Discover more from AutoMarketplace

NYC Flooding Exposes Lack of Comprehensive & Collision Insurance Coverage in TLC Industry

Historic flooding caused by remnants of Hurricane Ida totaled several NYC TLC vehicles. TLC drivers often don't carry, and can't afford to carry, comprehensive & collision coverage for their vehicles

It’s been a very wet summer this year in NYC and flooded roads with standing water are becoming an increasingly common sight. In fact, the summer of 2021 was the second-wettest in recorded NYC history, BEFORE the remnants of Hurricane Ida struck!

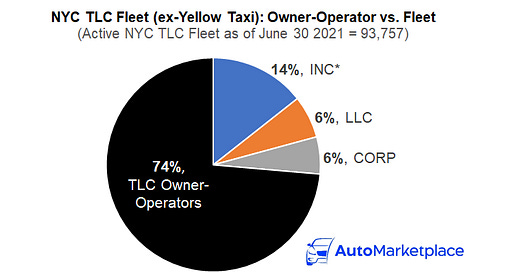

When the storm stemming from Ida passed over the NYC area about two weeks ago, the rainfall and flooding were historic. Unfortunately, for some NYC TLC for-hire drivers, many who just have liability-only insurance policies (i.e., doesn’t cover physical damage or flooding), the flooding totaled their cars leaving them in a precarious financial / professional situation. This is a unique problem that many non-commercial drivers often don’t face as “normal” car insurance usually includes ‘comprehensive & collision’ coverage along with the required liability protection.

While there is some hope that federal emergency relief funds could help, the process could take months and may not be practical to wait for (i.e., many drivers need to get their TLC-plated cars active ASAP so they can work to earn a living/pay bills).

So, why don’t NYC for-hire drivers have ‘comprehensive & collision’ policies?

Comprehensive & Collision Coverage in the NYC For-Hire Transport Industry

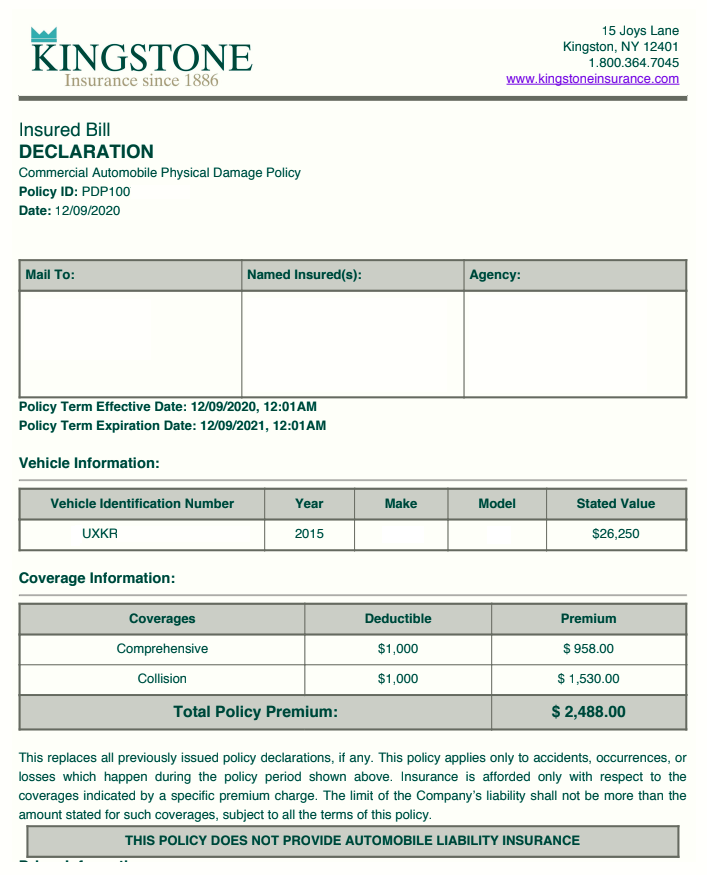

The short answer to why most NYC TLC drivers don’t have ‘comprehensive & collision’ insurance policies is it is prohibitively expensive, especially layering on the cost of a standalone liability-only policy. In fact, as we wrote two weeks ago NYC TLC liability policies usually cost between $3,000 to $4,000 per policy (add $1,500+ more per policy for fleets). As the example policy below shows, NYC commercial for-hire comprehensive & collision policies have annual premiums, not including out-of-pocket deductibles, that cost ~9% of a vehicle’s assessed value. In other words to insure a car valued at $26,250, it costs (again just for the physical damage policy), about $2,500. Layer on the cost of a liability-only policy and a TLC driver is looking at between $5,000 to $6,000 (!!!) in annual auto insurance premiums per year for a “full coverage” policy (i.e., liability plus comprehensive/collision). This dynamic also explains why many are often confused by seemingly high TLC vehicle rental rates in NYC (i.e., it’s very much insurance related).

Layer on the cost of a liability-only policy and a TLC driver is looking at nearly $5,000 to $6,000 in annual auto insurance premiums per year for a “full coverage” policy (i.e., liability plus comprehensive/collision)

For context, New York State’s average car insurance policy is $1,582 per year (already 11% above the national average). Like-for-like NYC TLC drivers would have to pay ~4x for similar coverage that most non-commercial NY drivers enjoy. (Note: similar is in italics because TLC liability coverage is actually not similar to most NY State auto insurance policies). To be fair, commercial for-hire insurance should conceptually cost more than a “normal” car insurance policy (i.e., more miles driven and risk), but should it be 4x more?

What Can Drivers Do To Protect Their Vehicles Against Increasing NYC Flooding Risks?

As the NYC area becomes more flood prone, TLC drivers and fleets need to start thinking harder about protecting their vehicles from water damage and hedging risks. In an ideal world, I would say the peace of mind that comes with paying an extra $150 to $250 per month for full coverage insurance is worth it, especially if you have a loan on your vehicle. That being said, I also know many drivers would prefer to keep that money to the side to take care of other bills. In fact, if you hypothetically owned a vehicle for 5 years and never had a physical damage claim, the sum of the physical damage premiums does add up (i.e. $~2,000 avg. per year * 5 years = $10,000!).

Personally, our recommendation to most TLC drivers is to get full coverage insurance. However, if you don’t want to, then it’s probably wise to put $150 to $250 per month in an emergency fund (literally a “rainy day” fund), which is invested in conservative investments that keep up with inflation. It’s also important to note, some lenders require you to keep comprehensive & collision policies and do occasionally check (many don’t though after the initial car purchase).

Personally, our recommendation to most TLC drivers is to get full coverage insurance. However, if you don’t want to, then it’s probably wise to put $150 to $250 per month in an emergency fund (literally a “rainy day” fund), which is invested in conservative investments that keep up with inflation.

Are you a NYC TLC driver who’s car was impacted by water damage caused by flooding? Please reach out, as we want to understand what your experience has been and how you have navigated your vehicle being damaged/totaled.

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️

My car got flooded