Discover more from AutoMarketplace

🔐🖤🩷 Industrywide Utilization Rate Hits 54.4% in May, 6.7% Lower Than May 2022

Uber started "locking out" NYC TLC drivers in May. May industrywide utilization rate (UR) is now well above 53% regulatory floor. Are driver "lockouts" working? UR-based pay formula must be abandoned

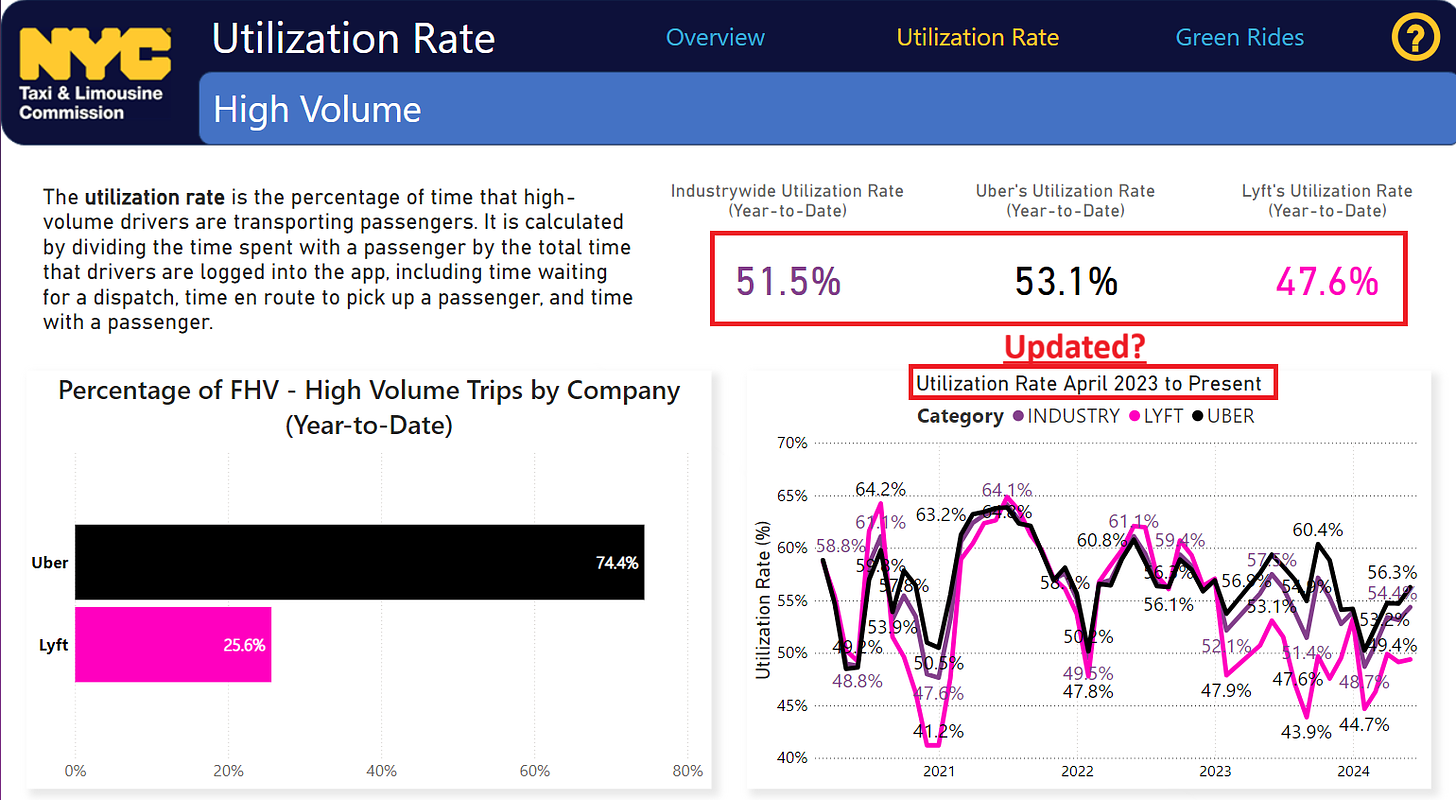

Industrywide utilization rate (UR) is a key metric used in NYC TLC’s driver minimum pay calculation for high-volume bases (currently Uber and Lyft)

UR is how busy a driver is kept while logged into either Uber or Lyft in NYC

Uber started “locking out” drivers in mid-May to legally “game” intention of TLC’s UR-based driver minimum pay protection rules

⭐ TLC data now shows UR metrics going back to February 2020

May industrywide UR was 54.4%, but year-to-date UR of 51.5% is well below 53.0% TLC regulatory floor, with seasonally slow August approaching

⚠️ Note: TLC needs to check whether year-to-date UR calculations accurately reflect May data, as it appears to be the same as April 2024

Uber’s standalone May 2024 UR hit 56.3%, while Lyft, which hadn’t started driver lockouts until mid-June, is still struggling to break 50% UR

This is our tenth monthly update on NYC TLC utilization rates (UR). UR can simply be described as how busy a NYC TLC-licensed driver who works for Uber and/or Lyft is kept while they are logged into their apps.

Our video below continues to gain traction and has helped people understand all the various dynamics which has led to NYC driver “lockouts”. If you need a refresher or want to really understand (*in our opinion) why lockouts have arisen (again), we encourage you to watch the video below.

UR Data Now Goes Back To February 2020!

Remember, industrywide UR is measured on a calendar year (January to December) basis, so there might be some months (i.e., January, August) that can drag UR lower but are offset by other, busier months (i.e., June, September).

⭐ Notably, the TLC has now released Uber, Lyft and industrywide UR data going all the way back to February 2020! This information was not available before. We commend 👏 the TLC for such robust data disclosure.

⚠️ However, it appears the TLC has not updated year-to-date (YTD) utilization rates. The reported YTD URs are the same as April 2024, although May 2024 URs were higher?

May 2024 UR Figures

Since we don’t believe the reported🤔 51.5% industrywide UR is accurately reflecting May data, we can’t really comment on the new data as it relates to the 53% industrywide UR floor included in TLC’s minimum driver pay formula.

What we can say is fears around industrywide UR dropping below 53% is a major reason why Uber and Lyft are currently “locking out” NYC TLC drivers.

Both apps have restricted NYC TLC driver access, at certain times, because they face significant financial penalties, if they are subject to current TLC UR-based driver pay rules.

📉 May Industrywide UR of 54.4%, was 3.1% lower than May 2023 (YoY) and 6.7% (👀) lower than May 2022

📈 May Industrywide UR of 54.4%, was 1.3% higher than April 2024 (MoM)

We continue to urge the TLC to drop UR as a regulatory metric and instead focus on appropriately controlling NYC for-hire driver and vehicle supply.

🖤 Uber Standalone UR Argument?

The latest UR data will also likely be used by Uber to “double-down” on its call to be judged on a standalone basis vs. industrywide.

As we covered, Uber is arguing that they should be judged on a standalone UR basis and that Lyft is driving the industrywide metric lower. Uber is technically correct, but such action would, in our opinion, effectively kill Lyft’s business in NYC given Uber’s much larger market share.

This is another reason why we continue to argue UR should be abandoned by the TLC altogether and the regulator should instead focus on driver and vehicle supply controls. Controls, which btw, can easily be adjusted if the market needs more FHVs.

📉 Uber’s May UR was 56.3%, 3.1% lower than April 2023 (YoY)

📈 Uber’s May UR was 56.3%, 1.6% higher than April 2024 (MoM)

📉 Lyft’s May UR was 49.4%, 3.7% lower than May 2023 (YoY)

📈 Lyft’s May UR was 49.4%, 0.3% higher than April 2024 (MoM)

Article continues after advertisement

NYC Trip Demand

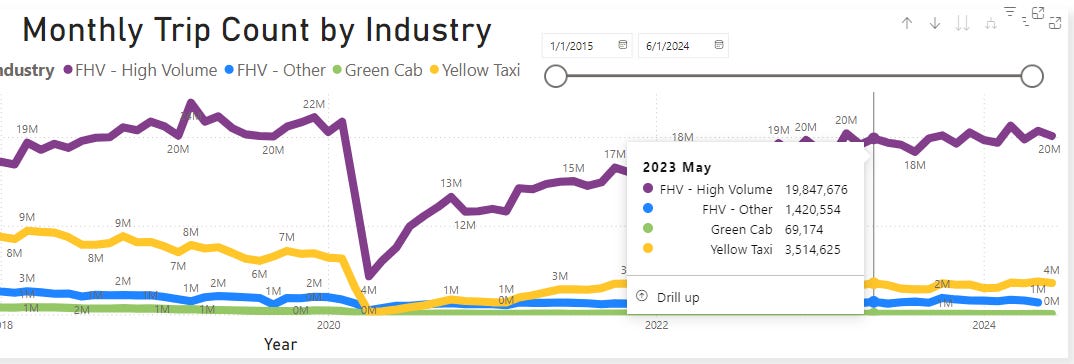

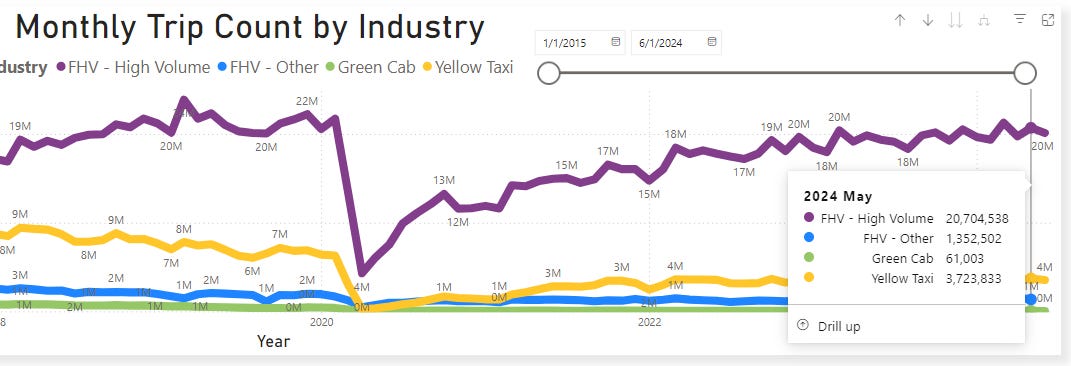

🖤🩷 In May 2023 there were 19.85 million total Uber and Lyft NYC trips. The industrywide UR was 57.5% in May 2023

🖤🩷 In May 2024 there were 20.70 million total Uber and Lyft NYC trips, or 4.2% more trips than May 2023. However, industrywide UR was 54.4% in May 2024

🚕 In May 2023 there were 3.51 million total yellow cab trips

🚕 In May 2024 there were 3.72 million total yellow cab trips, or 6.0% more trips than May 2023 although total active taxis are increasing (we will publish a separate article on this)

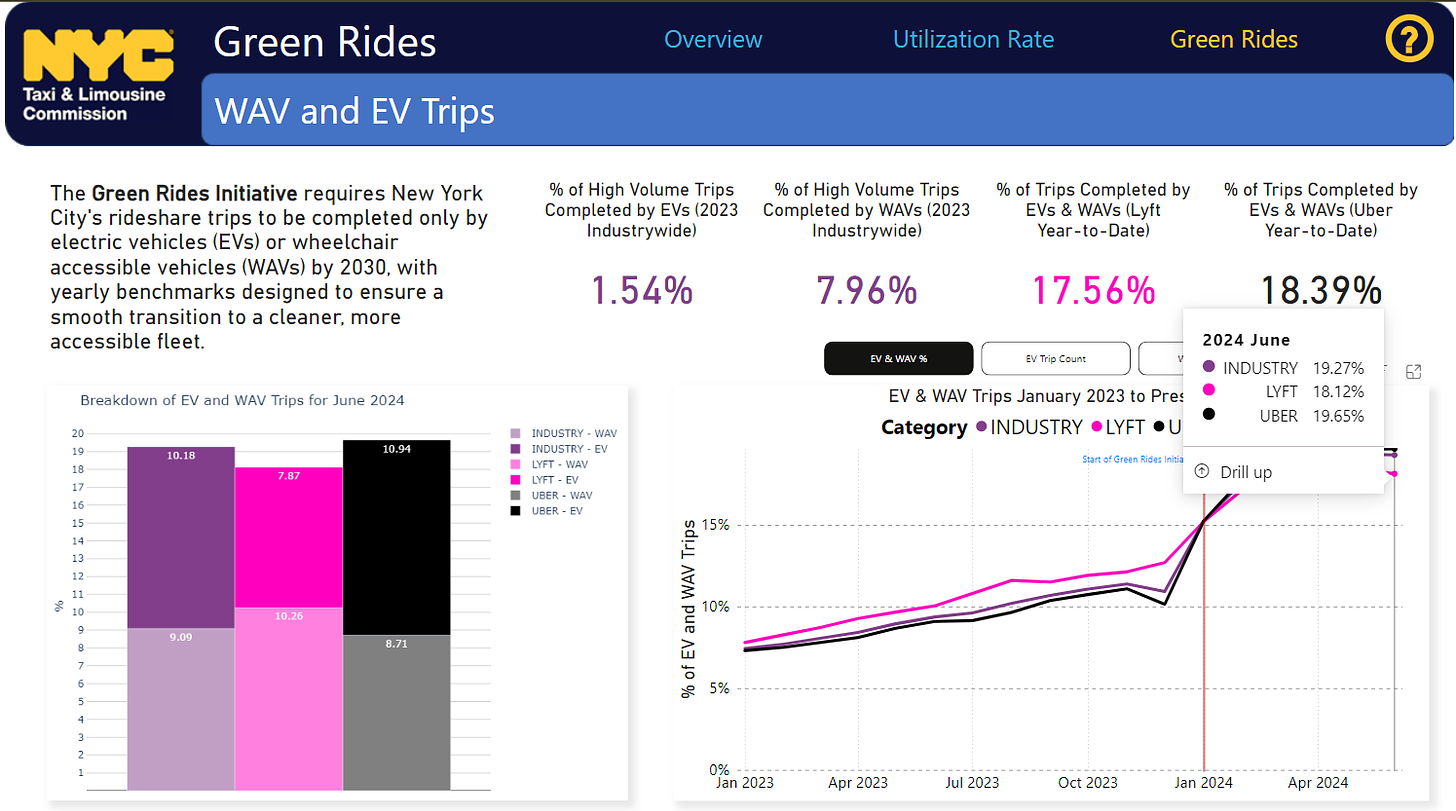

Green Rides Update

The TLC’s staggered goal of making 100% of all NYC rideshare trips serviced by an wheelchair accessible (WAV) or electric vehicle (EV) by 2030, is comfortably ahead of schedule, with nearly 1 in 5 Uber trips in NYC already “Green Rides” ⚡♿ compliant.

American Lease, a large TLC rental company, recent agreement to purchase over 3,000 all-electric Fisker Ocean SUVs should also be noted related to the Green Rides Initiative.

Lockouts Working? Incentives?

Uber only started restricting NYC TLC drivers to its app in mid-May. Lyft officially launched its NYC driver lockouts in mid-June. Although May is usually a seasonally busier month than April, Uber’s standalone UR significantly increased. This begs the question whether Uber is simply doing what the TLC is incentivizing it to do (i.e., it needs to legally drive up its UR or face financial penalties)?

The only way at this moment is for all driver to shutdown Uber for a whole week and then we can start talking, but I know 90% of drivers can’t afford to do that even for a single day, and that’s how they got us