Discover more from AutoMarketplace

👑 KING UBER: TLC Blinks To "Reduce" Lockouts, As Lyft Set To Lose Market Share

Mayor and TLC's deal to "reduce" driver lockouts is a win for Uber. We predict Lyft will lose NYC market share and an Uber monopoly will form. It's time for drivers to think like investors.

Mayor’s press release announcing plan to “drastically reduce” NYC driver lockouts is a win for Uber and will likely result in Lyft losing market share

Uber is clearly the most powerful organization in NYC’s for-hire transportation industry, the TLC, drivers, fleets and competition are increasingly subject to its monopoly power

Driver advocates at New York Taxi Workers Alliance (NYTWA) are furious about City deal they label as a “corporate give-away”, while advocates at the Independent Drivers Guild (IDG) appear to be supportive

🚀 Moonshot Idea: We *believe1 if enough drivers become shareholders in Uber & Lyft and/or acquire enough NYC taxi medallions & FHV Licenses (TLC Plates) they can gain true negotiating leverage, hedge against the rise of autonomous vehicles (AVs) and earn an investment return*

AutoMarketplace [+] will begin educational series explaining Uber and Lyft’s business model and financials (SEC filings). [+] will also begin series on NYC taxi medallion and FHV License (TLC Plate) valuation*

*NOT financial advice, do not rely on our opinions or statements to make financial and/or investment decisions ⚠️⚠️⚠️

If you read yesterday’s official press release about Mayor Eric Adams and TLC Chair David Do’s plan to “drastically reduce” NYC TLC-licensed driver lockouts, or a driver’s ability to access the Uber and/or Lyft apps when and where they want, one paragraph summarizes the deal.

“Under today’s agreement, Uber will immediately begin phasing out access restrictions for drivers using its platform, with the goal of ending them entirely by Labor Day if Lyft maintains an annual company utilization rate (the time drivers spend with a passenger) of at least 50 percent — a figure that is reduced when companies like Uber and Lyft onboard too many drivers. As part of the agreement, both companies will also pause onboarding for new drivers, as this helps to increase utilization rates and allows more work for existing drivers. Lyft will minimize lockouts as the onboarding pause continues.”

- Office of Mayor, Press Release (July 31, 2024)

What does this mean? Driver lockouts ending?

Let’s be simple and summarize what’s happening.

Uber has convinced the TLC to force Lyft to maintain a 50% standalone utilization rate (UR). In return, Uber and Lyft won’t onboard new drivers (companies have already been doing this for months) and Uber will try to wind down its lockouts by Labor Day. The TLC also agreed it won’t pass new rules & regulations (for now).

Whether this is a written and signed agreement ✍️, it’s not clear. It appears to be a handshake 🤝 deal.

Furthermore, Uber and Lyft have already artificially boosted UR figures for parts of May, June, July and likely August via driver lockouts. August is usually a very slow month, so Uber probably feels its final 2024 calendar year UR will be sufficient at this point heading into September and a busier Q4 period, buying it another year of utilization rate compliance.

King Uber

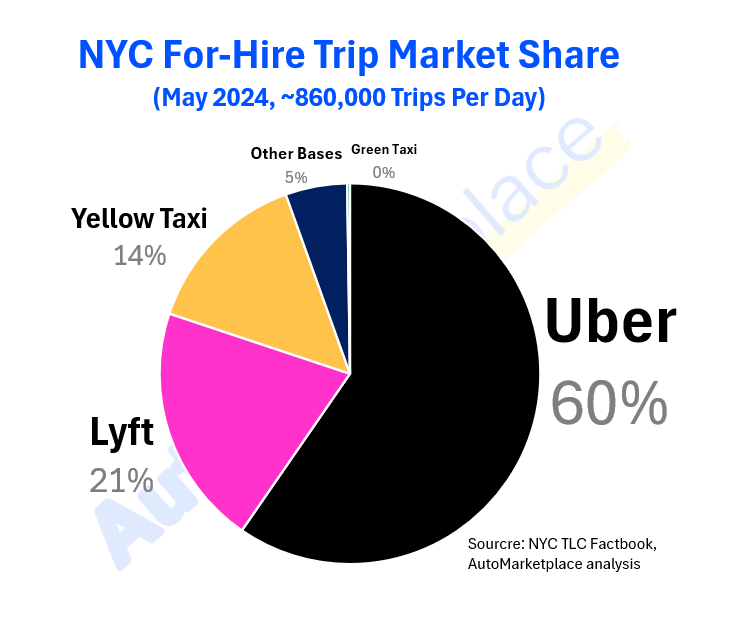

As we’ve mentioned, Uber’s much larger NYC market share position (~60% to Lyft’s ~21%) makes it easier for it to keep its driver base busier, resulting in a higher standalone utilization rate (UR).

Subjecting a much smaller market player (Lyft) to similar utilization requirements as the 60% market share leader (Uber), is bad policy and unfair. To use an Olympic Games analogy, imagine wrestlers, boxers or weightlifters 🏋️ not being divided into weight classes (i.e., heavyweight vs. featherweight). Almost everyone would agree that such a dynamic would result in fairly predictable outcomes.

This is essentially the logic behind why we’ve (1) argued for UR to be dropped from TLC’s driver pay formula, not minimum pay rates, and for the TLC to focus on limiting for-hire vehicle supply or (2) argued for the high-volume services (HVFHS) base threshold to be increased to 100,000 trips per day (from 10,000) so competition has a fighting chance against a very dominant marketplace leader.

Uber is edging closer to total “regulatory capture” of the NYC for-hire transportation (TLC) industry. It is now using this leverage to cement a monopoly.

We predict the following will happen (if TLC does not act in an appropriate manner):

Lyft’s NYC market share is about to drop relative to Uber’s

Uber’s overall market share will increase and breach 65% of all NYC for-hire transportation trips (~ 2 out of every 3 trips), especially when you include yellow cab e-hails dispatched by Uber

If TLC does not increase the HVFHS trip threshold, Uber’s market share might even breach 70%, as no competitor will be able to scale

We asked ChatGPT when a company would be considered to have a monopoly position, we paste the text of the response below.

“The exact market share that would be considered a monopoly can vary, but generally speaking:

70% or More: A company with a market share of 70% or more is typically considered to have monopoly power. This is a common threshold used in antitrust cases.

50% to 70%: A company with a market share in this range may be considered to have significant market power and could be scrutinized for monopolistic behavior, especially if there are high barriers to entry for other competitors.

Less than 50%: While it is less common, a company with a market share below 50% could still be considered a monopoly if it has a strong influence over the market, such as through control over essential facilities or through anti-competitive practices that limit competition.

In the United States, the determination of monopoly power involves not just market share but also the company's ability to control prices, exclude competition, and the overall competitive dynamics of the market. European and other jurisdictions may have similar but distinct criteria for determining monopoly power.”

- ChatGPT (AutoMarketplace prompt - “What market share would be considered a monopoly?”, August 1 2024)

Kindof sounds like Uber has gained or is gaining, by literal dictionary and regulatory definition, a monopoly market position in the NYC for-hire transportation industry. Its ownership and management is also not very decentralized. At least with the taxi medallion system there were thousands of individual drivers who owned medallions, essentially a piece of the NYC taxi franchise, and the price a passenger paid, excluding taxes and other government fees, directly went to a driver (there was no direct per trip commission or “take rate”).

It should also be mentioned TLC Chair Do stated the regulator is prepared to roll out new rules and regulations should Uber (or Lyft) start playing games or going back on promises 🤔.

“At the same time, we have prepared a robust rule package designed to disincentivize access restrictions, and we are absolutely prepared to introduce that should it become necessary.”

- NYC TLC Chair & Commissioner David Do

The TLC shouldn’t be surprised when (not if) that happens. If the TLC needs reminding, we present Exhibit #1 (see below). To be fair to Josh Gold, the Uber executive speaking, he had and has no way of forecasting Lyft’s utilization rate (UR), which is needed to predict what an industrywide UR might look like. However, his statement clearly implied that Uber was comfortable predicting, in almost any scenario they would not have to (re)-institute lockouts, if the industrywide UR threshold was lowered from 56% to 53%. Uber and Gold were dead wrong, it’s on camera 🎥.

Remember though, the TLC’s original rule proposal actually called for a 56% UR requirement!!! We will leave it to your imagination to what “lockouts” would have looked like if TLC’s original plan was followed. The TLC would have been dead, dead wrong.

Thankfully, there was a public hearing!

“There is no concern about falling below 53% [utilization rate]”

- Uber executive Josh Gold implying if industrywide utilization rate “floor” went from 56% to 53%, there would not be a need to institute Uber NYC driver lockouts

Instead of re-hashing our specific suggestions and proposals about how we believe lockouts can permanently end, we’re gong to go down a different path today. Just to quickly reiterate, clearly the utilization-based driver pay formula is a regulatory catastrophe and must be abandoned or amended as outlined above. Keep the minimum per mile and per minute rates, but get rid of the UR denominator or adjust the definition of what qualifies as a high-volume services base (HVFHS).

Not sure what else needs to be seen at this point.

Article continues after advertisement

Did you know? Drivers enrolled in Drivers Benefits can receive up to $2K in dental services1 each year, plus many other valuable Health & Wellness benefits – all at NO COST to you!

Drivers Will Have A Seat, By Becoming Shareholders In Demand & Supply

What if all drivers bought a stake in Uber and/or Lyft?

Remember, these companies are publicly-listed so buying shares is easy. If enough drivers collectively bought shares it stands to reason, taking a play out of the shareholder activism playbook, that a big enough driver-shareholder group could effectively demand changes at the rideshare companies. You also don’t have to own the whole company. If a driver group owned as little as 1% or 2% of Uber and/or Lyft, it would make that group one of the largest shareholders of the companies.

Owning 1% of Uber or Lyft Isn’t Going to Change Anything. Why This Thinking is Wrong?

This is probably the first pushback on this concept. Many drivers and labor groups understand anyone can buy a few shares in Uber or Lyft, but often think that it’s not going to move the needle. Such thinking though lacks imagination because the gig economy (and unions as well) has always been about the law of large numbers. Scale.

Part of the reason Uber and Lyft are influential relates to the fact that they’ve created a several million strong “flex” labor force. For example, the Independent Drivers Guild (IDG) is a union-like organization that is said to represent over 80,000 NYC for-hire drivers and 250,000 drivers collectively across New York, New Jersey, Connecticut, Massachusetts, Illinois and Florida. Now imagine if each of those 250,000 drivers owned $500 worth of Lyft shares. The power of large numbers becomes apparent.

250,000 x $500 worth of shares = $125 million or about 2.5% of Lyft’s equity (as in the entire company) based on today’s market value!

Some may still shrug their shoulders and say well owning 2.5% of Lyft is not really that big of a deal. However, an aligned shareholder group owning 2.5% of a large publicly-listed company will make that group very influential and would likely get it a meeting with management. Meeting with a CEO and executives as a large shareholder group AND independent contractor workforce will completely redefine the discussion.

Also, aligning financial incentives between labor and management is likely an efficient road to an equitable and balanced business model for all parties. As famous investor and Warren Buffett partner Charlie Munger once said, “Show me the incentives and I will show you the outcome.”

“Show me the incentives and I will show you the outcome.” - Famed Investor & Warren Buffett Partner Charlie Munger

“Greed Is Good”. What Can We Learn From Gordon Gekko & Carl Icahn?

Gordon Gekko, the iconic and controversial character played by Michael Douglas in the movie Wall Street, is famous for the infamous “Greed is Good” speech. While Gekko ends up being a bad marketplace actor that trades on inside information and doesn’t really care about labor (i.e., promises his young protégé Bud Fox (played by Charlie Sheen) a chance to turnaround his father’s failing airline only to renege on his promise later…watch the movie, it’s good!), there is still a lot to consider about somethings Gekko says in the movie.

We believe Gekko hit a nerve with many people when he delivers his famous speech. The executive and management “class” seem to be unfairly benefiting from the work of others. Put another way, executives get all the benefits, financial and other, while the average shareholder and worker is left with little or nothing for their investment and work.

As Gekko says in his “Greed is Good” speech…

“Teldar Paper [Company Gekko is going after] has 33 different vice presidents each earning over 200 thousand dollars a year. Now, I have spent the last two months analyzing what all these guys do, and I still can't figure it out.” - Gordon Gekko, Wall Street

Recently, we were watching a documentary on Wall Street legend Carl Icahn, who many believe Gekko is based on. While you may agree or disagree with Icahn and people like him, we think what comes across in the documentary is that he genuinely believes in driving change at companies via becoming a shareholder. He is the quintessential shareholder activist, buying stakes in companies to drive change. Separately, his story from a middle class family in Queens to a billionaire is also interesting to understand, regardless of your opinion of him as a person.

Conclusion

Yes, it’s not lost on us that what we are suggesting is a long shot (also known as a 🚀 moonshot) idea. However, things that facilitate meaningful change, from business to politics, are usually moonshots in the beginning.

We believe an open-minded person can often turn their hatred or skepticism of Wall Street “types” and tactics into tools that they can use to facilitate change. In addition, many of these tactics are not unethical or illegal, in our opinion. If drivers owned shares in Uber and/or Lyft, they could get a seat at the table. Instead of being subject to the monopoly, own part of the monopoly.

In addition, there would be a financial incentive for all parties involved to reach agreeable outcomes. For example, if drivers are happier, driver turnover goes down which in turn reduces driver marketing and incentive spend, increasing profits for all shareholders, including drivers.

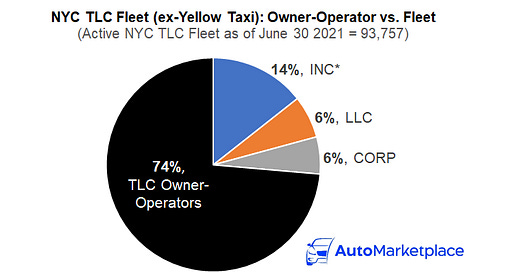

Yet another way to drive change is for a group of drivers to own more of the limited supply of NYC taxi medallions and/or for-hire vehicle licenses (TLC Plates). Basically, driving change via being a shareholder in the “supply” Uber, Lyft or any NYC for-hire transport company relies on. Owning a lot of the “supply” might also make it easier to launch a competitor to Uber and Lyft in NYC.

This is a big topic that we’ll return to again with more technical articles in our [+] section. Oftentimes the first step in facilitating huge ideas is to deeply understand how a company works or the logic of an investment proposal. Stay tuned!

⚠️⚠️⚠️ Disclaimer: Do not rely on our opinions or statements to make financial and/or investment decisions ⚠️⚠️⚠️

AutoMarketplace covers the NYC for-hire transportation industry and automotive news. Check out AutoMarketplace on YouTube ▶️

🗣️ Interested in advertising with us? Click here

NOT financial advice, do not rely on our opinions or statements to make financial and/or investment decisions ⚠️⚠️⚠️

I’m done with this industry. I started with Uber in 2014 and it’s been nothing but disappointment after disappointment. I’m not going to go into details but this is one of the few industries where you actually become better at your job, gain experience, and are rewarded with lower pay, lower prestige, and the indignity of being told you’re not welcome to drive because there is some feud over a nuance about a rule that’s totally out of your control. Uber is in the unenviable position of mostly only trying to satisfy their shareholders. That’s it. They want to take as much money as they can from riders and give as little to drivers. It’s a good formula for them. Drivers are nothing more than a commodity for rideshare companies. We are easily and summarily deactivated, suspended (by TLC), locked out, and now waitlisted. Here’s the best part: WE (the drivers) PAY both rideshare companies and TLC with our money for these “privileges.” I ran into a busboy today at a seaside restaurant and asked him how much he was paid. $16/hour plus tips. That hourly rate is not too far off from what we make and we have to bring an automobile into the equation by either leasing or purchase. It’s insane. And if you want to make over $100k it’s possible but be prepared to not have a life.

With Uber now possibly monopolizing this NYC market all bets are off. That’s an FTC situation and the Federal government should now be looking at the relationship between City Hall and Uber. There’s something weird going on there, no different that the weirdness between Revel and City Hall.

Despite all this, it’s still a race to the bottom. Those who don’t have the financial and/or logistical means of having an electrical vehicle will be crowded out in a game of musical chairs until 2030. Then your fossil-fueled car will no longer be needed, no matter how new. Self-driving cars will come to NYC., so your driver driven electric vehicle will no longer be welcomed. I used to think NYC would never succumb to autonomous vehicles but the way that Uber seems to control City Hall (not the other way around) has now led me to believe autonomous vehicles will absolutely take over.

And drivers? Well, drivers are like trying to corral 100,000 cats. Good luck with that. You can’t get them organize, form a strong union, nor invest 500 bucks into Uber. These are the same people that will tap your rear bumper in traffic, cut you off on the road, and have road rage with you. This is not a brotherhood.

This was a decent industry for a while but I’m going to go into a profession whereby a robot, AI, or a remote person in another country can not do my job.

Good luck!

Uber is definitely running things here, the deal doesn’t really secure anything but Lyft locking out drivers for longer periods of time in order to reach a number they could’ve reached if they would’ve hired accordingly to their demand, it would’ve never been a problem to begin with and it would’ve bought enough time plan for future supply controls rules, etc. Rules need to be amended and I assume they will be but that doesn’t mean that they will be beneficial to Lyft for example, at least not if they are trying to protect drivers income, at the end of the day Uber states they can keep their drivers busy and being the fact UR is measured on a calendar year we have to give them the benefit of the doubt, Lyft clearly cannot, that’s mismanagement on their side in some part since the rule was there and they knew they needed to follow, or What? They purposedly mismanaged so Uber can start lockouts and they can follow suit and then ask for fairness from TLC rules? I think in part if their death in NYC was to come due to UR, we would understand how it happened, but if rules are amended to anything that explicitly protects drivers income are they going to survive unless they get rid of at least half of their drivers? Point is, this “handshake deal” is just buying time and trying to stop protests and stuff like that.