Discover more from AutoMarketplace

☂️📈 TLC Insurance Costs Set To Increase 8% to 10%+

American Transit, largest NYC FHV insurance provider, set to increase PIP & APIP insurance base rates 20%, plus make other changes. Given 50% market share, other TLC insurers will likely follow suit

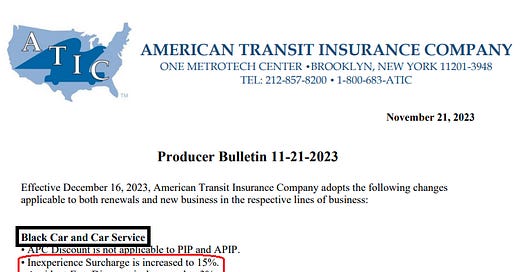

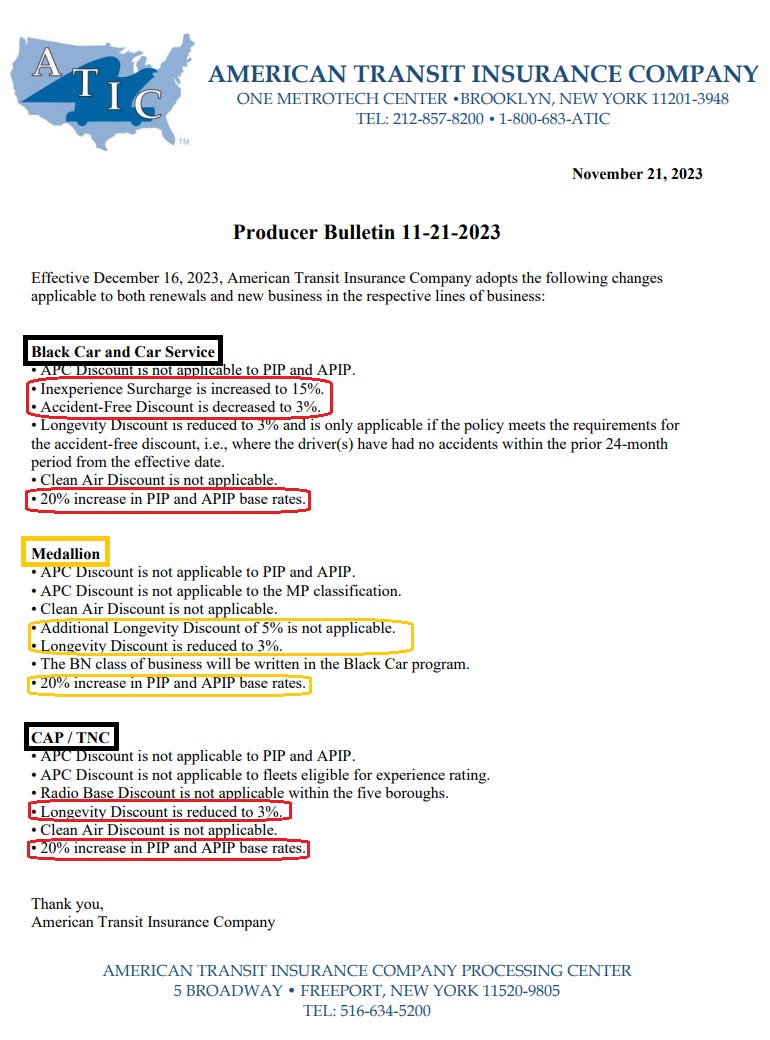

Based on an American Transit (ATIC) “Producer Bulletin” (or a notice insurance brokers who sell ATIC policies receive), TLC liability insurance premiums could increase 8% to 10%+ for many NYC drivers and fleets, ahead of the annual renewal period early next year.

This is a BIG DEAL, as for-hire vehicle (FHV) insurance is a core expense for many TLC-licensed drivers, FHV fleets and bases that operate their own fleet (i.e., Revel).

In addition, annual inflation adjustments used in the TLC Driver Minimum Pay formula (remember, only applicable to Uber and Lyft), seem to use general inflation measures vs. TLC-industry specific cost inflation, which might not fully capture this prospective insurance inflation.

How Are We Estimating An 8% to 10%+ Increase In TLC Liability Insurance Costs?

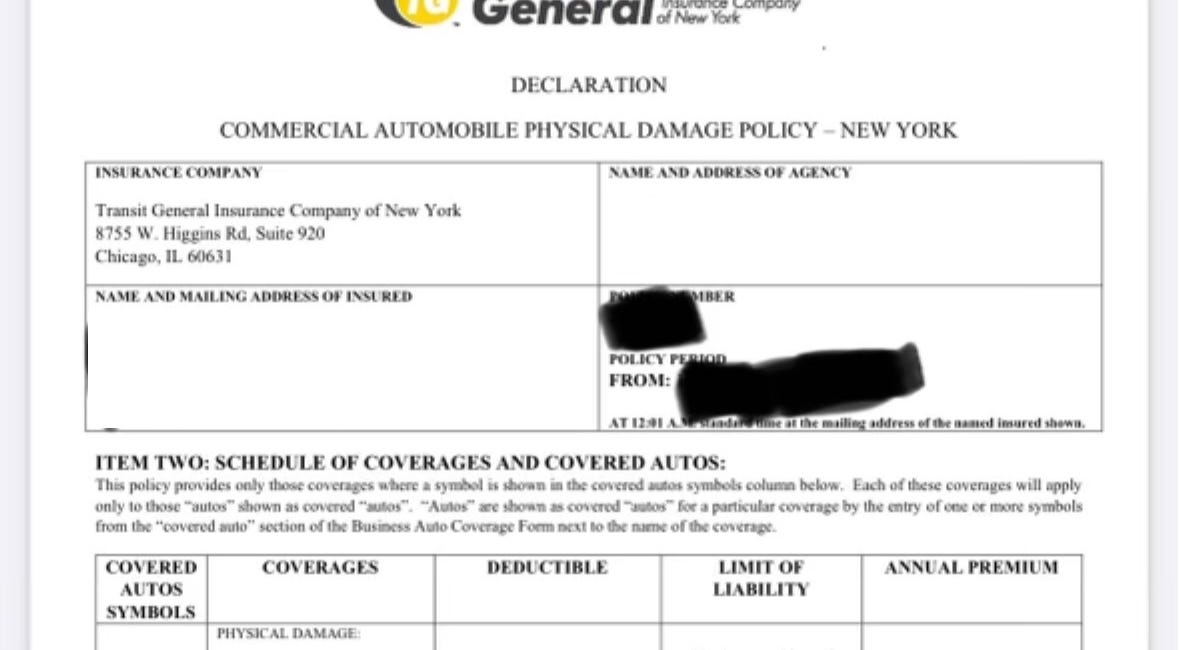

We’ve estimated the 8% to 10%+ TLC insurance premium increase based on a sample TLC liability insurance policy (Note: Hereford (HIC) policy), which expires in March 2024 and was underwritten (“binded”) in February 2023 (last annual renewal).

In the image below, you can see the Personal Injury Protection (PIP) and Additional Personal Injury Protection (APIP) portion of this policy represents ~30% of the total policy premium, with Bodily Injury Liability and Property Damage Liability representing the other ~70% of the policy premium. Based on the American Transit bulletin above, it states PIP and APIP base rates would increase 20%.

If we do the math, ASSUMING everything else is the same, it would result in the annual premium on this policy increasing by a little more than 6%. However, the American Transit bulletin also states other discounts and surcharges are changing. Combining our simple math, plus additional statements in the ATIC bulletin, we get our rough estimate of an 8% to 10%+ insurance premium increase for most NYC TLC drivers and fleets.

Obviously, for some TLC drivers and fleets the impact might be less, while for others it could be much more than a 10% annual premium increase.

Predatory?

Now, before you blame American Transit or before TLC Chair David Do starts talking about “predatory” insurance companies (Note: what costs does Do think informs TLC vehicle rental rates?), auto insurance premiums nationally have gone up significantly.

In other words, this is not a NYC TLC-specific trend.

However, it’s still very notable because the absolute dollar amount of insurance premiums paid by TLC drivers & fleets is much higher than what the average New York State resident pays (non-commercial auto vs. commercial auto).

A TLC driver or fleet will usually pay between ~$4,000 (individual rate) to ~$6,500 (fleet rate) per year for a liability-only policy. Add another ~$3,000 to ~$4,000 to those rates for a comprehensive & collision policy. Therefore, full coverage insurance for a TLC driver or fleet might cost ~$7,000 to ~$10,000+ per year 🤑 (before any additional increase ☂️📈). This figure represents a significant part of a driver’s income and a fleet’s operating cost.

For comparison, according to Bankrate.com, New York State residents pay an average of $1,371 annually for minimum coverage and $3,139 annually for full coverage. Full coverage in New York is 56% higher than the national average of $2,014 and minimum coverage costs 120% more than the national average of $622.

Some factors driving general auto insurance increases, including TLC insurance, are:

Increased incidents of accidents, theft and weather-related events

Increasing cost of repair (more expensive technology in vehicles, parts, technician / mechanic shortages, increasing labor costs)

General inflation and supply chain dynamics (availability of parts, including microchips)

Used vehicle prices

“The Insurance Information Institute says auto insurers paid $1.12 in claims last year for every dollar they collected in premiums. This year, that ratio is expected to be $1.09.”

- NPR

Furthermore, the TLC insurance premium increases referenced in this article relate to liability-only policies, As we’ve written previously, premiums for comprehensive & collision policies are also increasing or simply not available on certain vehicles (expensive EVs in particular), which are seen as a bad or impractical risk to underwrite (i.e., would need to charge TLC driver (or fleet) a rate they can’t practically afford).

NYC TLC Insurance: 2024 Market Overview

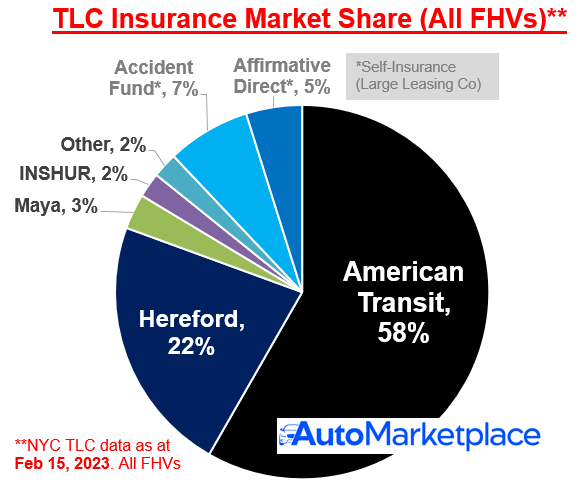

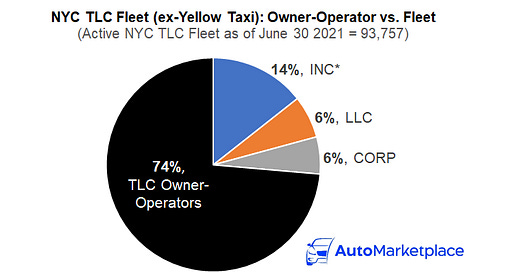

Given, American Transit is the dominant player in the NYC for-hire transportation insurance market (50%+ market share), we would expect to see similar premium increases from other TLC insurance companies: Hereford, Maya and INSHUR.

For the last two years, we’ve published a NYC for-hire transportation (TLC) insurance industry overview. We will publish our 2024 Market Overview in early to mid-January, ahead of the February insurance renewal period.

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

AutoMarketplace NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️