Discover more from AutoMarketplace

🗣️ MARKET CHAT: Is INSHUR Exiting The TLC Insurance Industry?

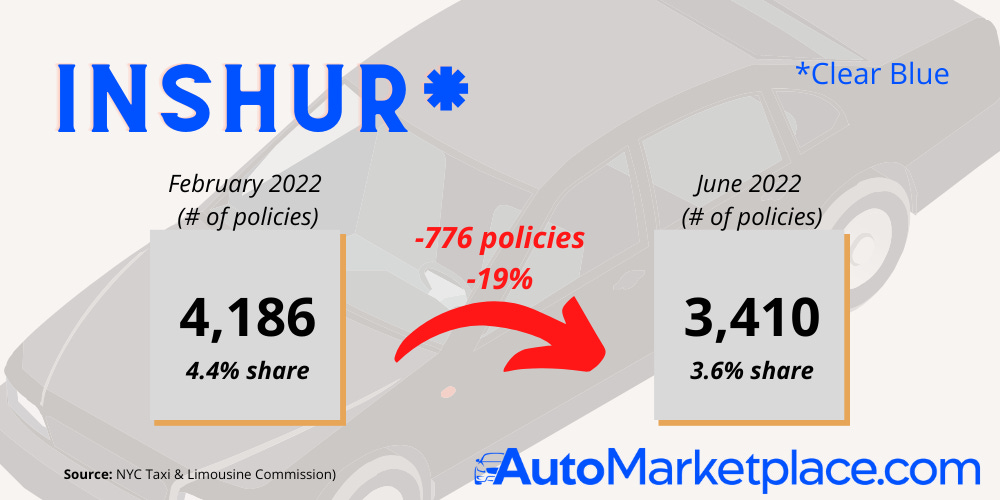

Recent data, combined with market rumors, seems to indicate INSHUR, the fourth largest NYC TLC liability insurance ☂️ provider, is significantly reducing size of their NYC business

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

⏱️TL;DR Summary

👋❓INSHUR Leaving NYC? Recent data, combined with market chat, seems to indicate #4 TLC insurance provider, INSHUR, is reducing size of their TLC insurance business significantly. (Note: INSHUR has a UK/EU business too)

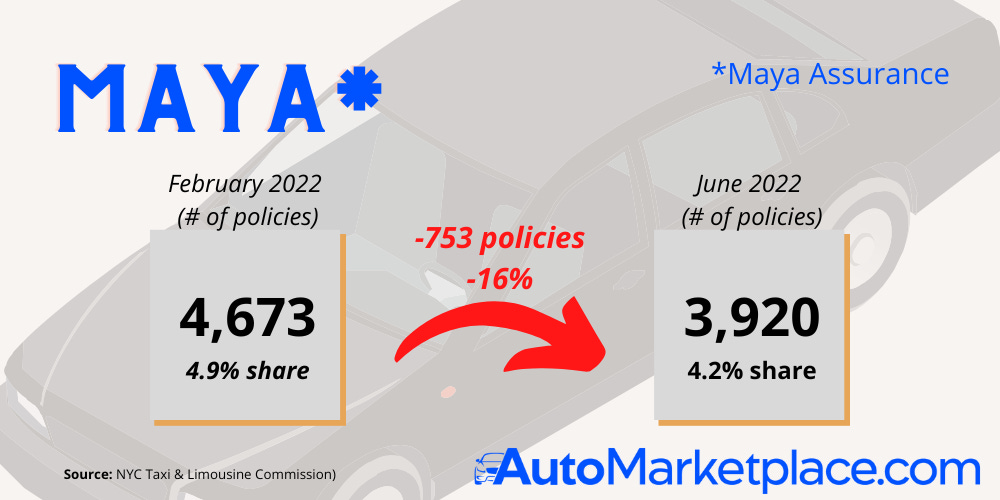

☔📉 Insurance Needs Scale. Once an insurance company has less than a certain # of policies to distribute risk, it calls into question whether the actuarial math is sustainable (i.e., Premiums - Claims - Overheads > $0). INSHUR and #3 TLC liability insurance provider, Maya, are losing scale.

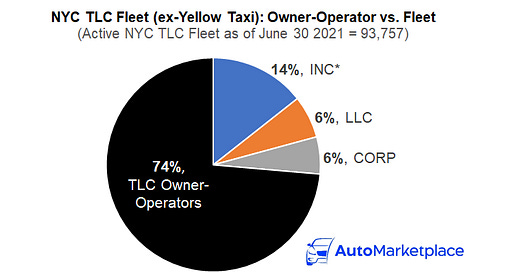

🥇🥈 Will Two Players Only Remain? Excluding self-insurance structures a few large fleets can create, American Transit & Hereford will essentially be the only two TLC liability insurance options for NYC TLC drivers and smaller fleets. #3 TLC insurance provider, Maya, is losing market share and doesn’t seem to insure smaller fleets.

📘📒 By Definition, Only A Few TLC Insurance Companies Can Exist. Given the commercial for-hire insurance requirements required to operate in the NYC TLC industry, only a few insurance companies can exist to distribute risk, UNLESS you convince large traditional auto insurers (i.e., State Farm, GEICO, Liberty Mutual) to enter, which they are unlikely to do. Therefore, we believe, a Black Car Fund-like insurance fund should be created to help capitalize a niche insurance industry and provide protection to drivers & smaller fleets.

👋❓Is INSHUR Leaving?

A few months ago, we did a full overview of the NYC TLC liability insurance market. From how insurance works to the specific dynamics of the NYC TLC liability insurance industry. Insurance, along with car payments and vehicle maintenance, is one of the largest expenses for most drivers and fleets.

Therefore, when we started hearing rumors that INSHUR, one of the four main NYC TLC insurance providers, was not renewing policies, we wanted to look at what the data said. What we found not only seemed to confirm the chat around INSHUR leaving the TLC market (or doing less business in it), it also highlighted similarly sized #3 player, Maya Assurance, reducing its TLC liability insurance business significantly. In addition, while Maya may still stay in the industry, a closer look at the policies Maya underwrites seems to indicate that it doesn’t insure TLC fleets.

Remember, in order to fundamentally run an insurance company (across many industries) and have the math work (i.e., premiums > payouts & overheads), scale is needed. For example, if you had an insurance company that only had 500 policies, just a few major accidents could put you out of business OR force you to raise premiums to an uncompetitive level.

As a reminder, based on AutoMarketplace.com analysis, this is what TLC liability insurance market shares looked like in February 2022 👇.

👇 Link to previous AutoMarketplace.com article below 👇

📊🧮 What The Data Shows in June 22?

Looking at the most recent NYC TLC liability insurance data, it's incredible how much INSHUR and Maya’s market share changed post the annual renewal season, which concludes on March 1 for most companies (although INSHUR policies are known to renew at different points in time).

Take a look for yourself 👀👇

🥇🥈 Then There Were Two

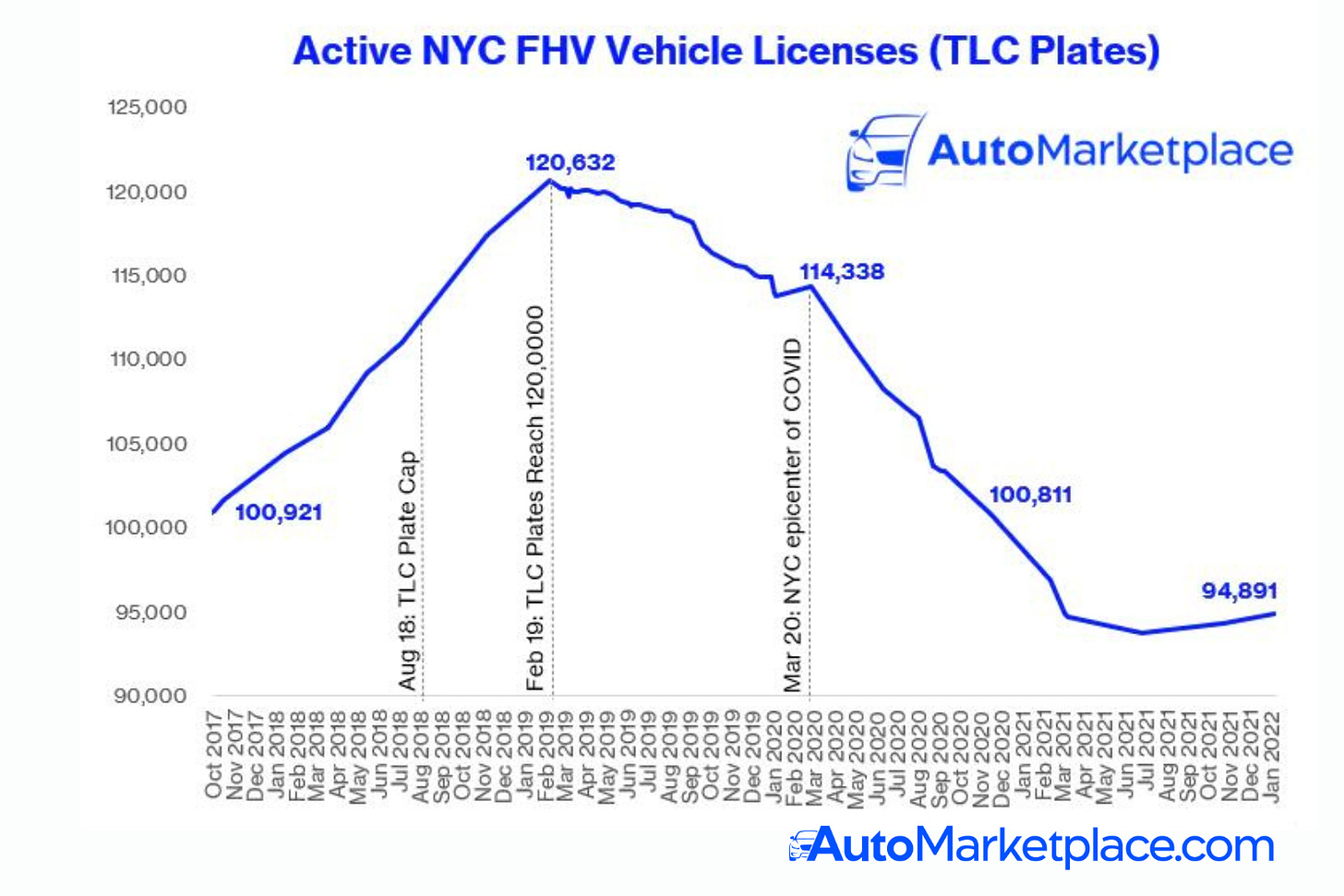

If INSHUR leaves and Maya significantly reduces its book of business, two insurance options remain - American Transit & Hereford. Now, as we’ve stated previously, this actually makes a lot of sense. Think about it 🤔.

“Given the TLC insurance market has limited growth now (TLC plate cap) and over 200 million trips that could result in claims, only a handful of companies collecting the majority of premiums could make the financial math work. For example, if you had an insurance company that insured 1,000 vehicles and was earning $4 million of premiums, only a handful of bad accidents or incidents would make that company financially unviable (claim payouts would be greater than premiums earned & investment income). This is why the insurance industry in general lends itself to large companies that can distribute risk and costs due to economies of scale, another way of saying the more premiums a company can collect, the more risk they are able to distribute. There is something to be said for quality over quantity and we’ll discuss that at the end.” - AutoMarketplace.com article, NYC TLC Insurance: 2022 Market Overview & Thoughts. Feb 4 2022.

If there are a limited number of policies (vehicles) in a niche commercial for-hire transportation insurance market (i.e., TLC liability insurance), that national auto insurers like GEICO traditionally avoid (i.e., taxi insurance), it's reasonable to assume only a few scaled companies can make the math work. In addition, the math still seems hard or is being badly managed by #1 player American Transit.

⚖️⚖️ To be fair to American Transit, larger than normal loss runs (term used for financial losses related to insurance claims) could have also stemmed from the rapid rise of TLC-licensed vehicles, mostly related to Uber & Lyft, in NYC. ⚖️⚖️

🧵✍️ Concluding Thoughts

As I recently shared in written testimony to the NYC Taxi & Limousine Commission (TLC), I believe there needs to be is a Black Car Fund-like entity (maybe the Black Car Fund itself can manage it!), that helps TLC drivers and fleets afford commercial insurance premiums, given the limited options. Perhaps Uber & Lyft can pitch in (in return the companies will be given more flexibility related to minimum pay standards) or passengers pitch in (minor surcharges, but this goes to drivers via the insurance fund and is based on complex open sourced insurance models).

Finally, and this is the most controversial opinion probably, NYC TLC drivers that are consistently responsible for very large AT-FAULT loss runs (i.e., most drivers are subsidizing a few very bad drivers), must be more actively managed in some way. Over time, I think this is going to happen anyway via TLC insurance companies raising premiums on those drivers…making it uneconomical for them to drive in the NYC for-hire transportation market.

💭 As always let us know your thoughts by commenting below or emailing us at info@automarketplace.com!

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️