesn’t appear the regulator is as financially sophisticated as they probably need to be. Given the recent release of 1,000 *NEW* EV TLC Plates, of which 80%+ went to individual drivers, is the TLC unintentionally forcing drivers into troubling financial obligations.

We are left wondering about the source of this unnecessary, unnuanced, and combative rhetoric. While we support the *responsible* adoption of electric vehicles (EVs), we oppose any misleading calculations that could lead drivers to make poor financial decisions. Have we forgotten the lessons of the taxi medallion crisis?

If a driver must replace the battery or other costly components, it may lead to severe financial consequences. We believe that the TLC's decision to promote expensive EVs at a time when interest rates are at a generational high could eventually result in financial crisis for some drivers, for which the TLC will likely not take responsibility.

- AutoMarketplace NYC (March 21, 2023)

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

***NOTE*** - May 1, 2023: We’ve heard from a few NYC TLC Brokers that Transit General (https://transitgeneral.com/coverage/) is currently underwriting comprehensive & collision coverage for TLC-plated EVs, including the Tesla Model 3 and Y

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

“To be blunt, purchasing a $100,000+ Tesla Model X for the NYC TLC industry is not a well thought out financial decision.”

You are too kind. It’s probably the STUPIDEST decision a driver could make, especially now in light of the denial of insurance revelations. This has to be emphasized. Add to that limited charging stations, long waits for collision repairs, the constant threat of deactivation from rideshare companies, and onerous note payments (~$2k monthly with $20k down payment and financing $80k at 8.5% over 4 years) and that is the making of a financial disaster. Quite frankly, you’re not going to get the financing if you can’t get collision insurance. The insurance company might actually be doing you a favor by denying coverage for your $100k Tesla. If you do manage to drive without collision insurance then you’re left hanging in the wind.

***FOLLOW-UP NOTE***: We’ve heard from a few NYC TLC Brokers that Transit General (https://transitgeneral.com/coverage/) is currently underwriting comprehensive & collision coverage for TLC-plated EVs, including the Tesla Model 3 and Y. However, no NYC for-hire transportation insurance company, to our knowledge, is willing to underwrite comprehensive & collision coverage for pricier EVs (e.g., Model S, Model X)