Discover more from AutoMarketplace

Uber Planner Coming Back? 📅 , Do Confirmed & What Our Testimony Will Be ✋ Next Week

Ahead of next week's NYC Taxi & Limousine Commission (TLC) hearings, we share some additional thoughts and the testimony we plan to give

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️

⏱️TL;DR Summary

🗳️ As expected, D.C. taxi regulator David Do was confirmed as the new NYC TLC Chair Commissioner (in time for next week’s TLC meetings 👇)

📅 NYC TLC will hold two consecutive meetings on May 23rd and 24th, ahead of major decisions on pricing, leasing and other industry initiatives (please see our previous article for more details, including how to submit testimony / questions)

Monday, May 23rd meeting will focus on the yellow cab industry. Tuesday, May 24th on the non-taxi FHV sector

🧢 Uber (& Lyft) NYC “driver caps” will likely appear soon, a repeat of what happened in April 2019

✍️ If you are a TLC driver that has not signed up for Uber & Lyft, you probably should sign up given the huge share of the NYC for-hire market they control

✅ One key benefit of an effective “driver cap” is that the NYC TLC market will re-professionalize quickly and part-timers will leave the industry. This should, we believe, result in more earnings for full-time NYC TLC drivers

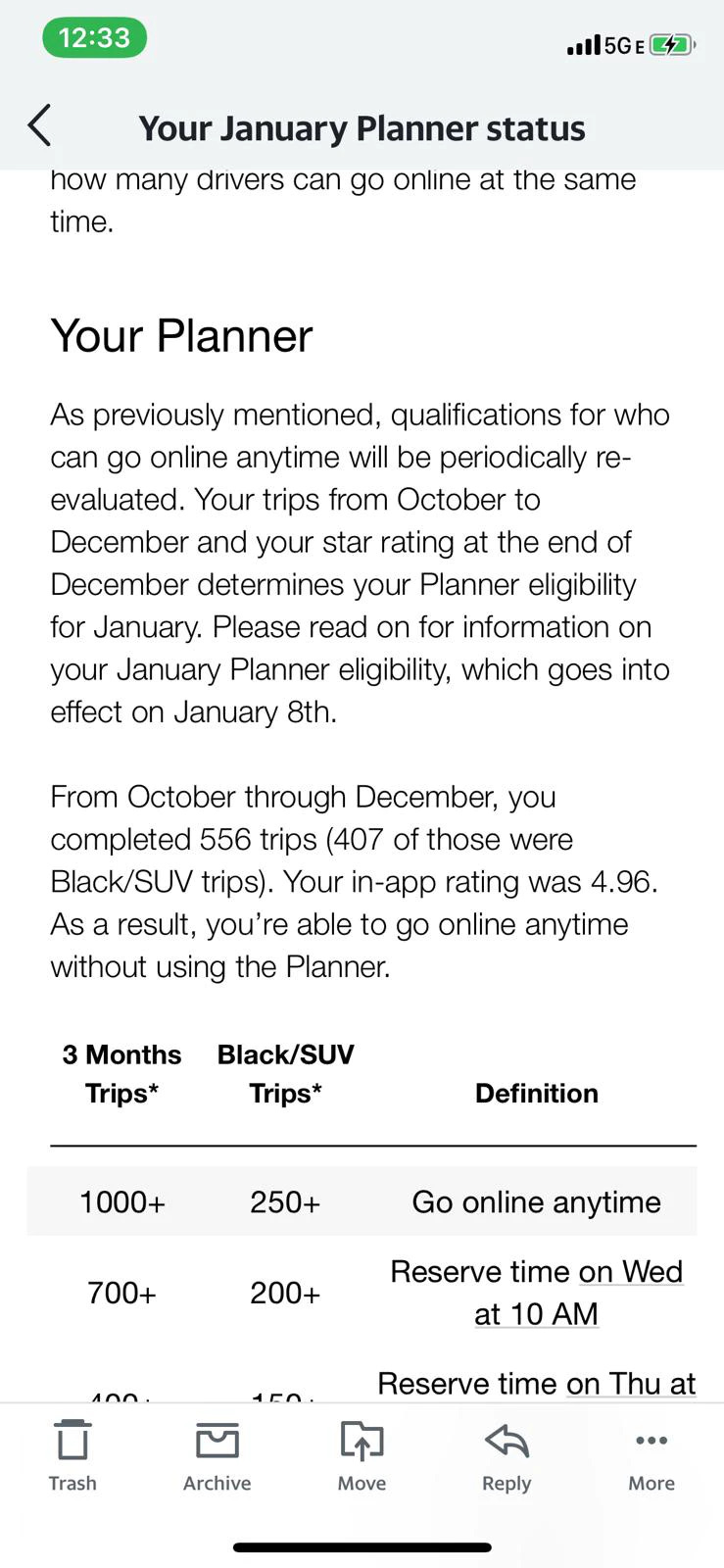

🤔 The main downside to a “driver cap”, in our opinion, is non full-time Uber/Lyft NYC drivers (those that only do Uber and/or Lyft part of the time to supplement other base or private work), might be unfairly punished. Remember, under the previous Planner if you met certain trip thresholds you were allowed to login whenever you want (i.e., flexibility remained)

The topics we will (attempt) to discuss on the 23rd & 24th revolve around:

Luxury vehicle leasing industry protections & FHV Corp. expenses

Greater visibility around where the FHV License Pause (aka TLC Plate Cap) is headed, so informed business / driver decisions can be made, including investing in NYC taxi medallions

A proposal to create a Black Car Fund (BCF)-like entity that collects a surcharge that partially pays for insurance premiums, reflecting how Uber & Lyft operate outside of NYC (as a concession, Uber & Lyft should be protected from overly aggressive driver minimum pay increases)

Upcoming Congestion Fee exemptions

Uber & Lyft Driver Deactivations

Uber & Lyft Qualified Vehicle List Changes

We've been warning about the return of the Uber "Planner" for almost a year now. Our warnings were premature though by several months, but directionally now seem to be playing out. The writing was on the wall if you gamed out how a post-pandemic recovery might look like in the NYC for-hire transport industry. It is (interestingly) probably one of the only topics that NYC TLC drivers & Uber/Lyft AGREE ON 🤝👀.

Uber (and Lyft) don't want to limit the flexibility of their driver supply or be subject to additional utilization rate regulations, AND

Drivers want to enjoy flexibility related to when they drive. Wasn't that after all one of the most attractive aspects of joining Uber & Lyft, in the first place?

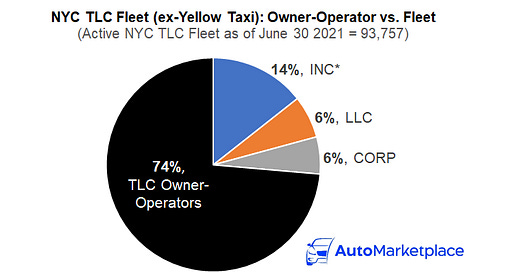

It's probably best to read our May 2021 piece, but in a nutshell there are positives and negatives that come with the “Planner”. One benefit is that utilization rates would quickly re-professionalize the NYC for-hire transportation industry. NYC isn't a typical "rideshare" market. It is a market that solely consists of commercially-licensed TLC drivers, who are subject to a whole host of regulations. In our opinion, part-timers have diluted the attractiveness and earnings potential for what was an historically full-time professional for-hire transport industry. An industry that provided a pathway for a good middle class (even upper middle class) life.

On the other hand, overly aggressive utilization rate regulations can be abused and make it very difficult to do business in NYC. At the end of the day, you don't want to be so prescriptive that you become business unfriendly. Uber and Lyft have the right to operate and make a profit, but they must also be balanced and how they approach a market that historically consisted of full-time professional drivers. We think this doesn’t need to be “zero-sum”, let's find equilibrium.

We paste below our submitted testimony, which we hope to talk to next week.

💰 FHV Corporations / Lease Caps: We understand the need to prevent abuse by FHV Corporations, especially those who have access to hundreds of FHV licenses that non-WAV focused TLC drivers cannot access anymore. As a smaller FHV Corporation we see merits in a Lease Cap, like the yellow cab industry currently follows. However, as a leasing company that focuses on the UberBlack market, we think it's very important to incorporate vehicle acquisition costs or it will risk limiting luxury leasing options for TLC drivers. For example, if a Lease Cap formula doesn't incorporate the cost of a vehicle, it can lead to unintended consequences (leasing companies will only offer Camrys). Furthermore, we believe Lease Caps should adjust on an annualized basis, based on an agreed to CPI formula vs. once every several years (same applies to driver pay calculations)

🧑 "One Driver, One Plate": We understand the demand for a "One Driver, One Plate" policy. Based on our analysis, the vast majority of non-yellow cab TLC drivers do not lease their TLC vehicle and those that do might be better served by Lease Caps. If the TLC opens up the FHV License Pause, taxi medallion values will plummet (Full disclosure: we do not currently own any taxi medallions, but are considering investing). In our view, lifting the TLC Plate Cap makes the taxi medallion asset class uninvestable. In addition, it puts the City's medallion debt guarantee at risk. That being said, we also believe there should be a pathway for full-time non-yellow cab TLC drivers, who have shown a long-term commitment to the industry to acquire their own non-leasable FHV license (i.e., more than 10,000 confirmed TLC trips)

☂️ TLC Insurance: We believe a Black Car Fund (BCF)-like entity should be created to collect minor trip surcharges to partially compensate driver & fleet insurance premiums. Outside of New York City, Uber & Lyft bear the financial responsibility for commercial insurance premiums, which in part justifies their 20%+ take rates. As a concession to Uber & Lyft , who will somewhat correctly argue that the driver minimum pay regulations already incorporate the cost of insurance premiums, the company should not be subjected to overly aggressive driver minimum pay increases. The cost of insurance should not only fall on NYC TLC drivers and fleets.

🎫 Upcoming Congestion Fee Exemptions: We believe the entire NYC FHV sector should be treated equally as it relates to upcoming congestion fee discussions.

❌ Driver Deactivations: Uber & Lyft deactivations should be subject to third-party and/or TLC arbitration given how large their collective market shares are (over 70% of the entire NYC for hire transportation market). The companies have every right to deactivate drivers, but given their market influence, they must be subject to more oversight.

🚙 Uber & Lyft Qualified Vehicle List Changes: Uber & Lyft, once again given their immense market share, should have regulations around their vehicle list and their ability to change it without sufficient notice. For example, the Acura MDX and BMW X5 historically were UberBlack vehicles, until Uber suddenly changed what qualifies as UberBlack. Given drivers and fleets make significant investments in their vehicles, any change in this list has to be done with sufficient notice (minimum 2 years in advance, unless extenuating circumstances).

⏱️TL;DR Summary (previous piece)

🚕 Yellow taxi fares will likely have a headline increase of over 25%, which in reality represents a 3% per year inflation “catch up”

🗳️ 2012 taxi politics has a lot to teach us about how 2022 might look

🪙 Taxi lease caps will likely be raised, positively impacting medallion valuations. FHV Corporations (aka TLC leasing companies) are also likely to be subjected to similar lease caps

🌱 A new TLC industry status quo is beginning to take shape

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️