The $400 Per Week Camry & TLC Fleet Economics

With the EV exemption gone, TLC drivers fear the return of the "$400 per week Camry". We dig into the numbers on why it costs so much to rent a TLC-plated Camry and how TLC rules may progress

One of the first pieces I wrote for this newsletter (then known as TLCMKT) attempted to shed light on a question TLC drivers always asked me, especially pre-pandemic:

Why does it cost $400+ per week to rent a TLC-plated Camry (or similar car)?!

I wanted to re-visit the numbers as TLC drivers, who currently rent, are calling for a mechanism that gives them the ability to acquire their own for-hire vehicle license (i.e., “one driver, one plate”). With the EV exemption removed, many drivers who rent worry that TLC rental fleets, especially those that control thousands of for-hire vehicle licenses, will begin charging predatory rental rates. In fact, many think the rates charged today are predatory! It’s an interesting point that deserves attention. Essentially, if a few companies control a large chunk of the TLC rental market they’ll be able to set prices knowing drivers are “stuck” renting. In fact, during both the TLC Commission and Black Car & Livery Task Force meetings last week, I noticed a lot of TLC drivers brought up rental rates. Many drivers stated they were paying $1,600+ per month (i.e., $400 per week) and were struggling to make ends meet. The drivers were asking for a pathway to “acquire” their own FHV License to help them lower their expenses. Therefore, I wanted to shed more light on NYC TLC fleet economics.

To be transparent, I know a lot about TLC fleet economics because I (1) founded and have run a small NYC TLC fleet since late 2016 and (2) have researched and invested in different automotive-mobility companies related to an investment company I manage. Specifically, I created an all-BMW TLC fleet growing from a single car to over twenty by the time the FHV License Pause was voted into law in the summer of 2018. When I started, the thought of a TLC “Plate Cap” hadn’t even crossed my mind. What I was trying to do was offer BMWs to UberBlack drivers at extremely competitive prices (i.e., similar to Camry prices). Two million NYC “taxi” miles and hundreds of thousands of dollars in maintenance, insurance and other administrative expenses/headaches later, I have a very good understanding of NYC TLC fleet dynamics and economics.

Given my background, I want to make clear that this article will not be one-sided. For example, there are strong arguments that a TLC driver would be financially better off if they could own their own car vs. rent it. In addition, there are some bad actors who overcharge drivers and that should be called out. On the other hand, the owning vs. leasing a vehicle debate has existed for decades outside and inside the TLC industry. What this article will attempt to do is provide numbers and context. Everyone will not reach the same conclusions although they’ll be presented the same information.

NYC TLC Fleet Economics

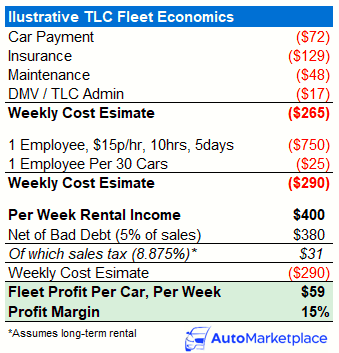

Although I laid out a lot of “fleet math” in my original article, the below fleet math excludes depreciation costs and instead credits how much a TLC car is worth after 4 years (i.e., residual value). Given depreciation is a non-cash expense, it wouldn’t totally be fair to include that cost in estimating TLC fleet cash flow margins. For this illustrative exercise we will focus on a TLC-plated Toyota Camry LE listed at $400 per week.

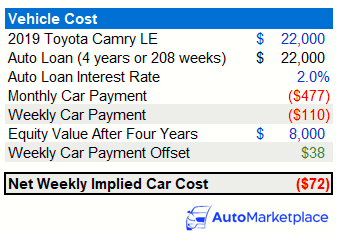

Vehicle Cost (ex-Sales Tax)

Let’s assume a fleet acquires a used, 40,000 mile Toyota Camry LE for $22,000 (mid-range of Kelley Blue Book private party value). A TLC vehicle owned and operated by one full-time TLC driver will usually register +/- 30,000 miles per year (80 to 110 miles per working day, per driver). Some drivers will drive more than this in a year, but we’ll use the 30,000 annual mileage as an average estimate.

We’ll assume the car runs 4 years and has a residual value of $8,000 (i.e., CARFAX will have ‘Taxi’ in history and vehicle will have 160,000 miles). In addition, we will assume that the TLC driver has access to (1) competitive auto loans (this won’t be the case for some drivers, but for the fleet it should be) and (2) doesn’t need to make a downpayment.

How does the per week vehicle math look using these assumptions?

NYC TLC Insurance

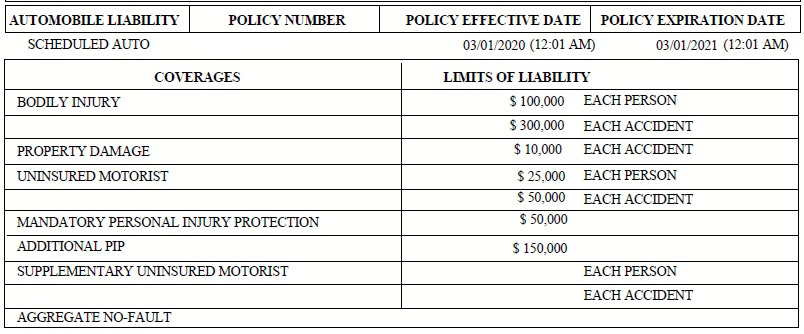

All vehicles used in NYC’s for-hire transport industry are required to keep commercial liability insurance providing, at minimum, $100,000 per person / $300,000 per accident liability coverage and $200,000 personal injury protection (PIP). This insurance does not provide comprehensive collision coverage though, only liability coverage. For example, if you are involved in a collision that resulted in physical damage to the car, the cost to repair the damage is not covered by the liability insurance and would only be covered by insurance if the other driver was at-fault.

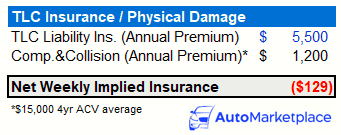

The cost of liability insurance can vary greatly based on a driver’s record. For example, at-fault (even 50/50 fault) accidents can increase an individual’s annual premium by over 25%. Most drivers’ annual premiums will be somewhere in the range of $3,500 to $5,500 per year. NYC TLC fleets generally pay between $5,000 to $6,000 per vehicle, per year for liability insurance (Note: TLC owner-operators usually have access to more competitive liability insurance rates). Larger fleets usually self-insure physical damage costs and typically ask a driver for a $1,000 deductible in case of an accident. NYC for-hire vehicle comprehensive & collision annual premiums are often calculated as 8% of the actual cash value (ACV) of the vehicle.

We lay out the implied per week vehicle insurance cost below.

Maintenance & Working Capital

Average weekly maintenance costs are hard to exactly estimate given major one-off costs can arise, especially as the car gets older (i.e., transmission). Although we “annualize” maintenance costs below to get our implied per week maintenance costs, it’s important to note that TLC drivers can run into trouble due to “working capital”. What do I mean by this?

Essentially, when a costly repair arises (i.e., transmission needs to be replaced for $3,000+), will the driver have enough cash on hand or access to credit to pay for it? If they don’t, an income “death spiral” can occur - where the driver can’t repair the car and because they can’t repair the car they can’t earn income. For this exercise we assume the driver has the working capital resources, but it is something to take into consideration when weighting the benefits and costs of leasing.

A well maintained TLC car that is not a “lemon” will usually cost an average of about $2,500 per year to maintain (i.e., tires, brakes, oil changes, other wear and tear). This figure is annualized over four years (i.e., Year 1 there may only be $1,000 in maintenance costs, but Year 2, 3 and 4 will be greater).

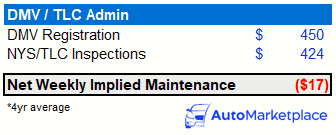

DMV, TLC Admin Costs

These costs are straightforward and regulatory in nature. Every for-hire vehicle needs to pay the following:

~$450 annual DMV registration fee

$625 biennial NYC Taxi & Limousine Commission (TLC) inspection fee

$Three $37 NYS inspections every 4 months

Sales Tax, Overheads & Financial Summary

Finally, I assume this TLC fleet has at least thirty vehicles and only needs one employee working 10 hours per day, 5 days per week at $15 per hour (Note: Some TLC fleets may consider this an underestimation. For example, extra employee costs may arise in case of emergencies). I exclude other overhead costs, such as rent expense, given office space maybe used for other businesses (i.e., in-house mechanic) or is a home office. Finally, I assume 100% utilization rates (i.e. a vehicle is occupied every week of the year) and estimate a modest 5% bad debt expense ratio (i.e., 5% of rental income is not paid, which many fleets may also find to be a “best case’ scenario assumption given this figure typically runs higher for many NYC TLC fleets. In addition, fleets often have to deal with E-ZPass / NYC Parking Tickets and sometimes come out of pocket to cover those costs).

Since rental fleets are exempt from paying sales tax when they buy vehicles, they must pay sales tax on the rental income they collect. Sales tax calculations can get very complex (AutoMarketplace will make separate content on this topic in the future). We conservatively assume the TLC rental in this example is long term in nature (i.e. greater than one year and therefore subject to an 8.875% sales tax). Note, short-term rentals maybe subject to 19.875% (!) sales tax in NYC, but we don’t assume that here.

Summarizing everything above, this is how the unit economics of a NYC TLC fleet illustratively look.

Conclusion

I hope you found this analysis of the costs associated with a NYC TLC rental useful. TLC fleets could argue the profit per car is fair given the risks they take on, including:

Losing vehicles to crashes and the financing being underwater (i.e. insurance payout less than remaining loan on vehicle).

High driver turnover resulting in weeks where the car in unoccupied.

Not receiving lease payments (i.e. bad debt).

Administration related to driver parking tickets, E-ZPass and TLC summonses.

Unexpected maintenance costs arising.

Covering the cost of overheads.

On the other hand, a TLC driver could argue that the implied profit seems excessive if he or she has:

A longer term contract (i.e., multiple years).

Clean driving record and no history of accidents.

Good overall credit and consistent record of timely payments.

No incidences of parking tickets, E-ZPass violations or TLC summonses.

Proactively taken care of car, lowering probability of large maintenance events and increasing ultimate residual value of car.

Used the car for more than 4 years.

Been paying maintenance expenses to rental company-owned service shop.

As you can tell, TLC fleet economics can be quite an involved calculation. While the $400 per week rate on its face can seem excessive, it is likely unfair to characterize it as predatory. On the flip side, as long as a long-term TLC driver has access to cash and/or working capital when major maintenance issues occur, the math does imply they will save a few thousand dollars per year owning a car vs. renting one.

I can definitely understand the frustration of a long-term TLC drivers not being able to own their own for-hire vehicle license (i.e., get their own plate). For now, what the industry does need to be mindful of is TLC fleets using their for-hire vehicle licenses to start price gouging. My guess is the TLC may create lease cap rules to prevent this from occurring. In fact, the yellow cab industry already has lease caps rules, so there is industry precedent. In making any new rules though, the TLC will also have to incorporate many things, including ensuring a formula that incorporates the cost of a vehicle (i.e., Escalades cost more than Camrys).

Finally, as I wrote last week a “one driver, one plate” policy will likely face aggressive pushback from a yellow cab industry that is still recovering from the pandemic and wants to reclaim the scarcity value that was historically associated with their medallions. In other words, if many TLC drivers can get their own FHV license (aka TLC plate), why is a medallion valuable? The sole right to hand hail in NYC is not as valuable as it once was.

What do you think? Are you for a “one driver, one plate” mechanism? If so, how should it look?

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

Yes, I am for such a mechanism! It should be so!

I get what your saying about the fleet cost of renting a car, but as a long term driver the cost for me is a but mich when I have to pay $459 a wk to rent a 18 Nissan Altima rented from Buggy. I can buy the same car for about 10 to 15k (which i check on multiple used car sites, ie carfax, autotempest and even kbb) and pay no more than $300 a month (high balling) to own. And of course I'll have other expenses including insurance, maintenance, etc. But the difference is timing. Once a month as opposed to every week make a HUGE difference in profit saving. That's my only grip with renting from a fleet. I have to pay Buggy $459 a week while still having to try and save for all my other bills that come once a month. Then when that week where all my monthly bills plus again the rental are due the rental has already ate a HUGE chunk of my profits from working that month. It's like I'm working for the rental company and not myself.