Discover more from AutoMarketplace

🔓📈 NYC Uber & Lyft Utilization Rates Rebound. Lockout Risk Declines, As Uber Monopoly Takes Hold

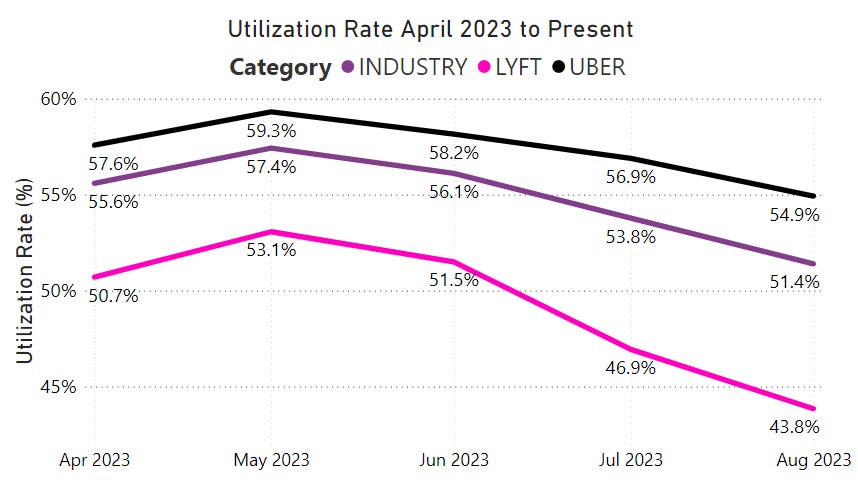

Uber & Lyft's NYC utilization rates (UR), or how busy a driver is kept while on the apps, jumped in September. Risk of app lockouts decrease, but taxi industry & other FHV sectors still struggling

Just a few weeks ago, based on the latest available TLC data at the time, we published an article about rapidly declining Uber and Lyft NYC utilization rates (UR).

We don’t want to repeat the whole article and overview why UR is so important, but we did mention seasonality might impact Uber & Lyft’s UR, which is used in the TLC driver minimum pay formula.

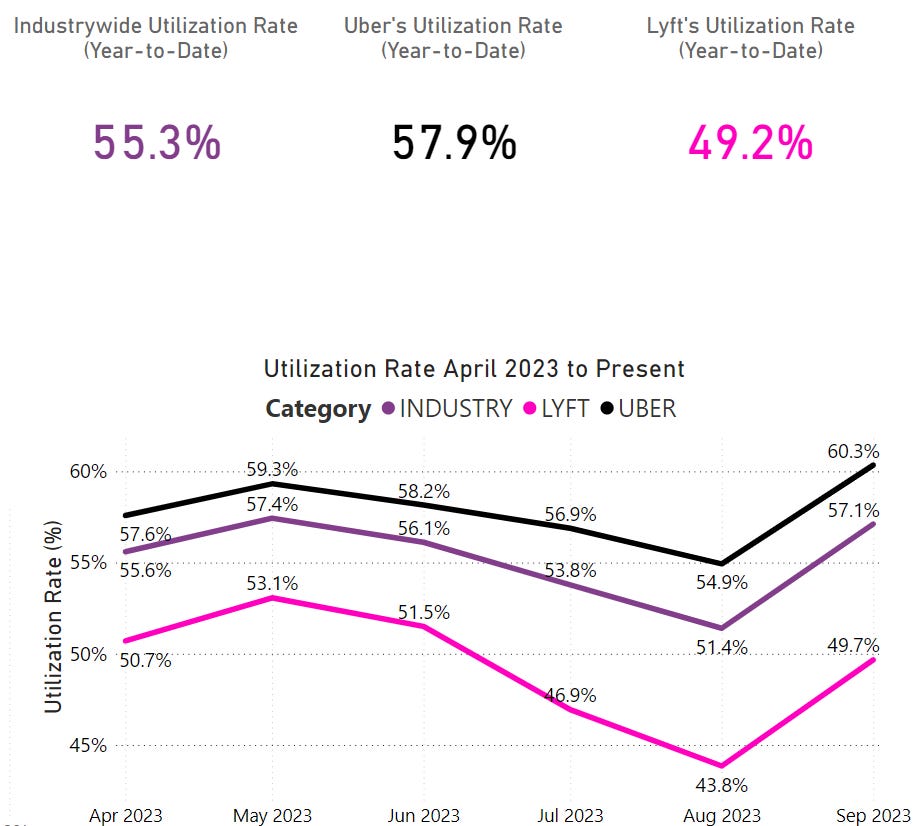

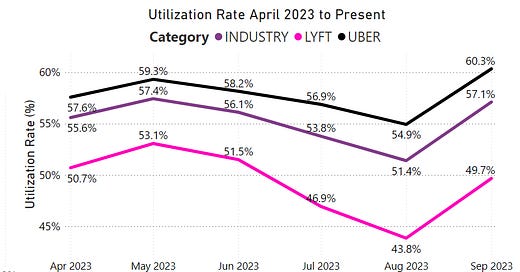

Well, it appears, both Uber and Lyft NYC strongly reversed a declining UR trajectory, with Uber NYC breaking a 60% UR (📈) and the industrywide year-to-date (ytd) UR increasing above 55%, well above of the 53% UR floor.

Lockout Probability Decreases, But *New* NYC Uber Drivers Might Be Onboarded

Firstly, we are glad to see UR this healthy as it implies NYC Uber & Lyft drivers are busy, which should hopefully translate into stronger earnings for drivers who work on the apps (Note: this is different than ALL TLC-licensed drivers). This should also presumably decrease the risk of lockouts, or the Uber/Lyft planner returning.

However, if Uber & Lyft’s industrywide UR can sustain in the high 50%+, it actually implies some other dynamics are at play.

In our last article about UR we wrote:

“As more yellow cabs get back on the road and as Revel is allowed to expand by increasing its vehicle fleet due to the reinstatement of the EV exemption, it’s only going to cause industry-wide HV (Uber/Lyft) UR to decline further. One must understand, winning market share is now an increasingly zero-sum game in NYC.

In other words, 1% market share lost by Lyft might be a 0.5% gain for Uber, but also 0.5% for yellow cabs, Revel and other bases. Sure, some growth might offset the “zero-sum” market share game, but the latest trip data is showing declining to plateauing trips. This will put further downward pressure on HV UR, leading to lockouts.”

- AutoMarketplace (November 19, 2023)

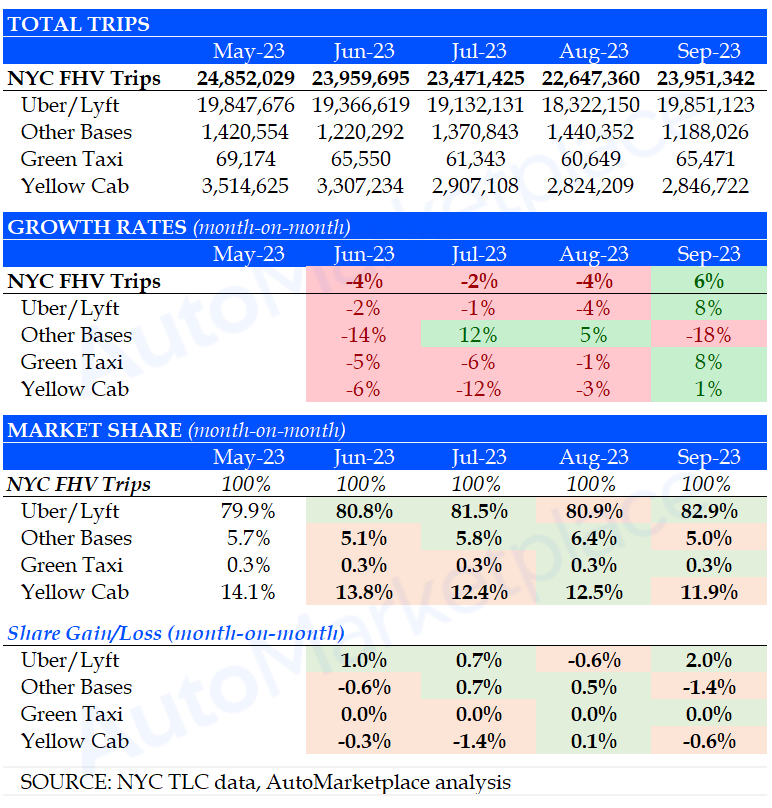

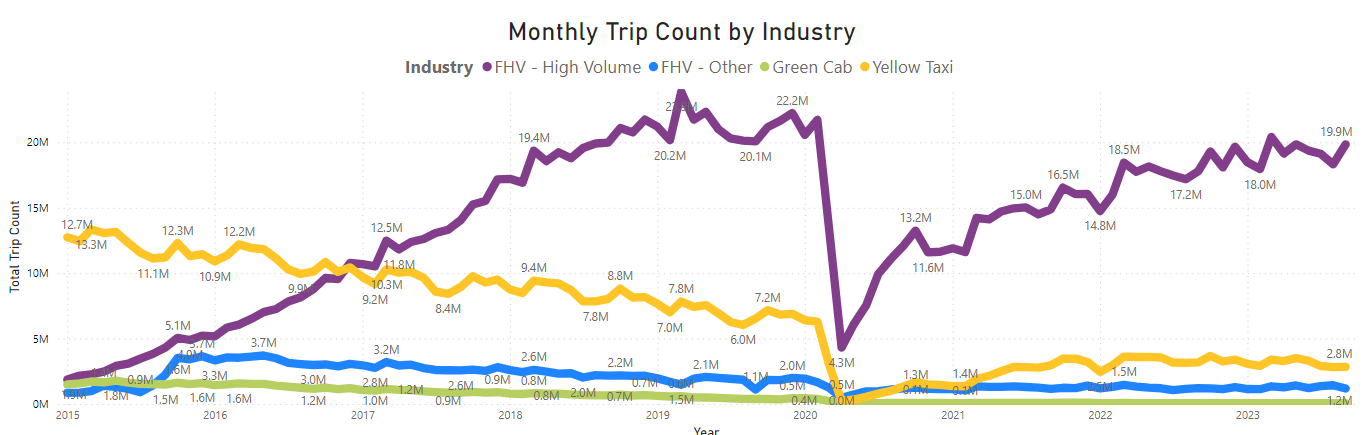

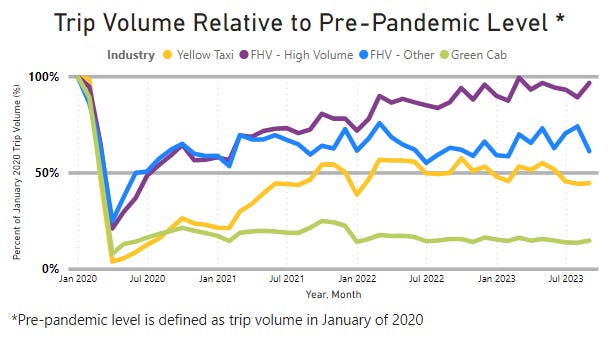

The September data is revealing something different to what we predicted based on August vs. July trip share dynamics. We were right on the zero-sum nature of the NYC FHV market, but what’s actually happening is Uber & Lyft seem to be gaining & growing share from all other FHV sectors. So, a 2% trip market share lost by yellow cabs or other bases is actually becoming a full transfer of trip market share to Uber/Lyft.

Here’s the analysis. As you can see, in August 2023 (vs. July) Uber/Lyft lost 0.6% market share, while all other sectors gained share. In September 2023 (vs. August), Uber/Lyft gained 2% total market share by taking share away from other non-HV bases and yellow cabs.

The data is dynamic, so when the data is beginning to indicate that we got something wrong, we’re going to flag that and explain. Maybe next month it reverts back? 🤷

So, what are we trying to say now?

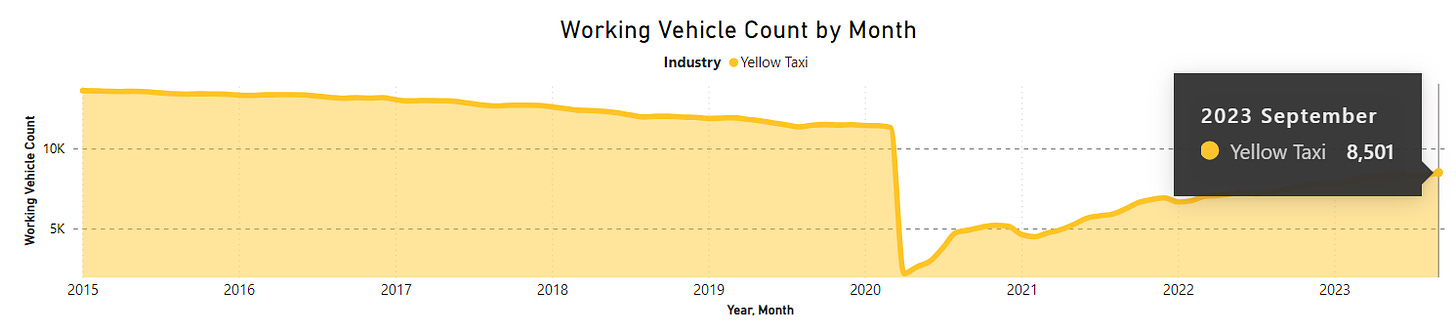

NYC taxi and other FHV sector “UR” remains horrible: Uber and Lyft URs could be growing stronger because of increased overall trips, but also because they are taking share from other FHV sectors. For example, although there is no official yellow cab “UR” metric, a simple way to measure this would be to see how many trips per active yellow taxi are occurring. With ~4,500 taxi medallions inactive and taxi trips plateauing, Uber & Lyft seem to be claiming trip share from yellow cabs and other FHV sectors (see analysis above and charts below). In fact, as more yellow cabs get active, their total trips and trip share are declining (this is not a good trend for the medallion sector). For example, in May 2023, yellow cabs had a 14.1% FHV trip market share, but now it’s down to 11.9% and there are more taxis on the road!

“Heads I Win, Tails You Lose”: If High-Volume (HV) UR begins to remain consistently and comfortably above the 53% UR floor, more drivers will get off the NYC Uber & Lyft waitlists. For example, Uber consistently argued that reinstituting the EV exemption to the TLC Plate Cap would essentially be a “vehicle swapping” exercise, due to UR restrictions. If Uber can add new TLC drivers from a waitlist because they are beating the 53% benchmark comfortably, well that’s not a “driver who leases, becoming an owner-driver” dynamic, that’s a new driver (& vehicle) coming online. That’s a yellow cab driver (& likely black & livery base driver) losing money in several ways (i.e., earnings potential, medallion value, etc.). Also, if a Uber/Lyft driver has an EV, they’ll likely have more staying power (vs. a non-EV driver) because of the Green Rides mandate. Uber is a very sophisticated operator, so it will begin to “solve down” to the 53% UR floor vs. maximizing driver pay. For example, if industrywide UR became 60%+ because growth & market share gains, Uber will likely add more drivers (& vehicles), than keep UR and driver pay higher (especially if they can access more vehicles).

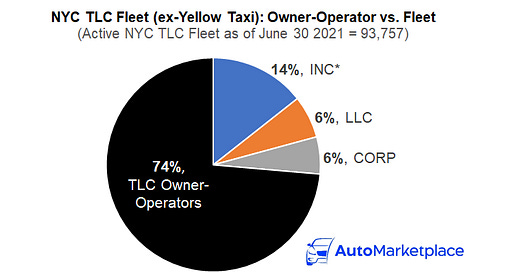

We think Uber is an exceptionally well run company and has navigated NYC politics incredibly well over the last decade. You can’t really blame Uber for winning, that’s clearly what they are paid to do and how their team is incentivized. However, it’s becoming increasingly clear their power is entering into monopoly territory. It also makes any Uber, Lyft or TLC talking point re. “predatory” leasing companies, who control less than 25% of total FHV supply, ironic.

Hyperbole? Well, let’s look at the data.

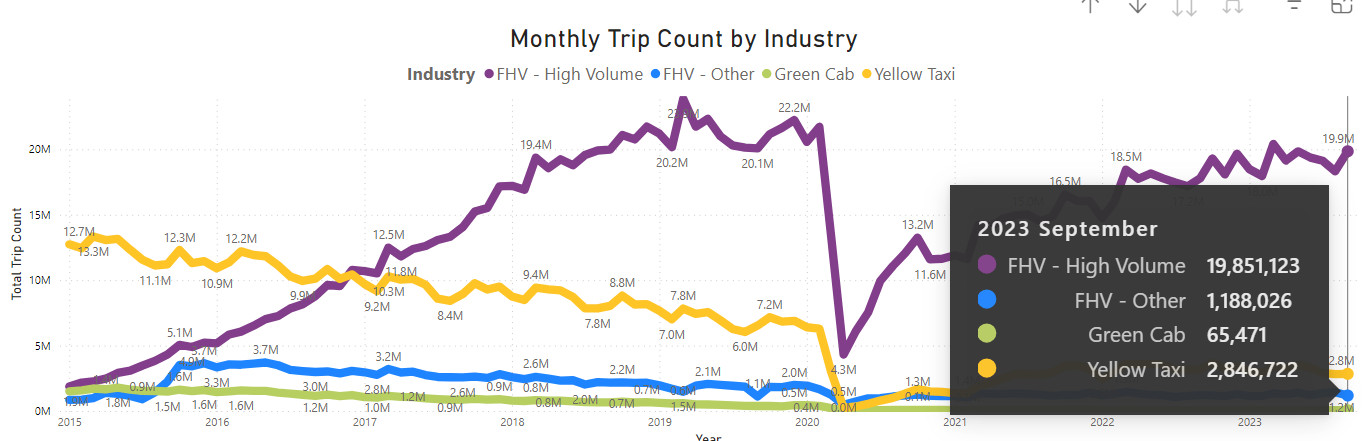

Of the ~24 million monthly, legal NYC for-hire transportation trips in September 2023, FHV - High Volume (i.e., Uber & Lyft) accounted for 19.85 million, or 83% total NYC trip market share!

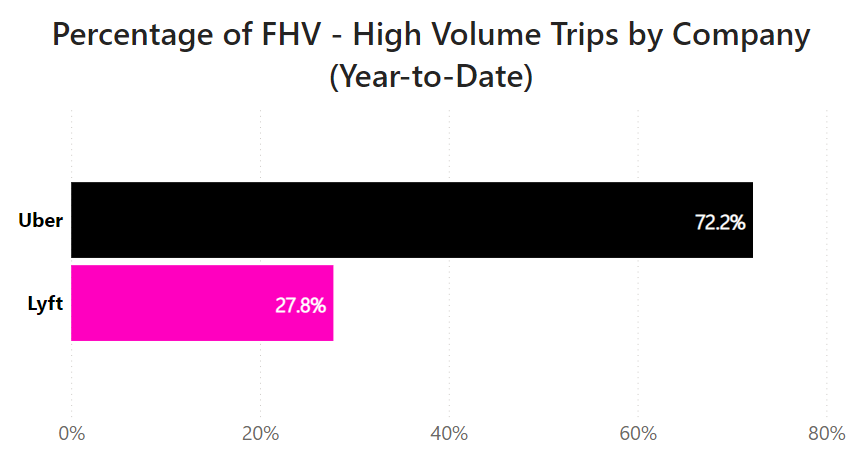

Of this 83% total trip market share for FHV - High Volume, Uber is much larger than Lyft, accounting for 72% of the 83% total.

Simplified, Uber controls ~60% of NYC’s for-hire transportation market, as in the ENTIRE market. Isn’t that a monopoly or duopoly situation 🤔? When someone has a monopoly, including the government, they can definitely act in a “predatory” manner, maybe others don’t agree but a discussion should definitely be had.

If the TLC does not protect the yellow cab industry (or other sectors) via reasonable regulations (i.e., limiting NYC FHV supply), these sectors will fade away. What you’ll then be left with is a a dynamic where Uber has so much power & influence over the NYC for-hire transportation that it will essentially be more powerful than the NYC Taxi & Limousine Commission (NYC TLC) itself.

That’s not Uber’s fault, it’s actually a compliment. It is, in many ways, this current (& previous) Mayor, City Council and TLC’s fault. This publication is presenting straightforward, “hard” data to make our points, the TLC presents qualitative, nonsensical political talking points. Again, it’s either incompetence or something much worse.

Finally, let’s say an economic slowdown occurs (or congestion pricing causes people to take public transport more), maybe you’ll see overall FHV trip declines. Perhaps, if this plays out, what you’ll see is Uber & Lyft reinstitute lockouts because their URs would decline, but think about the other dynamics that would likely play out in other FHV sectors? Non-High Volume sectors may lose more trip market share on a relative basis. What will become obvious to everyone is there are way too many FHVs on NYC roads right now, excluding the ~10,000 *new* FHVs soon to come online!

Some may call us paranoid, but the data is telling a story that we’re trying to understand and communicate. The prediction game is hard, but we’re getting nervous about what adding 10,000 more FHVs might do, to all sectors frankly. Increasing non-taxi FHV supply that much, so quickly, is going to have some major impacts.

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

Wait until we get slammed with congestion pricing just as things are recovering. 40% fare evasion on MTA buses alone (don’t get me started on the subways) yet the MTA comes after vehicles coming into Manhattan for more money. Honestly, and I hate to say this, it might be time for a Republican NYC mayor and NYS Governor. Sometimes this is needed to bring the pendulum back and bring things into balance. Maybe this will stop the EV fetish.