Discover more from AutoMarketplace

NYC TLC Insurance: 2022 Market Overview & Thoughts

With the annual NYC TLC insurance renewal season underway, we provide an objective overview of the industry and some suggestions for drivers and fleets

LET’S BE CLEAR

The point of this article isn’t to complain or shame the insurance providers that cater to the NYC for-hire transportation industry. There are no accusations of illegal dealings or corruption in this article. Any educated discussion of TLC insurance (aka insurance NYC for-hire drivers and fleets must purchase for their vehicles) will recognize it’s a tricky and quirky business. I also personally know executives and brokers in the industry, and I find many to be forthright and honest. Just because someone or company is making money doesn’t mean they are doing something underhanded. Also, just because YOU THINK someone is making money, doesn’t mean they are.

This isn’t an attack piece; this is an educational article because this is what this industry needs right now. The TLC industry needs a constructive discussion about insurance. Often when people don’t understand something, due to a subject matter being opaque or hard to understand, it can lead to unfair accusations.

So, let’s everybody take a breath and…

At the same time, and as I’ve mentioned in other articles, before AutoMarketplace I was (still am) the founder/owner of a modestly sized TLC fleet concentrating on luxury cars. We’ve paid over $500,000 in TLC insurance premiums. I started the fleet with one car and have done every admin task imaginable, several times over (😅 I’ve been to the DMV & TLC over 50 times in person). From screening drivers, hit & runs, theft, accidents, and other insurance claims, I have some experience you could say. More interestingly, I am incentivized to understand how to reduce the probability of insurance claims to help improve our premiums and in turn margins of an otherwise capital intensive and low margin fleet business. TLC liability insurance is usually the single largest expense for not only TLC fleets, but drivers in general.

As I write about the TLC insurance industry below, just remember it’s from the perspective of someone who’s paid over half a million dollars in TLC insurance premiums. I would be lying if I didn’t admit I have my own set of complaints. It’s aggravating that our fleet’s premiums haven’t gone down, although our loss-run performance (number and dollar amount of insurance claims) is strong and likely places us among the top decile of fleet operators. I also have a nuanced perspective though on what’s going on, given my background in financial services and technical understanding of how insurance works.

Anyways, I want to make clear this isn’t paid advertising or a hit piece. I do want to give context to my commentary on the industry though.

Why Are There Only a Handful of TLC Insurance Companies? How Big is the TLC Insurance Industry?

Most people appreciate and understand the fundamental value proposition of insurance. Basically, you collect money from a large group, to help facilitate the payout of one-off expenses, often related to catastrophes or rare incidences. Without insurance, most individuals and companies would not be able to financially navigate many life and business risks.

For example, if you own a house, you may pay $100 per month for home insurance that covers flooding in case of the off chance (i.e., 0.1%) your house gets flooded, and you need to pay $250,000+ to fix it. An insurance company calculates premiums based on sophisticated mathematical models (known as actuarial models), to make sure the premiums they collect can payout expected claims, but also sustain a viable business. In the example above if the hypothetical 0.1% probability of your house flooding went up to 1%, it should make sense to you that your insurance premiums are going to go up significantly.

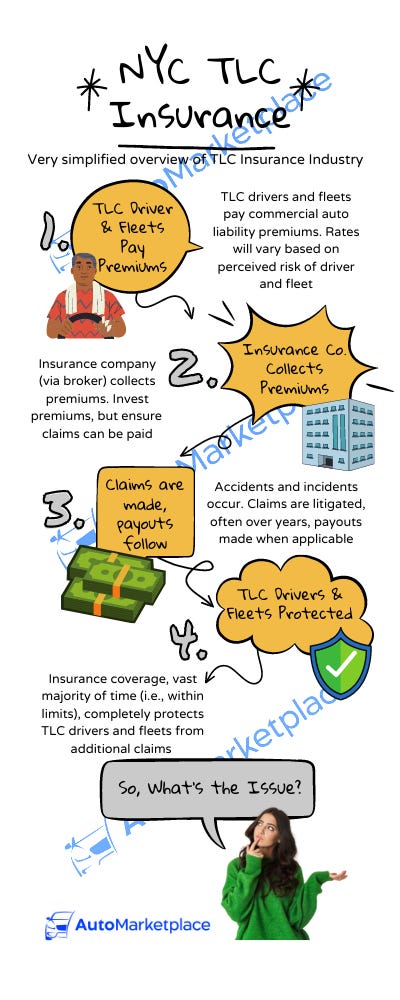

Below, we illustrate how the NYC for-hire transport insurance industry (aka TLC insurance industry) financial flows look like at a high level.

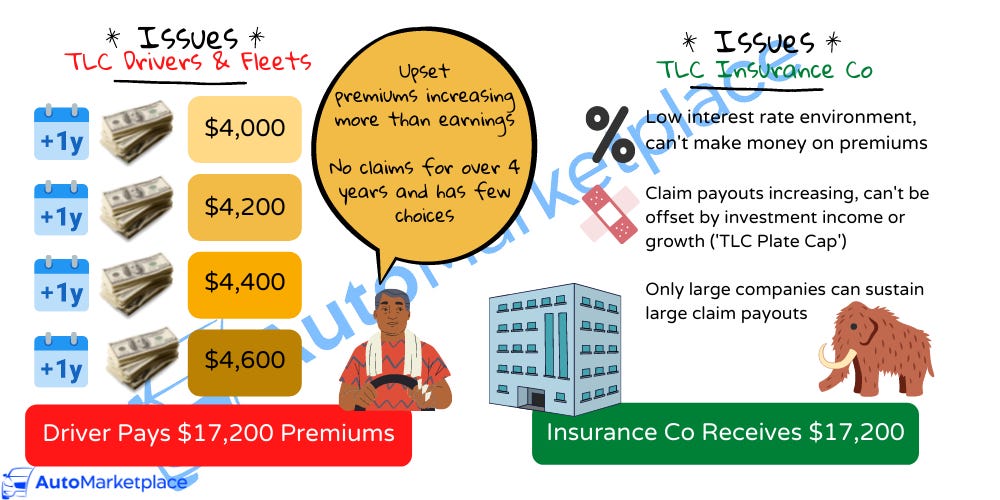

The perceived (and actual) issues, which may not be obvious to an outsider, are simply summarized below.

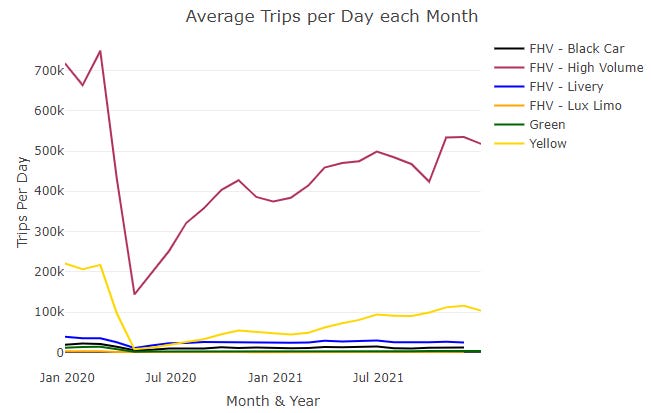

This can get much more complex with reinsurance structures etc., but that discussion isn’t required for a simple high level understanding of the TLC insurance market. The driver & fleet issues are easy to understand. In this example, a driver’s premiums keep going up, there is no history of claims and there are a few insurance options in the market to choose from. The insurance company issues are less obvious. For example, a low interest rate environment (premiums are often invested in low-risk bonds to earn return) and inflation related to claims payouts (cost of healthcare) puts significant pressure on insurance company financials. In addition, the FHV License Pause (TLC Plate Cap) has also limited the growth of the TLC insurance industry. A market with little growth and negative macroeconomic dynamics is tough to navigate.

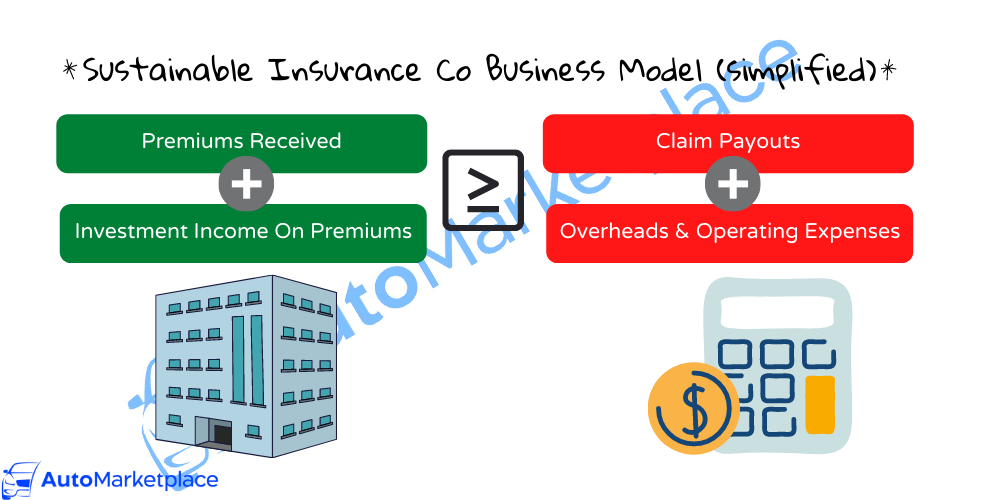

You also must go back to first principles and think about the nature of insurance. The only way to have a financially viable insurance company is to collect premiums from enough people who have de minimis claims to offset larger claim payouts and the operating expenses of the business. At minimum, the math should result in at least a breakeven business model (see graphic below).

The unfortunate story below illustrates the sort of risks involved in the for-hire transport insurance market. There are underlying reasons why State Farm, GEICO, Allstate, Progressive, etc aren’t in the TLC and taxi insurance industry in general…it’s risky. It’s also important to note that although Uber is being sued, ultimately an insurance company will be liable for a chunk of the payout, at least up to a policy’s liability limits.

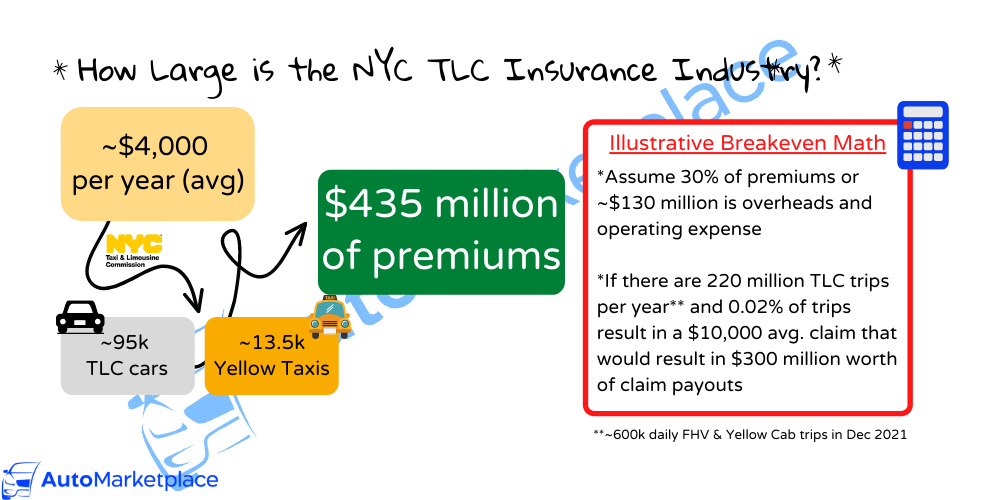

In NYC, those policy limits are $100,000 per person and $300,000 per incident. Using educated assumptions, we size the NYC TLC insurance industry below and show you why we think only a handful of companies can exist.

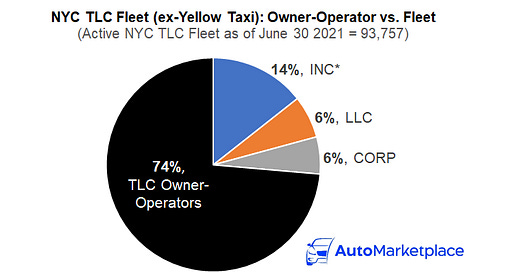

Based on the latest data, there are ~95,000 active TLC cars (non-yellow cabs) in NYC. In December 2021, about 600,000 daily FHV and yellow cab trips were happening in NYC, which if sustained would result in over 200 million yearly for-hire trips.

For individual drivers, TLC liability policies tend to be between $3,000 to $5,000 annually. Fleet policies tend to range between $4,500 to $6,500 per car, per year. Remember, these are not full coverage policies that also cover physical damage and collision claims (we will discuss that at another time). Most NYC TLC driver and fleet policies are liability-only policies that don’t cover physical damage claims.

Since we don’t have the exact industry loss run data, for the time being we’ve hypothetically sized the market and shown a simple breakeven analysis below. We believe the TLC liability insurance industry is worth between $400 to $500 million in premiums per year. In our breakeven analysis, we are making illustrative assumptions to give our readers a sense of what the simple claims math would need to be for the industry to be at breakeven. Again, the real math is much more complex, but the below is just a simple hypothetical example.

Given the TLC insurance market has limited growth now (TLC plate cap) and over 200 million trips that could result in claims, only a handful of companies collecting the majority of premiums could make the financial math work. For example, if you had an insurance company that insured 1,000 vehicles and was earning $4 million of premiums, only a handful of bad accidents or incidents would make that company financially unviable (claim payouts would be greater than premiums earned & investment income). This is why the insurance industry in general lends itself to large companies that can distribute risk and costs due to economies of scale, another way of saying the more premiums a company can collect, the more risk they are able to distribute. There is something to be said for quality over quantity and we’ll discuss that at the end.

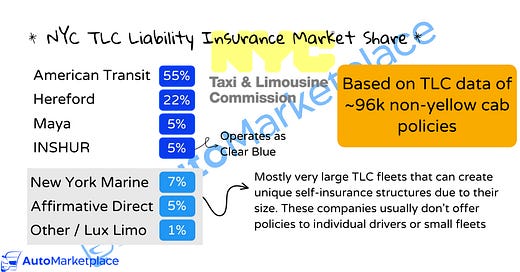

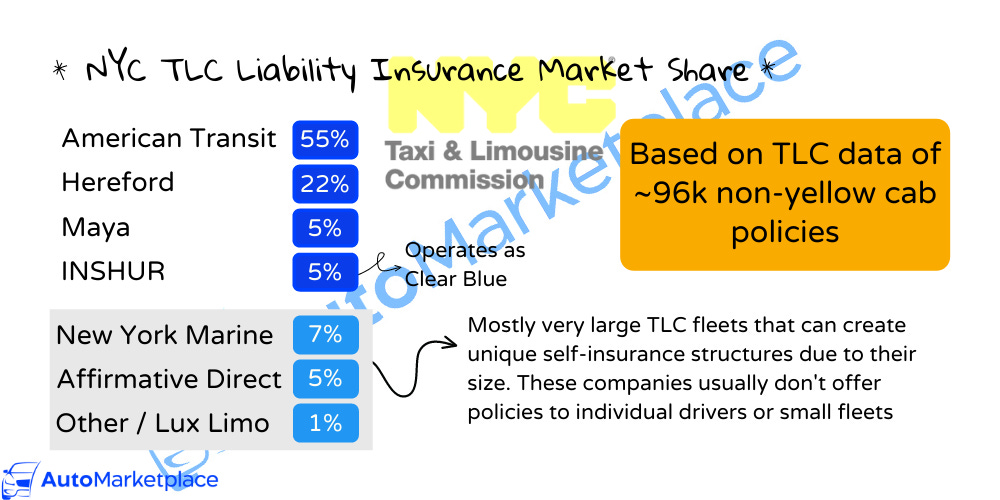

Who Are The Largest Players in the NYC TLC Insurance Industry?

Below we share a market share breakdown of the largest non-yellow cab TLC liability insurance providers in NYC. Note, the latest TLC insurance data has about 1,000 more active vehicles than the latest NYC Open Data TLC list (96k vs. 95k).

Remember our previous points when contextualizing these market shares. We believe the market can only support a handful of companies. However, that doesn’t mean we don’t think the status quo can improve.

It’s also probably interesting to note that American Transit, the leader in NYC TLC liability insurance, seems to be in some serious financial trouble.

The Future of the TLC Insurance Industry & Some Thoughts

Conceptually there are a few high level ways, outside of creating a new insurance company, to combat increasing insurance costs as a NYC TLC driver or smaller fleet.

Earn more money relative to insurance costs (less expense as a % of income)

Lower insurance costs by avoiding at-fault accidents and driving violations that result in points

Now many might expect me to go into suggestions like calling for the creation of a new insurance company that only insures lower risk (“the best”) NYC TLC drivers, or having drivers/fleets form co-ops to buy out TLC insurance brokers to reduce costs via owning broker commissions or even call for Uber / Lyft to take on some of the cost directly or by charging passengers a per trip insurance surcharge. All interesting suggestions, but I want to approach this in a different way.

I believe the most practical way for NYC TLC drivers and fleets to combat the rising cost of TLC insurance is to steadily invest in an asset(s) that:

Appreciates faster than insurance and general inflation, &

You can easily borrow against (while still maintaining conservative leverage).

This may sound SCAMMY, but I assure you it’s well thought out and I will explain the thesis in more detail in another article. I believe the best asset to achieve that goal is BITCOIN. Bitcoin is a notoriously controversial and volatile asset, but if you look at it over a long enough time horizon, it has acted as an effective store of value. In other words, it’s been a very effective inflation hedge.

But is it…🤔

It’s a strategy I’ve adopted for our own fleet, so I’m not promoting something I wouldn’t do myself. In addition, as we launch AutoMarketplace our overall thesis and perspective on this will become clearer.

LET ME ALSO MAKE CLEAR I’m not trying to sell you Bitcoin. However, as we enter a new internet paradigm (Web3) enabled by decentralized blockchain technologies (yes, I’ll explain what all that means in another article), it’s important to at least understand what all the fuss is about. After all, new NYC Mayor Eric Adams recently converted his salary into Bitcoin and Ethereum, so this has now fully entered the mainstream.

If you decide it doesn’t make sense, that’s fine as well. No judgement. The taxi industry ignored Uber and one day it’s inevitable a new technology will come to disrupt Uber itself, and we believe Bitcoin, Ethereum, blockchain, crypto, all buzz words today, will play an important role in not only disrupting Uber, but changing many things, including insurance & financial services. It can take a while to understand all of this fully, but we believe it’s well worth it and it’s something we are quite passionate about at AutoMarketplace.

Are you an NYC TLC driver or fleet? What do you pay for NYC TLC liability insurance? What do you think about our suggestion re. Bitcoin? Are you skeptical? Have you previously invested in Bitcoin or crypto? What are your general thoughts?

Please feel free to email us at info@automarketplace.com or comment below!

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️