Discover more from AutoMarketplace

⚡😬 EV Bet Goes Wrong, As Rental Giant Hertz CEO Steps Down

Hertz CEO is stepping down. Many point to failed electric vehicle (EV) push as reason for resignation. Hertz began building NYC TLC fleet for Revel & Uber use, but seems to have stopped suddenly

Stephen Scherr, an ex-Goldman Sachs executive, is stepping down as CEO of rental giant Hertz after being appointed in February 2022

Scherr, backed by major shareholders Knighthead and Certares, made a big bet on EVs, including plans/partnerships with Tesla, Uber, Polestar & GM

Hertz recently announced it’s selling large portion of EV fleet, citing lack of demand, costly depreciation and expensive repairs, specifically related to rideshare rentals

Gil West, former COO of Delta Airlines and GM's Cruise self-driving unit, will become Hertz CEO on April 1, 2024

Hertz began building a NYC TLC fleet for Revel and Uber, but then appears to have stopped suddenly in line with company wide pivot on EVs

In business and on Wall Street, more often than not, if you don’t perform, there are consequences. Hertz CEO Stephen Scherr, an ex-Goldman Sachs executive, appears to have finally lost the confidence of Wall Street, and likely major Hertz shareholders including Knighthead and Certares. Specifically, Scherr’s big bet (that, to be fair, initially began before his appointment) on EVs might be the reason he’s lost his job. At least this is what multiple media reports imply.

“We are appreciative of Stephen's contribution over the last two years, including on a number of key strategic initiatives, which Gil [West, former COO of Delta Airlines & GM's Cruise self-driving unit] will now lead in their continued execution."

- Tom Wagner, Vice Chair of Hertz and Co-Founder of Knighthead Capital Management

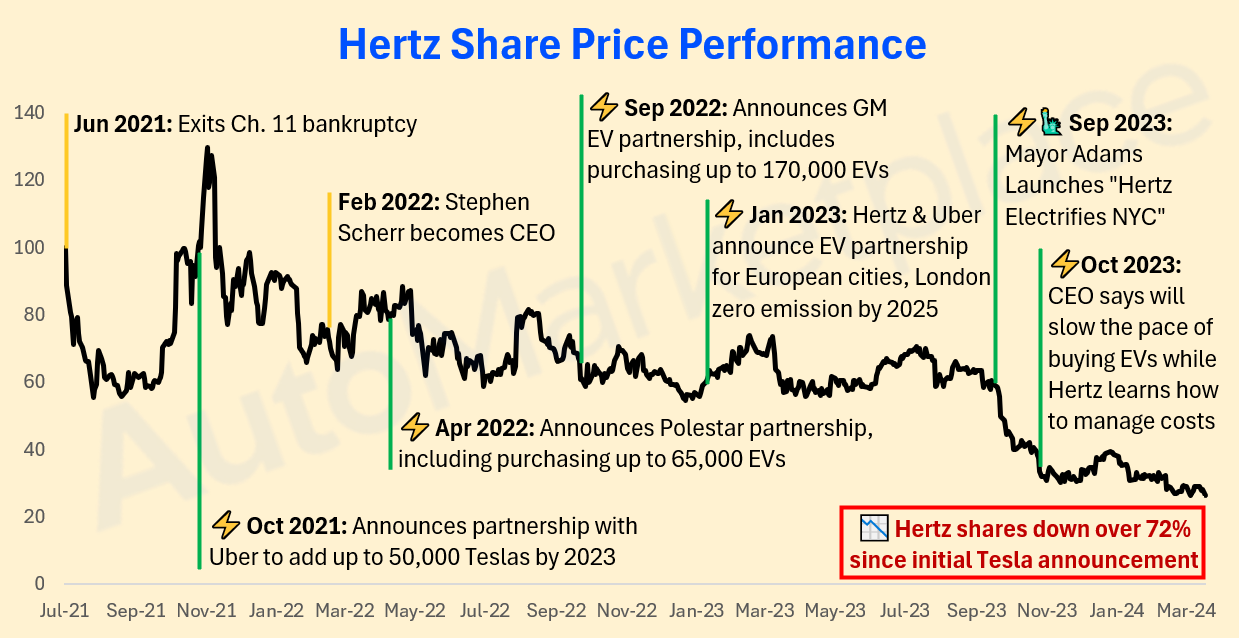

Mr. Scherr was appointed CEO of Hertz in February 2022, a few months after Hertz’s share price hit all-time highs on the back of general market sentiment and the announcement of huge electric vehicle (EV) ambitions. In October 2021, Hertz announced plans to build one of the world’s largest EV fleets, including an initial (but unofficial) order of 100,000 Teslas and a partnership with Uber to add up to 50,000 Teslas to the rideshare platform by 2023.

Times have changed. Hertz stock is down over 70% since its Tesla and Uber announcements and shares were down another 6% in today’s trading session 👀. According to Hertz’s last financial report, the company has recorded in excess of $200 million in losses related to a drop in value of the EVs and has been rapidly reducing the size of its EV fleet, including Teslas.

EV Transition, Difficult Even For Experts

We think it’s worth repeating that we are believers in, and indeed think, the vast majority of the NYC for-hire transportation (TLC) fleet will (& should) transition to EVs (or other zero emission vehicles) over the next 10 to 15 years, even if Green Rides Initiative goals get pushed back. City charging infrastructure clearly (i.e., charging lines) needs to catch up to the reality of driving an EV as a NYC for-hire vehicle (FHV).

Remember, if EVs are viable and cheaper to operate, with or without the Green Rides mandate, NYC TLC drivers and fleets will naturally adopt them. The fact that drivers and fleets are not naturally (excluding the purchase of EVs for TLC Plate speculation purposes) adopting them currently, is telling. Any driver or fleet operator, who lives the daily street reality of putting NYC “taxi” mileage on vehicles, can tell you this.

Hertz’s big EV bet, gone wrong, is a good case study for regulators, drivers and fleets to take note of. The lesson isn’t that EVs will not be adopted over time, the lesson is this isn’t an on-off switch and financial math is brutally nonpartisan. If Hertz, a giant rental company with a genuine expertise in running vehicles and fleet management, miscalculated the operational costs of EVs, perhaps we should all adjust our assumptions about whether individual NYC TLC drivers, who have significantly less financial resources, can make EV math (currently) work.

As we, along with other media outlets, recently covered, Hertz’s big push into EVs backfired for several reasons. Specifically noteworthy for the NYC TLC industry is Hertz’s experience related to renting out EVs to rideshare drivers.

“Part of the problem is linked to Hertz’s plans to rent EVs to ridehail drivers. Of the 100,000 Tesla acquired by Hertz, half were to be allocated to Uber drivers as part of a deal with the ridehail company. And drivers said they loved the Teslas! But Uber drivers also tend to drive their vehicles into the ground. This higher rate of utilization can lead to a lot of damage — certainly more than Hertz was anticipating.”

- The Verge

Article continues after advertisement

Hertz NYC TLC Plans?

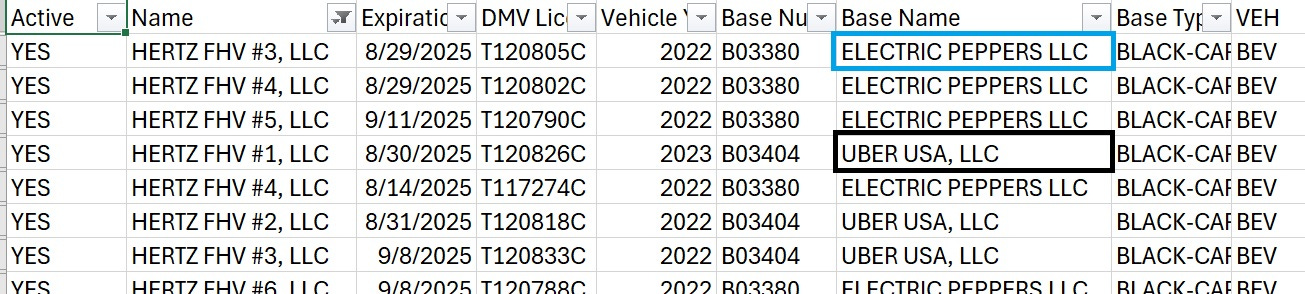

Back in March 2023, after the TLC released 1,000 EV FHV Licenses (TLC Plates), we noticed entities that seemed to belong to Hertz started showing up in TLC fleet database. In fact, we noticed Hertz, outside of Revel, got the second largest allocation during the March 2023 EV TLC Plate release. Just an observation, not an accusation.

Hertz, it appeared, built a NYC TLC fleet of 56 vehicles in a few months and had plans to grow. As per the annotated stock chart above, NYC Mayor Eric Adams and Hertz actually held a formal ceremony on September 20th, where they announced a program called “Hertz Electrifies New York City”.

We also checked the TLC insurance database to make sure the entities we thought belonged to Hertz, weren’t merely an individual using the Hertz name. Our analysis showed the entities, uniquely, were all insured by AIU. Based on the database and our industry knowledge, AIU doesn’t offer NYC for-hire transportation commercial liability insurance to any other TLC driver or fleet, implying a very unique fleet entity (i.e., how does a smaller, 56 vehicle fleet get a new insurance company to underwrite NYC TLC risk?)

Finally, we noticed:

At least half of Hertz’s vehicles were associated with Revel’s NYC dispatching base Electric Peppers LLC and the other half to Uber’s base Uber USA, LLC

Hertz entities didn’t appear (as of now) to have added any additional EV TLC-plated vehicles after the October 2023 reinstatement of the EV exemption to the TLC Plate Cap

Given Hertz financial resources, we do not think the NYTWA TRO really impacted the company’s ability to buy and TLC plate EVs from October 18th to November 13th, 2023, when the EV exemption was fully open. We believe Hertz didn’t add a single new EV TLC-plated vehicle in relation to a sudden shift in the company strategy (several reports started to appear in late October 2023), scaling back its EV ambitions, especially related rideshare rentals. Finally, we also think this is yet another sign that Revel might close their rideshare business (not infrastructure business) in NYC and seems to be no longer directly investing in vehicle capital expenditures (Hertz buying vehicles that Revel rents).

Hertz is likely a good case study of underestimating the transition to EVs, not a case study about not transitioning at all. It’s something to learn from and another chapter in a macro trend towards vehicle electrification, a trend we believe will take 10+ years to play out and maybe longer in dense urban environments like NYC. Policymakers, drivers and fleets should take note of Hertz’s experience.

⚡ NYC EV Charging Discussion With Benjamin J. Stein

As it relates to this topic, we also think it’s worth mentioning our recent discussion with Benjamin J. Stein, who was among the first 350 employees at Uber, joining the company in 2013. His experience at Uber included recruiting new drivers and helping the company build their NYC ‘vehicle solutions’ business, including partnering with TLC leasing companies. Ben also worked for a large TLC rental company, before founding Outpost Energy. Outpost Energy is focused on NYC electric vehicle (EV) charging infrastructure.

I am convinced electric vehicles (EVs) are relatively expensive toy cars that have no business in the NYC taxiing business for the purposes of being a professional vehicle needed for reliability and dependability. One CEO had to learn that the hard way and thousands of other new vehicle license holders that were given TLC EV licenses will soon learn that, in general. Unfortunately, most of those independent drivers will not have the deep pockets of a corporation to get themselves out of financial trouble and they will go out of business. This will be the fault of the TLC for shortsightedness when divvying out the EV licenses. Shame on them. The only way to rectify this to these new EV owners will be to convert those EV vehicle licenses to, at minimum, hybrid vehicle licenses. Hybrid vehicles have proven themselves to be reliable, great on gasoline, and their costs are about in line with fossil-fueled vehicles. It’s time to right this wrong.