Discover more from AutoMarketplace

🎩🖤 Uber NYC Lockouts Working? TLC Needs To Prevent Monopoly Enabled By Regulatory Capture

Industrywide UR is edging closer to 53% regulatory floor, but Lyft losing market share and drivers losing flexibility. TLC must either drop or adjust UR-based pay formula to prevent Uber NYC monopoly

TLC has updated year-to-date (YTD) utilization rate (UR) figures in its Factbook to reflect May 2024 data, but removed pre-April 2023 UR stats

Uber NYC lockouts started in mid-May and appear to be working at increasing industrywide utilization

May industrywide UR was 54.4%, May YTD UR of 52.1% within reach of 53.0% floor that’s enforced on a calendar year figure from January to December

Lyft is beginning to lose market share vs. Uber, AutoMarketplace believes TLC’s UR-based pay formula is at fault and must be dropped or adjusted ASAP

Driver earnings must be protected, but allowing for a competitive marketplace and ensuring drivers have flexibility, must also be prioritized

In our last article, we wrote:

⚠️ Note: TLC needs to check whether year-to-date UR calculations accurately reflect May data, as it appears to be the same as April 2024

The TLC has now quickly updated ✅ the unintentional error and we paste (see below) the corrected year-to-date (YTD) UR figures that appear in the regulator’s much followed Factbook. The TLC also deleted pre-April 2023 UR figures and we’re not sure if that data will reappear and/or be adjusted in future updates.

Two notable observations from the updated TLC data, that were not mentioned in our last article:

📈 Industrywide YTD UR has now passed 52%. Remember, the industrywide UR figure used in the TLC’s driver minimum pay formula is a calendar year number (January to December), so there might be some months (i.e., January, August) that can drag UR lower but are offset by other, busier months (i.e., June, September). Increased industrywide UR is likely (at least partially) explained by Uber lockouts that began in mid-May.

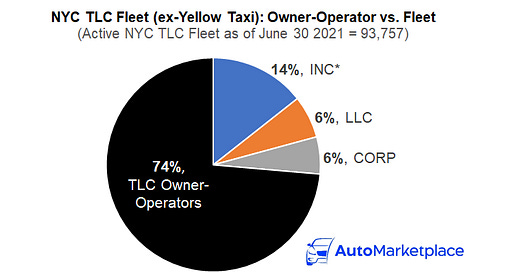

🩷 vs. 🖤 Lyft’s market share (vs. Uber’s) is decreasing and now sits at 25.6%. May YTD data shows Lyft’s market share of NYC high-volume (HV) trips decreasing to 25.6%. For context, when the TLC began publishing UR data, Lyft had a ~28% market share. In other words, Uber is becoming more dominant. We think TLC’s UR-based pay formula is creating a “regulatory capture” dynamic that Uber is benefitting from.

Also of note, Uber executive Josh Gold recently revealed to City & State that 10% of yellow cab trips now originate via the Uber app! 👀 As we’ve mentioned, yellow cab “e-hails” are not subject to utilization rules (this is a loophole that uniquely benefits Uber in our opinion, and negatively impacts non-taxi medallion NYC for-hire (TLC) drivers).

“Gold achieved the détente by positioning Uber as an ally in the taxi industry’s recovery; 10% of taxi rides are now referred to Uber drivers.”

- City & State. July 29, 2024.

We wanted to thank AutoMarketplace friend Carolyn for flagging this (we’ll write more about this in another article).

Article continues after advertisement

Did you know? Drivers enrolled in Drivers Benefits can receive up to $2K in dental services1 each year, plus many other valuable Health & Wellness benefits – all at NO COST to you!

Let’s Explain…

Without repeating what we already stated in our last article, Uber began “locking out”, or restricting access to, NYC TLC-licensed drivers in mid-May, with Lyft following in mid-June. While May is a generally a busier month and UR was expected to increase, Uber lockouts 🔐 undoubtedly helped bump up the figure.

YTD industrywide UR is now only 0.9% off the 53.0% TLC regulatory floor, which is based on a January to December calendar year figure.

Given that (1) June is usually a busy month for overall trips, (2) Uber lockouts were in full swing in June, and (3) Lyft also began lockouts in June, YTD industrywide UR might come close to breaking 53% in the next Factbook update. Let’s see! 🤔

In terms of Lyft losing market share vs. Uber, we’ll frame why we think it’s happening, as follows. When NYC drivers are subject to lockouts because (do not reverse cause and effect) Uber and Lyft are financially incentivized to legally comply with TLC’s UR-based minimum pay formula, it appears drivers could be choosing one app over the other, out of fear 😟 that they will lose ❌ access to their “main” app (i.e, NYC TLC-licensed driver is going to focus more on Uber trips to make sure they don’t lose access to Uber, which might cause them to lose Lyft access or priority).

We are flagging this (again) to make drivers and the TLC aware of the potential consequences of allowing Uber to measured on a standalone UR basis (what Uber is lobbying for).

We wrote about this a few months ago:

“Fair Point, But BEWARE!

We empathize with Uber’s complaint re. the use of a industrywide UR metric and in fact recently called for the TLC to eliminate the UR metric altogether. Instead, we believe the TLC should focus on strictly capping for-hire vehicle supply (TLC-plated vehicles) and even potentially consider limiting the issuance of NYC TLC commercial driver licenses.

….

Our warning to NYC TLC drivers, is if Uber is judged on a standalone UR basis two things will likely happen (*our opinion*):

UBER KILLS LYFT: Uber’s much larger trip market share in NYC (~75% (Uber) vs. ~25% (Lyft)), will likely result in previously “dual-app” TLC drivers choosing to be online with Uber more. In a standalone UR world, Lyft will be forced to launch much stricter NYC driver lockouts, to increase its UR (i.e., Lyft is not benefiting from Uber’s higher UR). This will create a “doom loop” for Lyft, where Lyft NYC driver supply declines, passenger wait times go up, passengers then increasingly prefer Uber, Uber gets more trips, drivers are more attracted to Uber, etc. etc. Uber finally kills Lyft in NYC. 😵 Death by UR.

UBER-ONLY, LYFT-ONLY NYC DRIVERS: If Lyft is judged on a standalone UR basis, it will need to launch stricter driver lockouts to increase its UR. This also might cause Lyft to send more trips to a smaller subgroup of “Lyft-only” drivers who will basically only work for Lyft, earn more and will be incentivized to abandon Uber. Again, given Uber’s much larger share, Uber again likely comes out ahead and increases their relative NYC trip market share.”

It should be noted, the current UR status quo remaining will also likely result in UBER-ONLY, LYFT-ONLY NYC DRIVERS. Driver lockouts are usually based on how busy you are with one app, so drivers will likely choose to go “all-in” with one app vs. the other.

- AutoMarketplace (May 16, 2024)

We also speak to our logic in the below video at 0:27:29 as to why we think Uber or Lyft standalone UR 👎 is a bad idea.

TLC Needs To Either Drop or Adjust UR-Based Minimum Pay Formula, As Soon As Possible

Our readers will know our stance on how we believe lockouts can end:

The TLC should keep minimum per mile and per minute rates (adjusted for *real inflation) and not use utilization (UR) in its driver pay calculation. Instead, the TLC should focus more on its unique ability to control for-hire vehicle licenses (TLC Plates and/or TLC Driver Licenses). Utilization will take care of itself if supply is appropriately controlled (the humble origin of the taxi medallion 🚕).

If the TLC does want to keep a utilization (UR)-based pay formula the regulator should increase the high-volume for-hire services (HVFHS) threshold to 100,000 trips per day. This will ensure Uber does not use UR-based driver pay rules in a way the TLC did not intend. This adjustment will prevent a marketplace monopoly (or duopoly) from forming.

“If the TLC and NYTWA want to keep a UR-based NYC driver minimum pay formula, our suggestion would be to raise the HV daily trip threshold to 100,000 trips. This will allow more competition to enter the market and give drivers hope that more options will arise.”

- AutoMarketplace (June 25, 2024)

Competition Shouldn’t (Unintentionally) Be Killed Via TLC UR-Based Pay Regulations

On point (2) above, we’ll refine why we are suggesting the TLC increase the daily trip threshold (from 10,000 to 100,000 trips per day) for a business to be considered a high-volume (HV) service or base.

If total HV, or Uber and Lyft, trip volume is ~20 million NYC trips per month that would mean the following:

~20 million trips per month / ~30 days = 665,000 Uber and Lyft NYC trips per day

Lyft has a ~25% market share or ~165,000 NYC trips per day

Uber has a ~75% market share or ~495,000 NYC trips per day

The rest of the market, including yellow cabs, represents ~20% of trips (that’s it!)

Right now, any NYC base or dispatching entity (“doing business as” or d/b/a name) is subject to TLC’s UR-based driver minimum pay rules when it breaches 10,000 trips per day, or a mere 1.5% to 2.0% total market share. By raising the HV threshold to 100,000 trips per day or ~15% total market share, it will encourage competition and prevent an Uber monopoly or an Uber and Lyft duopoly.

Bloomberg recently reported that the TLC was set to propose new rules in “the next couple of months” to address Uber & Lyft driver lockouts. We hope the regulator understands how much is at stake and why it needs to really think about what’s actually causing lockouts. It’s sometimes hard to look in the mirror and acknowledge mistakes (everyone makes them). Our criticism of past TLC policy errors has always aimed to be constructive.

We also know the regulator’s intentions are generally noble. NYC TLC Chair David Do is a genuinely nice person, but one who’s learning on the job and it’s costing working class New Yorkers their livelihoods. It’s important to get the rules and regulations right. Unfortunately his TLC continues to be outsmarted by Uber, a very intelligent and sophisticated operator that knows how to “win”.

We want to see a successful NYC for-hire regulator and marketplace where drivers earn a respectable wage, have more options to choose from, can work when and where they want and a place where new businesses can arise. There is a place for Uber in this marketplace, a very important one that they have earned by outcompeting others. However, Uber should not be be allowed to gain a monopoly 🎩 grip on NYC’s for-hire transportation market. The City and TLC must promote a regulatory environment that allows new entrants to effectively compete (i.e., Uber can still beat back new competition, but not via regulatory capture).

Time is running out to prevent an Uber monopoly. The TLC must act sooner, rather than later.

So here's some facts for you. I am earning on average 11% less per day. In the same 9-10 hour work day, I spend between 1 and 4 hours driving around trying to position my car in a place where Uber or Lyft will allow me to log on. This means my expenses have actually INCREASED while my revenue has DECREASED. So to see a headline suggesting lockouts are "working" is a bit galling.

I don’t think there’s a successful way out, any decisions made will be the beginning of some other issues that may arise. TLC creating or adjusting rules doesn’t guarantee they will not be outsmarted by Uber again, at the end of the day if there’s no negotiation in between things are going to continue to work the way they have been working for some more years,I personally think rules need to be adjusted but TLC needs to sit down with Uber and Lyft and work certain things out as well. Creating a more diverse FHV maketshare sounds like the right thing to do specially if you trying to avoid a monopoly or duopoly but we also have to remember that bringing more competition can bring also a little bit more of affordability (only a little bit not much, since pay rates won’t allow much of it) and that’s not something the City or specifically the MTA is looking forward to, at the end of the day we don’t know if the rules were created to make sure that not more than 2-3 companies can survive the UR. 🤷🏻♂️

TLC doesn’t have it easy, they need to make sure their decisions also don’t affect other City interests.