Discover more from AutoMarketplace

💸 TLC Is Missing $10 Million+ Opportunity In Plate Release

Issuing 400 EV-only FHV Corporation Licenses (a/k/a TLC Plates) without holding an auction, is a $10 million+ missed opportunity that can support City/TLC Budget, which in turn could advance EV goals

Since we’ve started this newsletter, we’ve written several articles about the history of the taxi medallion crisis and why we also believe medallion values are finally set to recover. From a comprehensive debt restructuring (with a City loan guarantee! ✅) to the (re)establishment of an NYC for-hire vehicle supply cap mechanism, it’s undoubtedly been a long and volatile road.

We went from the $1 million taxi medallion in 2014 to sub-$100,000 lows during the pandemic, this all occurred in less than a decade! Outside of medallion valuations, the income, health, stress and other impacts on long time TLC drivers, many who spent their entire professional career betting on the NYC taxi industry, cannot be fully captured in financial calculations.

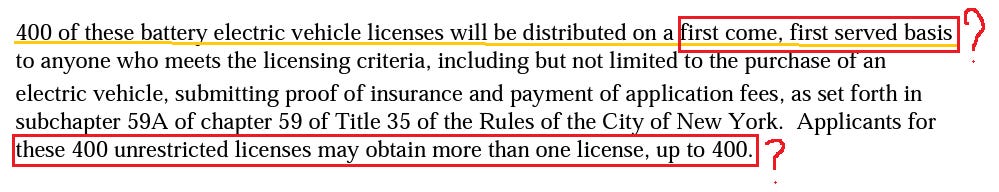

So, when we read details about the NYC TLC’s plans to release 1,000 more EV-Only FHV Licenses (a/k/a TLC Plates), something struck us. FIRSTLY, the 600 (out of 1,000) non-transferable EV-Only TLC Plates, aimed at providing individual drivers an option to exit leasing arrangements, seemed like a fair idea and good way to promote EV adoption - no issues there! HOWEVER, the 400 (of 1,000) TLC Plates reserved on a “first come, first serve” basis (with no limit per entity) aimed at bases and corporations, seemed odd 🤔.

While more specific details will be shared during the Wednesday, January 11th meeting at 10am, we thought we would make a suggestion ahead of that meeting, for the TLC to seriously consider. Again, this only applies to the 400 TLC Plates aimed at corporate entities and NOT the 600 non-transferable TLC plates reserved for individual drivers (we like that idea).

FHV Corporations

As we’ve covered, business entities that have claim to FHV Licenses (i.e., licenses attached to a specific corporate tax ID (or EIN) ) are known as FHV Corporations. To be clear, TLC Plates attached to an individual’s name are NOT TRANSFERABLE. FHV Corporations can technically be sold via a business sale (i.e., someone is selling their business that has claim to FHV License(s)). Although this dynamic may sound like sort of quasi taxi medallion asset, there are some key technical differences, some which we highlight below.

Unless a company was prescient enough to own EACH FHV License (TLC Plate) in a standalone business entity, selling individual FHV Corp. TLC Plates to individuals isn’t really possible. Sure, you could sell a “10 Plate Corp” to 10 people, but that’s more akin to selling a leasing company to a group of drivers vs. selling 10 individual medallions to 10 people.

While there is a secondary market for FHV Corporations, or essentially TLC leasing companies (exception being a single FHV license attached to a business entity), this is a very nascent market. Many FHV Corporations are likely not practically salable, having unremitted sales tax and other unresolved legal obligations (i.e., E-ZPass, NYC Tickets). While deals are being done, many may not involve proper due diligence by the parties involved in the transaction.

Although street (“hand”) hail rights might not be as valuable today, yellow taxi medallions still have the exclusive right to this demand. In addition, exterior and interior advertising revenues can be generated with medallions cabs, while other TLC-plated vehicles do not have those rights.

Taxi medallion fare revenue is generally not subject to commission fees from Apps. Most non-taxi medallion TLC vehicles function on trip demand from Uber, Lyft and other bases, whose business model is built on 20%+ broker fees (i.e., commission). In other words, if you own a taxi medallion outright and make $500 in gross fare revenue, you’re not usually paying anyone broker fees, only remitting taxes and regulatory fees.

Non-medallion TLC Plates can only be dispatched by a HVFHS, black car, or livery base and are subject to different taxes and regulatory fees (i.e., sales tax, Black Car Fund). Potential congestion pricing exemptions for yellow cabs, but not for other TLC vehicles, may yet be another major difference between the two FHV license classes.

The points above explain why taxi medallions are currently selling for $165,000+, while FHV Corporations garner the equivalent of about $25,000 per TLC Plate (with the exception of a “One Plate, One Entity” FHV Corporations that may have a premium attached to it). The TLC market clearly understands the dynamics we highlight above, in coming up with valuations for these esoteric assets.

So, what are we getting at?

Let’s first briefly establish some important facts and then we’ll get into our broader point and specific suggestions.

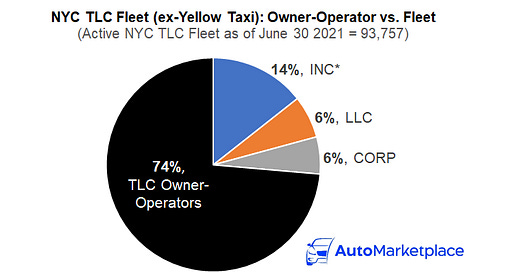

Fact #1: A majority of TLC Plates are registered to individual owner-operators

The majority of TLC plates are registered to individual TLC drivers. Yes, this is counter to many driver advocacy group (plus Uber & Lyft) narratives, but this is the technical truth.

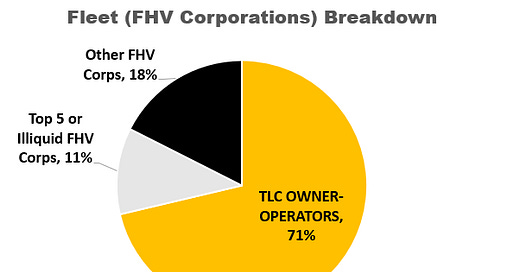

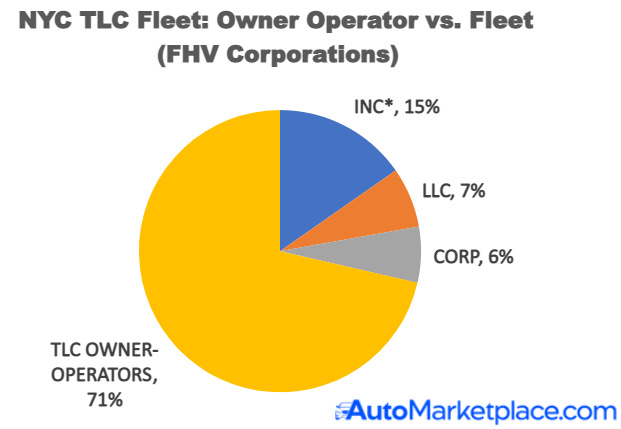

Based on our analysis, we estimate ~29%, or 27,379 FHVs, are essentially fleet-owned or owned in a FHV Corporation structure. This is also likely an overestimate as it includes “One Plate, One Entity” businesses that are likely owned by an individual TLC driver.

Therefore, out of the current active NYC TLC fleet of 95,287, excluding yellow cabs, ~71% are operator-controlled (i.e. TLC driver has claim to their own TLC Plate).

Fact #2: A large minority of FHV Corporation TLC Plates belong to large single business entities

A large percentage of TLC Plates associated FHV Corporations are attached to large business entities. This is important to note because it creates illiquidity in the market. Unless, one of these entities wants to sell their entire company, these plates are likely not moving ownership (i.e., not for sale). Yes, we get that there are clever legal and financial structures one can come up with (i.e. issuing fractional shares), but these companies are unlikely to go that route.

In addition, our guess is these very large, often self-insured, leasing companies will likely be subject to Lease Caps to prevent abuse from price gouging on one end to underpricing smaller leasing companies (only temporarily) to drive them out of business in order to consolidate their market share (akin to Uber and Lyft’s original VC-enabled playbook).

In essence, 40% (or 10,500+ TLC Plates) of the 29% total FHV Corporation total is effectively illiquid supply. This figure is also likely an underestimate, as large leasing companies may own multiple FHV Corps.

TLC Should Auction Off 400 Corporate Allocation As Single FHV Corporations

Now, with the above facts established, let’s go back to first principles and remind ourselves of some taxi medallion history. As recently as 2014, taxi medallion auctions netted the City hundreds of millions for its budget. In other words, wouldn’t it be nice to regain a mechanism where one could raise millions of dollars by auctioning a City asset that has a clear need for a regulated supply cap🤔…from congestion considerations to protecting commercially licensed NYC TLC driver earnings. This is quite literally the main reasons behind why the taxi medallion and FHV vehicle supply cap mechanisms exist! It’s important to go back to first principles, go back to the origin of the medallion system in 1937 and why it was created.

While it may be a while before any new taxi medallions are auctioned off, the NYC government can at least temporarily reclaim this financial mechanism, via auctioning off the 400 EV-only FHV licenses reserved for corporations. If the TLC structures the auction in a “One Plate, One LLC” structure, our estimate it the City can easily raise north of $10 million! This money, in turn, can help fund the regulator’s electrification goals, from fast charging stations to providing drivers help in purchasing EVs.

In addition, and as a concession to traditional black car & livery bases, we also believe these 400 EV-only TLC Plates should actually be “EV or Hybrid-only” FHV Licenses. Most traditional Black Car & Livery Bases, based on their own guidance, are not ready to adopt electric vehicles at this exact moment. Therefore, if you allowed those bases a chance to bid for an FHV License that they can attach a Hybrid vehicle to (i.e., first 3 to 5 years can be hybrid, before they need to switch to EV), you (1) will help them meet their immediate client demand and (2) will likely even raise more money at the auction!

Concluding Thoughts

To allocate 400 EV-only TLC Plates to corporate entities on a “first come, first serve” basis(!) and no limit per entity(!), in our view, is not good policy and will likely be subject to claims of unfair dealings. For example, if it is revealed (via publicly available NYC Open Data) that Revel managed to acquire a large chunk of these new EV-only TLC Plates, there will likely be a lot of driver backlash, whether fair or unfair. It may not seem obvious, but we know this market. To be clear, we aren’t accusing Revel of backroom dealings and we think they have every right to expand their business within the TLC’s given regulatory framework.

We also think the TLC can use the current unique backdrop to partially reclaim a financial mechanism it once had with taxi medallions. A mechanism that historically helped the City raise hundreds of millions of dollars. In turn the money raised, as mentioned, can further promote TLC’s overall electrification goals.

Finally, an auction will make clear that the regulator very carefully considers ANY & ALL future FHV License issuances of any kind, until taxi medallion values and driver earnings recover to a healthy level. Remember, any issuance of more TLC Plates will impact medallion values. Although medallions aren’t being auctioned, they will want to see some mechanism to prevent further FHV License issuances.

As always, let us know your thoughts in the comments section below or by emailing us at info@automarketplace.com.

AutoMarketplace.com NYC covers the for-hire transportation industry and automotive news. Check out AutoMarketplace.com on YouTube ▶️