Discover more from AutoMarketplace

Why I Believe NYC Rideshare Will Be A Professional Full-Timers Market (Hint: Insurance)

Today's TLC email coupled with a recent Streetsblog story is an important reminder that NYC is a unique "rideshare" market that will eventually only consist of full-time professional drivers

How NYC TLC liability (aka NYC rideshare) insurance works and why it costs so much has always intrigued me. It is often the largest expense, outside of the vehicle itself, that most NYC TLC fleets and drivers face. While exact figures are hard to come by, most NYC TLC drivers pay between $3,000 to $4,000 (fleets $5,000 to $6,000) of insurance premiums per year (per vehicle). This is ONLY for liability and does not include comprehensive & collision coverage, which would cost an additional $1,500 to $2,500 per year for most TLC drivers (i.e., traditional full coverage insurance would be over $5,500 per year (per car) for the majority of NYC for-hire drivers and fleets). Given New York State’s average car insurance policy is $1,582 per year (already 11% above the national average), NYC for-hire commercial policies are, like-for-like, 3x to 5x more costly than what most New Yorkers pay for auto insurance.

Given New York State’s average car insurance policy is $1,582 per year (already 11% above the national average), NYC for-hire commercial policies are, like-for-like, 3x to 5x more costly than what most New Yorkers pay for auto insurance

In many ways the higher premiums make sense given the vehicles have high utilization rates and are used to transport people. In a fairly in-depth Streetsblog article, reporter Jesse Coburn explores the esoteric history of the NYC for-hire transport insurance industry. In summary, Coburn essentially makes the argument that NYC for-hire liability limits of $100,000 (per person) are too low, in fact more than 90% lower than the $1.25 million liability limit policies that Uber/Lyft carry for non-NYC rideshare drivers. He uses two very unfortunate situations to illustrate his point.

The case of Velma Mitchell, a pedestrian, who was hit by a TLC-plated vehicle while legally walking in the Bronx. Her subsequent injuries and rehabilitation have altered her life and ability to work. Given the lower liability limits for NYC for-hire vehicles, the total compensation she will be able to recover is likely far less than the true personal financial and psychological damage of the incident.

The case of Mohamed Hossain, a TLC driver who was tragically killed by a uninsured drunk driver in June leaving Hossain’s uninsured motorist insurance as the only compensation available to his wife and three children for his death (Note: I separately hope the Black Car Fund was contacted which also offers a $50,000 Death Benefit to licensed TLC drivers if killed on the job)

The article is fairly sophisticated in its analysis of the situation. It recognizes that insurance for “true” rideshare drivers Upstate, who don’t need a commercial license to operate a taxi, should carry more liability coverage than professionally licensed and regulated NYC TLC drivers. In addition, the article gives a voice to industry professionals that recognize raising the liability limits in NYC would effectively sideline a large chunk of drivers (and fleets) as they would be unable to afford the cost of higher liability limit policies (i.e., drivers are already paying 3x to 5x the cost of the average New York State policy as noted above).

Asking them and other for-hire vehicle drivers in the city to buy policies with 10 times the coverage would put many out of business.

“The entire industry would collapse,” said Steven Shanker, general counsel for the New York Livery Fund.

Finally, the question arises of whether Uber, Lyft or other rideshare apps should pay for insurance costs (as they do in other markets) or whether a supplemental public car insurance fund could subsidize payouts to crash victims when a driver’s insurance is insufficient. I like the idea of a supplemental public car insurance fund which could, for example, be partially funded by the commissions rideshare apps collect, helping subsidize already high NYC for-hire insurance premiums. Remember, Uber and Lyft take the same commissions in NYC as they do in other markets, but seem to have de minimis insurance obligations vs those markets (in other words their NYC businesses are very profitable if they don’t have to pay for insurance!).

I actually wrote about this in 2019, related to a potential investment in Lyft.

In fact, if we were to eliminate the 50%+ of 'insurance-related cost of revenues' it would imply Lyft's NYC business had a ~70% contribution margin…on the revenue it made in New York City, or ~$145m in 2018. This would imply Lyft NYC may have accounted for ~16% of Lyft's total contribution margin in 2018! (Seeking Alpha article in 2019)

NYC TLC Email

The NYC Taxi & Limousine Commission (TLC) sent an email to all licensed drivers and vehicle owners today sharing some interesting safety and crash data. It also reminded licensed TLC drivers that they faced consequences, including points and summonses, related to red-light violations. This email combined with the Streetsblog article really reminds drivers (and other industry participants) what’s at stake, especially as NYC begins to truly open up after the pandemic.

***TEXT OF NYC TLC EMAIL***

Dear TLC-Licensed Driver,

A major responsibility of the NYC Taxi and Limousine Commission is caring for the safety of the public and our licensed Drivers. We write to emphasize New York City’s commitment to improving road safety and to remind you about the TLC summons policy for red-light violations.

Seventy percent of pedestrian deaths are caused by dangerous driver choices. Most TLC Licensees drive vigilantly and safely. However, while Taxis and FHVs make up only 5% of vehicles on the road, they are responsible for 14% of fatal crashes. Sadly, in 2021 (January-May), TLC Licensed Vehicles were involved in 10 fatal crashes, 6 of which included pedestrian fatalities. Additionally, in 2021, there were 2,812 car crashes that involved TLC Licensed Vehicles and resulted in a serious injury. We must do better to be safe.

Making safer choices include actions like slowing down, turning cautiously, watching for pedestrians and cyclists, and staying alert. It is important that you pay attention to the rules of the road, particularly stop signs. Remember that pedestrians and other vehicles are counting on you to stop when directed. Ignoring a stop sign can have deadly consequences.

Another important rule is stopping at red lights. If a TLC-Licensed Vehicle goes through a red light, the Department of Finance (DOF) will issue a red-light ticket. Because TLC Licensees are held to high standard, they can also face additional penalties for this violation under TLC Rule §80-13:A violation of TLC Rule §80-13(a)(3)(vii) carries a fine of $300 and 3 points if a licensee pleads guilty without a settlement before the hearing OR a fine of $400 and 3 points if found guilty following a hearing. Before a hearing is scheduled, a Licensee will be mailed a settlement offer for the red-light camera violation, which usually includes $0 and 3 points. If the settlement offer is accepted, a Licensee does not have to come to a hearing; the violation will stay on a Licensee’s TLC driving record and will count toward the calculation of future TLC penalties. If a Licensee does not accept the settlement offer within the timeline given in the letter, a hearing will be scheduled at the Office of Administrative Trials and Hearings (OATH). A Licensee may present any defenses or arguments at a hearing before a Hearing Officer at OATH.

As a part of the City’s Vision Zero Program, the City has installed red-light cameras throughout the five boroughs. The Red-Light Camera Program is critical to saving lives in New York City and helps to lower the number of drivers who are speeding. Collisions caused by drivers who violate traffic signals are highly related to crashes involving fatalities and severe injuries because the higher your speed is, the longer it will take you to stop your vehicle. Look at this powerful image below. Driving 40 MPH more than doubles the time it takes to stop, even though it is only 15 MPH faster than 25 MPH:

Driving the speed limit is a key element of Vision Zero. In recent years, the City reduced the speed to 25 MPH. A pedestrian struck at 30 MPH is 2 times more likely to be killed than a pedestrian struck at 25 MPH. The more slowly you drive, the more time you have to react to an emergency situation, keeping you safer. NYC’s speed camera enforcement reduces speeding violations by 71.5% and has lowered the number of injury crashes at locations with speed cameras by 17% since their installation. The best way to avoid getting a ticket by a red light or speed camera is to not drive faster than the speed limit and to stop at red lights.

Remember that a penalty for violating the law is meant to discourage future violations, as well as to prevent tragedies that can devastate the lives of TLC-Licensed Drivers, passengers, pedestrians, cyclists, and other road users. In the spirit of Vision Zero, your choices matter. Thank you for choosing to keep New York City safe.

***END TEXT***

Why I Believe All NYC “Rideshare” Drivers Will Be Professional Full-Timers?

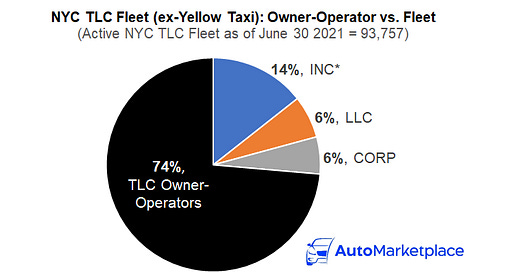

Firstly, I should explain that I put “rideshare” in quotes because by now it should be apparent that the NYC for-hire transport market is much more regulated than any other rideshare market in the United States, perhaps the world! Uber, Lyft and their independent operators are effectively subject to NYC Taxi regulations (i.e., commercial licensing, insurance, etc.). As outlined above given the cost of insurance for drivers WITHOUT a record and the low liability limits in place in NYC, it seems that drivers (and fleets) who cause large insurance payouts will effectively be uninsurable. What do I mean by this?

In the Streetsblog article it actually names and interviews the driver who hit Velma Williams, the pedestrian crossing the street in the Bronx. The driver unfortunately admits to making a bad mistake and the article concludes by making the point that the TLC driver essentially faced no consequences, outside of a $200 ticket.

“When I was about to turn left, all of a sudden — I didn’t even see the lady — but when I was turning left, she got struck,”…

“I feel very sorry for her,” said [TLC driver], 61. “I didn’t do anything on purpose. It was just an accident.”

[TLC Driver] is still driving for Uber, he said — the same SUV that hit Mitchell. The car wasn’t damaged in the collision. The total cost of the crash to him was a $200 ticket for failure to yield — which at least strengthened Mitchell’s case against him. The police didn’t ask [TLC Driver] any questions about the crash, he said, and Uber didn’t either.

That’s not completely accurate. What will happen is the driver’s license will have points and his liability insurance premium is likely to go up by at least 20% (i.e. $600+ if not more). If any additional at-fault/split-fault accidents happen during the next 12 to 24 months, especially involving a pedestrian the driver will be uninsurable. In other words the driver’s premiums would be too high vs. potential earnings OR an insurance company could make a case that it would be uncomfortable underwriting the risk. As drivers native to the rideshare apps (i.e. Uber, Lyft) become NYC TLC veterans, only those who have shown the ability to operate safely will be able to afford TLC liability insurance. Therefore, we believe over time, only full-time professional (i.e., proven) TLC drivers will remain in the NYC for-hire transportation industry.

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️