☂️⚖️ Uber & NYC TLC Insurance Giant American Transit Might Reach Settlement

Based on court filing, Uber and American Transit, the largest insurance company focused on the NYC for-hire transportation (TLC) market, might end legal dispute with settlement

Before we get into the article, you might have noticed a slightly different AutoMarketplace banner.

Today, we’re launching AutoMarketplace [+].

To be clear, [+] articles will not be behind a paywall and non-[+] articles will still make up the majority of our content. We’ve created this new section in our newsletter for more technical articles that some of our subscribers might find too “in the weeds” 🤓.

These articles might include topics like insurance, taxes, business technicalities related to running a for-hire vehicle (FHV) fleet or being an independent 1099 contractor in NYC, taxi medallion valuation, FHV License (TLC Plate) valuation, NYC TLC fleet analysis, etc. Basically, [+] articles are going to be more technical in nature and speak to a business and investment-minded audience. Some of our readers will find it interesting, others, we can appreciate, might not care for so much detail.

Our [+] series will further distinguish AutoMarketplace as a unique content creator and platform in the NYC for-hire transportation (TLC) industry. Delivering stories and analysis you will not find anywhere else. Helping our readers become genuine industry experts.

In addition, [+] will help increase the value of our advertising space to make our newsletter a more effective platform for individuals and businesses wanting to market their services or products to NYC TLC drivers and fleets. If you’re interested in advertising with us, click here.

Information Liquidity for the NYC TLC Marketplace

When we started AutoMarketplace we wanted to increase information “liquidity” 🌊 in the NYC TLC market. To be simple, the more informed market participants are, the better a marketplace functions (an automotive marketplace, if you will, in this instance). For example, imagine the The New York Stock Exchange without the Wall Street Journal 🤔. It would impact the ability of the stock exchange to attract investors.

Obviously, we’re trying to do that on a much smaller scale, targeting a sizeable niche, local marketplace (“all things NYC TLC”). For example, if someone wants to buy a $100,000+ taxi medallion 🚕, they need a reliable and trustable source of information. They want to know how to think about valuation in a sophisticated way. The same concept applies to a driver or fleet looking to purchase insurance or an electric vehicle (EV), etc. These are consequential and large financial transactions for many. People and businesses need specific information and analysis to help them feel more confident when making these major financial decisions.

We hope you enjoy today’s article related to NYC TLC insurance ☂️ !

☂️🚕 Uber & NYC TLC Insurance Giant American Transit Might Settle Lawsuit

Uber started legal action against NYC TLC liability insurance giant American Transit Insurance Company (ATIC), earlier this year

ATIC has an over 60% TLC insurance market share and could be considered “Too Big to Fail”, although professional sources have reported solvency issues

NYC is a uniquely profitable market for Uber and Lyft because of insurance dynamics, but they rely on a few specialty insurers to properly pay out claims

Recent court filing reveals Uber and ATIC might be heading towards a settlement, which is important to track ahead of 2025’s annual rate review

In February, we wrote an article about Uber suing NYC TLC insurance giant American Transit Insurance Company (ATIC). The legal action related to Uber accusing ATIC of not providing sufficient coverage and properly paying out claims.

“American Transit Insurance Co.’s “unreasonable practices” handling claims has resulted in 23 lawsuits brought against Uber and its drivers over crashes involving bodily injuries, leaving the ride-share giant to pay “substantial amounts” to defend itself, according to the complaint filed late Friday in federal court in New York.”

- Bloomberg. Uber Sues Insurer for Refusing to Cover NYC Drivers in Crashes, by Robert Burnson. February 17, 2024 at 10:41 AM EST).

NYC is a very unique market for Uber and Lyft not only because of its size, but also due to drivers paying for commercial liability insurance (and needing a commercial driver’s license) when using “Uber X” (+ Lyft’s equivalent service offering).

For example, a driver servicing an Uber X trip in Miami does not need to have a commercial driver’s license or commercial vehicle plates, they can keep their “regular”, non-commercial Florida plates. How is that possible? What’s happening is Uber and Lyft are actually providing the commercial liability coverage while that Miami driver is logged into the app. This insurance dynamic is often cited as a justification for why Uber and Lyft might take 25%+ of a trip’s fare in markets outside of New York City.

In NYC, it appears Uber and Lyft have much lower operating costs because they are not directly paying for commercial liability insurance. In other words, NYC is not only a big revenue market, it’s likely an even bigger profit center for the rideshare companies. However, they are relying on commercial liability insurers that drivers use, such as American Transit and Hereford, to pay out claims in an efficient and proper manner. If this doesn’t happen, that’s a big problem. This is another way to frame why Uber is suing American Transit.

Too Big to Fail?

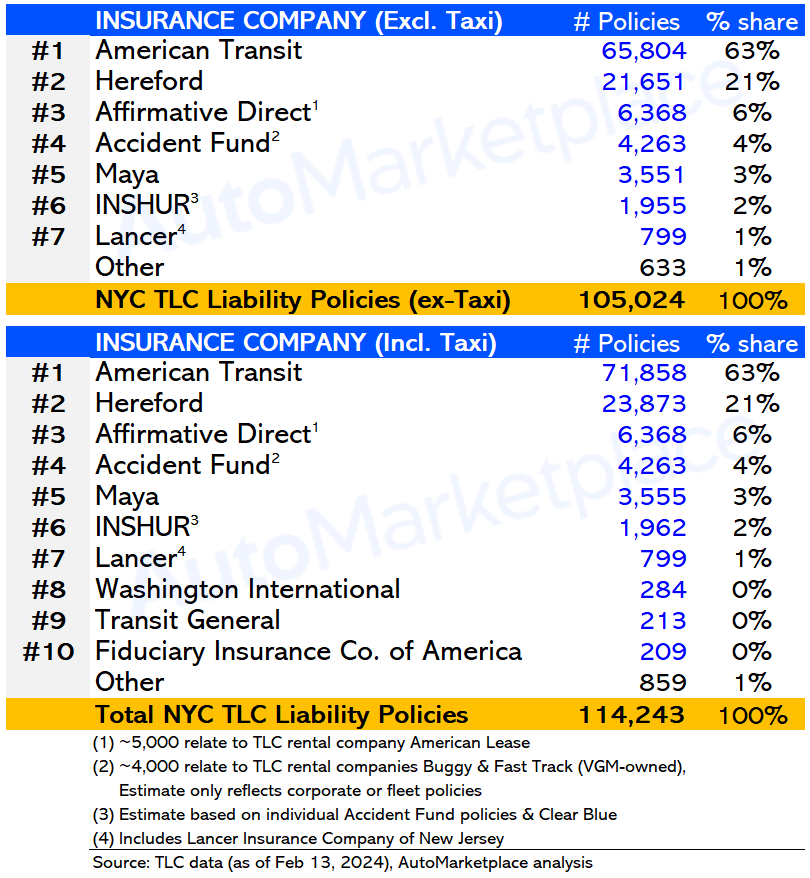

When we use the term “giant” to describe American Transit (a/k/a ATIC), we’re not being hyperbolic. AutoMarketplace analysis estimates that ATIC has over 60% total share of the TLC liability insurance market. The insurer has an even greater market share when you exclude large fleet operators who can create unique self-insurance structures that individual drivers and smaller fleets cannot access.

In fact, ATIC is such an important player in the TLC insurance industry we think it might be “Too Big to Fail”, a famous phrase attributed to the situation when large financial institutions were bailed out by the federal government during the Great Financial Crisis about 15 years ago, to avoid systemic risks to the entire economy. To be extremely simple, the thinking was if you let Citigroup or insurance giant AIG fail, it might take down 📉 the entire financial system with it.

Similarly, if ATIC is allowed to fail, and there are genuine concerns about its ability to operate as a “going concern” and whether it is solvent, which we discuss below, it could cause chaos in the NYC for-hire transportation industry. Let’s further explore these points by asking a question many TLC drivers and fleets have.

🤷 Why Aren’t There More TLC Insurance Options?

Article continues after advertisement

Why Aren’t There More Insurance Choices?

If you want to do quick Total Addressable Market (TAM) math for the overall commercial liability insurance opportunity in the NYC TLC market (NYC for-hire vehicles (FHVs) + NYC yellow cabs) it would roughly look something like the below calculation. Remember, this excludes the comprehensive & collision insurance market.

~120,000 policies * $5,500 avg. weighted policy = ~$660 million in NYC TLC liability premiums

(Note: $5,500 is a rough estimate based on AutoMarketplace analysis and we’re illustratively assuming no growth in this market sizing exercise)

Using this figure, we can also estimate the insurance broker market opportunity.

~$660 million in NYC TLC liability premiums * ~7% broker commission = ~$46 million of broker revenue

Given the numbers above, one might wonder why GEICO, Progressive, USAA, Allstate or State Farm don’t get into the NYC TLC insurance business? It’s a big enough niche, right?

The way, we believe, you have to think about it is as follows:

Core Questions: Is NYC for-hire commercial liability insurance attractive from an underwriter’s or actuarial perspective? What are the growth prospects? (“Can we make money? How much?”)

Firstly, insurance premiums = gross revenue, which is not profit. Many people have gotten into a bad habit of saying a company “makes” $X, but are actually referring to revenue, not profit. So, while ~$660 million of premiums are up for grabs, can one make money or will the cost of running an NYC TLC insurer result in losses?

In a previous article we went over the complexity of operating an auto insurance company in New York State, a no-fault (PIP) state, and what’s causing TLC premiums to increase so much (15% to 30%+ in 2024 alone)! Discussions with INSHUR’s Co-Founder & CEO Dan Bratshpis and Next Century Insurance’s Gavriel Gavrilov also provided some great insights.

We also wrote about Uber’s efforts related to pushing for increased regulation of New York’s “lawsuit lending” or “car accident loan” industry, which is also increasing the cost of insurance.

In our original article about Uber suing American Transit we also mentioned a 2021 S&P Global report that questioned whether ATIC was solvent (can they payout the claims they owe or prospectively owe?). Basically, a lot of insurance market headwinds.

Another way to think about the situation at American Transit is if a long time industry player, with an extremely dominant market share (60%+) and deep industry expertise, cannot profitably operate how can a new entrant, that will have a much smaller market share initially, succeed?

Furthermore, if the dominant player can continue to operate at razor thin margins for years or is indeed effectively insolvent (more on this below), that is a nightmare competitive backdrop. Right now, our guess is Warren Buffett-controlled GEICO is probably not interested in the NYC taxi insurance market.

American Transit might be “Too Big to Fail”. Or said another way, impossible to effectively compete with.

This is why the TLC insurance market lends itself to an incumbent monopoly or duopoly market share structure, at this current moment. The exception perhaps, as briefly mentioned above, being self-insured fleet “captives” of large TLC rental companies that might be large enough to experiment with self-insurance, at least for a couple of years.

In terms of growth, you might have a few thousand (hopefully) more yellow cabs come online or perhaps more FHV Licenses (TLC Plates) get released, but fundamentally the market is a bit zero-sum and low growth now, especially when you include attrition. In other words, insurance rate increases will mostly expand the market, not new policies.

Practically speaking, for at least a couple of years, NYC TLC drivers and fleets should not expect a lot of new insurance options to become available.

Is American Transit Insolvent? Maya Assurance In Trouble?

An AutoMarketplace friend flagged two purchasable reports, accessible in the National Association of Insurance Commissioners (NAIC) database, about both American Transit and #5 TLC insurance provider Maya Assurance.

The professional actuarial opinions can be summarized as follows:

American Transit Has A $644 Million Deficit!

Ronald T. Kuehn of Huggins Actuarial Services, Inc. concludes American Transit has underestimated its provisions for losses and expenses by $690 million and currently has a $644 million deficit 👀, as of December 31, 2023

Mr. Kuehn states that American Transit fails to meet the requirements of New York State insurance laws

Mr. Kuehn was also referenced in S&P Global’s 2021 report on American Transit

NOTE: Mr. Kuehn’s report represents his professional opinion and he was appointed by ATIC’s Board of Directors to conduct a 2023 actuarial review to satisfy the requirement of NAIC

Maya Assurance Also In Trouble?

Allen Rosenbach of ACR Solutions Group concludes Maya Assurance has underestimated its provisions for losses and expenses in a way that fails to meet the requirements of New York State insurance laws

NOTE: Mr. Rosenbach’s report represents his professional opinion and he was appointed by Maya’s Board of Directors to conduct a 2023 actuarial review

Uber & American Transit Settling Lawsuit?

If you combine all the information and dynamics above, the NYC TLC insurance market seems to be one straw away from breaking 🐪. This is one of the reasons why Uber’s lawsuit against ATIC was a big deal. If Uber won its case, what would that mean? American Transit bankrupt? American Transit raising its rates? Remember, ATIC has an over 60% market share!

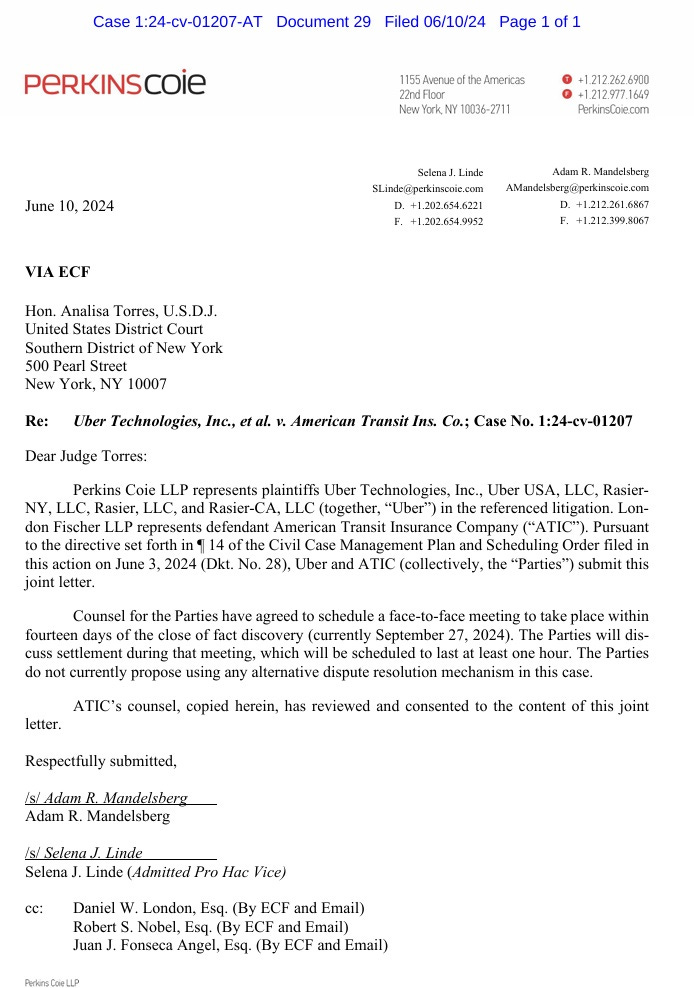

Based on a recent court filing, it appears Uber and American Transit might be heading towards a settlement later this year. At least this is our interpretation of a June 10th court filing by Uber’s legal team at Perkins Coie LLP, that appears to be a joint letter published with sign-off from ATIC’s legal team at London Fischer LLP.

“…,Uber and ATIC (collectively, the “Parties”) submit this joint letter.

Counsel for the Parties have agreed to schedule a face-to-face meeting to take place within fourteen days of the close of fact discovery (currently September 27, 2024). The Parties will discuss settlement during that meeting, which will be scheduled to last at least one hour. The Parties do not currently propose using any alternative dispute resolution mechanism in this case.

ATIC’s counsel, copied herein, has reviewed and consented to the content of this joint letter.”

- June 10, 2024, Court Filing. Uber Technologies, Inc., et al. v. American Transit Ins. Co., Case No. 1:24-cv-01207, US District Court, Southern District of New York (Manhattan)

Per the letter, we will track and report on what happens in October, but we believe this is a very noteworthy development in the NYC TLC industry. Specifically, how will a settlement impact ATIC’s ability to operate and any proposed rate increases it might announce going into 2025.

Driver Pay Formula Needs To Change ASAP

As a final point, although we’ve recently argued that the TLC should drop its use of the utilization rate (UR), we want to reiterate that we believe there should be minimum per minute and per mile rates. However, those rates are not properly accounting for “true” inflation, specifically insurance-related inflation.

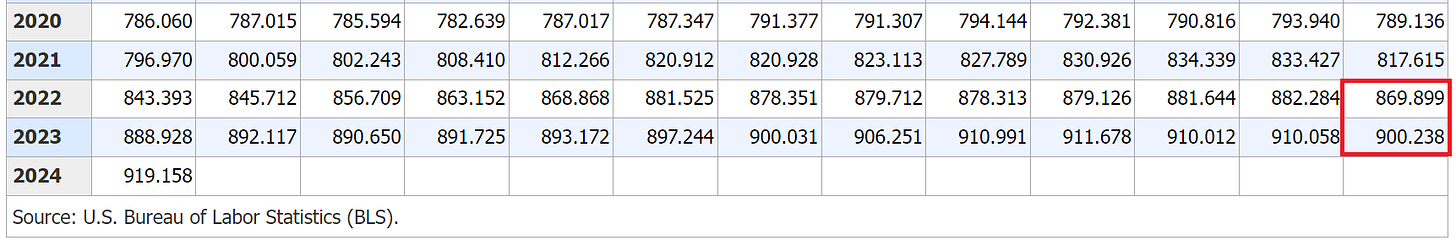

TLC uses the CPI-W inflation index for the NY-NJ-PA metro area. This index relates to Urban Wage Earners and Clerical Workers for the NYC metro area.

“CPI-W is designed to measure price changes faced by urban wage earners and clerical workers. Population coverage is the only difference between the CPI-U and CPI-W.”

- U.S. Bureau of Labor Statistics (BLS)

Looking at the change in the CPI-W index from Dec 2022 to Dec 2023, we get 3.49%, which exactly matches TLC’s minimum driver pay increase in 2024. For those who want track the CPI-W index for New York-Newark-Jersey City, NY-NJ-PA click here.

Insurance expense is a major cost center for both drivers and fleets in the NYC TLC industry. The cost of commercial vehicle insurance is often a driver or fleet’s largest (or second largest) yearly business expense. The TLC’s ~3.5% CPI-inflation adjustment to driver minimum pay in 2024 clearly doesn’t accurately reflect the increased cost of doing business as a NYC for-hire transportation driver or fleet.

This is easy to understand when one accurately weights NYC TLC driver-specific expenses as a % of their costs vs. using a regional inflation index that measures a general basket of goods and services. To be simple, if you’re an NYC taxi driver, inflation related to TLC insurance, vehicle maintenance, car repairs and the cost of new & used vehicles are going to impact you much more than it would an individual who works from home or in an office.

This is why we also believe Uber and Lyft should be subject to a NYC TLC-specific inflation index, so driver minimum pay rates would more accurately reflect the cost of doing business. We are encouraged to see that the TLC might already be looking into this.

However, the regulator cannot waste time and must act quickly to ensure next year’s insurance renewal rates are reflected in 2025’s CPI-related driver pay rate increases.

Hello! Just a quick question when you mentioned Uber and Lyft would have to lower operating costs in NYC because they aren't covering liability insurance in the city, is there any laws regulations that stems from that? Other than that this was really helpful and a great read.

Great Article as always. One question, if Cpi-w went up by 3% how much do u think a true cpi-tlc related expenses would have gone up by? Given the fact that car costs and insurance has gone up so much.