Discover more from AutoMarketplace

☂️🚕 American Transit (Officially) Insolvent?

Historic Q2 loss implies TLC insurance giant American Transit is insolvent. Will regulators and/or TLC step in? What it could mean for NYC drivers, fleets, brokers, Lyft & Uber?

American Transit Insurance Company (ATIC) has an over 60% NYC for-hire transport insurance market share and could be considered “Too Big to Fail”

Based on recent financial filing, ATIC appears to be technically insolvent

In our understanding, New York State insurance regulator (DFS) must now decide to either help rehabilitate insurer or move to liquidate

NYC TLC drivers & fleets could face large premium increases, TLC insurance brokers lower commissions, but competition might enter marketplace

Thousands of NYC drivers and fleets at risk of losing TLC plates due to inability to acquire or afford insurance

***Disclaimer*** Nothing we say or write should be the basis of an investment or business decision, financial determination or relied upon to predict how government agencies or regulators may or may not act.

TLC insurance giant American Transit Insurance Company (ATIC) continues to make headlines. Not the good kind 😐.

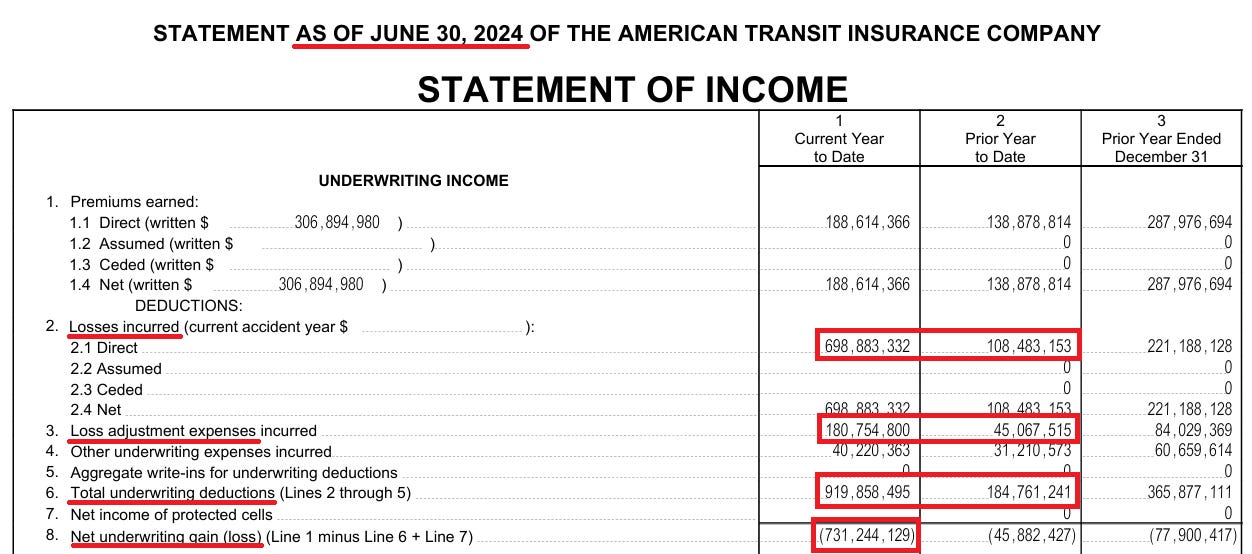

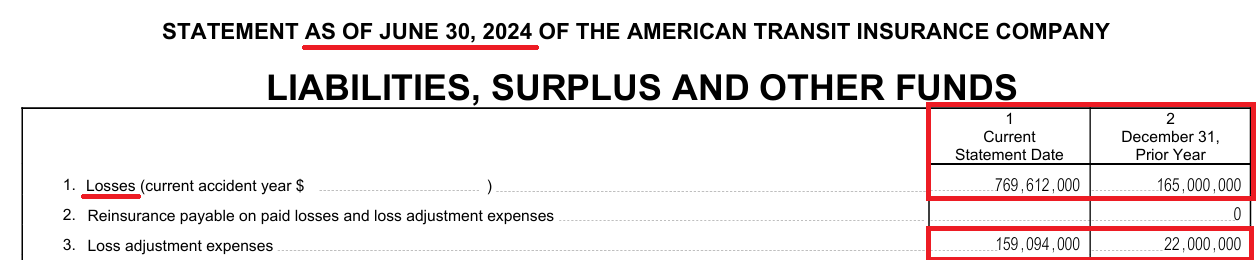

Based on a recent, publicly available financial statement, ATIC has recognized a historic negative $700+ million loss in Q2 2024. Basically, American Transit has indicated the estimated cost of its claims are much, much higher than previously disclosed. In our understanding, the loss means ATIC is technically insolvent. In other words, if American Transit had to pay out claims it estimates it might be liable for, it wouldn’t have enough money (to the tune of over $650 million).

In fact, according to insurance industry executives we spoke to, who also cited reporting by S&P Global’s Tim Zawacki, American Transit’s loss is the largest downward quarterly revision for an individual U.S. property & casualty (P&C) insurance company in the last 15 years! The underwriting loss was so large that it meaningfully impacted stats that measure the health of the entire U.S. commercial auto liability market 👀 .

For those who’ve been following the American Transit story, the historic loss might not be surprising, given previous independent actuarial findings. In fact, other insurers and Uber, which is currently suing ATIC, might be encouraged to see the losses officially being recognized. That being said, while we recently reported that Uber and American Transit might be heading toward a settlement based on legal filings, our interpretation was likely naive and optimistic.

In fact, given the above financial disclosure, we’re not even sure how ATIC would come up with the money to pay any meaningful financial settlement 🤔, even if Uber succeeds in its legal action against the company.

“Ronald Kuehn of Huggins Actuarial Services in a statement of actuarial opinion said the $190 million provision for unpaid losses and loss-adjustment expenses made by American Transit Insurance Co. is $508.8 million less than the $698 million he considered the minimum necessary...Using his estimate, Kuehn said American Transit's statutory policyholders surplus would render it insolvent by $430.9 million.”

- S&P Global (Actuary says NY livery insurer's reserves 'inadequate' by more than $500M, by Tom Jacobs & Terry Leone, June 4, 2021)

“Furthermore, if the dominant player can continue to operate at razor thin margins for years or is indeed effectively insolvent…that is a nightmare competitive backdrop. Right now, our guess is Warren Buffett-controlled GEICO is probably not interested in the NYC taxi insurance market.”

- AutoMarketplace (February 28, 2024)

Article continues after advertisement

Did you know? Drivers enrolled in Drivers Benefits can receive up to $2K in dental services1 each year, plus many other valuable Health & Wellness benefits – all at NO COST to you!

Impact(s)? Premiums going up?

One thing we want to avoid is speculating too much, or at least too aggressively, on what ATIC’s recent financial disclosures mean for the NYC for-hire transportation (TLC) insurance marketplace.

We can share and re-share a few facts and uncontroversial observations.

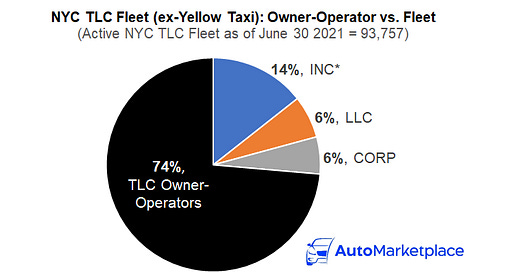

American Transit, based on TLC data and our analysis, has an over 60% share of the NYC TLC commercial auto liability insurance market.

NYC TLC premiums increased 10% to 30% year-over year from 2023 to 2024. This inflation is also, in our opinion, not correctly being reflected in the NYC driver minimum pay formula (note: might be changing soon).

We understand ATIC is cutting TLC insurance broker commissions. Given its marketplace dominance, TLC-focused insurance brokers might be experiencing (or could experience) significant financial headwinds.

If American Transit were forced into liquidation, the DFS needs to work with other insurers and/or come up with an affordable government-supported “last resort” option. If ATIC is not liquidated or rehabilitated correctly, multiple players in the NYC for-hire transportation marketplace (drivers, fleets, brokers, Uber, Lyft), would likely face significant operational challenges.

Based on our discussion with insurance industry executives and experts (please use the comment section to correct us, if we have it wrong), if an insurer can’t pay out the claims it prospectively owes, New York State’s insurance regulator (NYS DFS) will usually take one of the following two actions:

Work to rehabilitate the insurance company to make it stable / solvent

Work to liquidate the insurance company

“(2)(A) If there is a mandatory control level event, except as set forth in subparagraph (B) of this paragraph, the superintendent shall take such actions as are necessary to cause the insurer to be placed under rehabilitation or liquidation under article seventy-four of this chapter.”

- New York Consolidated Laws, Insurance Law - ISC § 1324. Risk-based capital for property/casualty insurance companies (FindLaw.com. Current as of Jan 1, 2021. Updated By FindLaw Staff.)

Since American Transit is such an important marketplace player we think the regulator will act in a potentially, unique way. After all, as we’ve mentioned before, ATIC is essentially “Too Big to Fail”. If the DFS moves to liquidate the 60% market share player, in an abrupt manner, that will likely cause major problems (we assume the DFS & TLC already know this).

For example, let’s say 25% of TLC drivers and fleets can’t get or afford insurance from marketplace alternatives, such as Hereford or INSHUR. Thousands of drivers and fleets will lose their TLC Plates (FHV Licenses). They will lose their ability to make income. They will be “deactivated” via insurance.

That being said, the regulator will likely not allow a technically insolvent insurance company to continue to write policies and collect insurance premiums in New York State, without major corrective actions. One could reasonably conclude that the regulator might force ATIC to come up with a detailed future business plan and track its progress closely.

Does this mean American Transit (in turn competitors) will increase premiums? Probably. Does this mean ATIC (in turn competitors) will try to reduce costs via cutting broker / agent fees? Probably.

The unpopular truth in all of this, and very few want to hear this, is TLC commercial auto liability insurance is likely underpriced. However, a NYC driver or fleet can only afford so much. For example, if a “true” sustainable insurance premium is a price only 40% of the marketplace can afford, what do you do? It points to deeper issues that need to be addressed at the State and City level, such as cracking down on “lawsuit lending” practices or disincentivizing frivolous insurance claims.

NYC Council Member Restler: Are you finding any issues in your review of the actuarial rates…in your conversations with the [New York Department of Financial Services (DFS)]?

NYC TLC Chair Do: I think this is a little bit counterintuitive to what you’re thinking…you’re saying the [TLC insurance] rates are high, we’re saying the [TLC insurance] rates are artificially low…

- NYC Council Hearing (March 14, 2024)

It also might mean the actuarial leeway given to drivers (i.e., measured on “loss runs”) could significantly be reduced. For example, if a driver has 2 or more at-fault accidents or even one major at-fault incident, they might not be able to drive in the NYC for-hire transport marketplace (“deactivated” via insurance).

Does Uber Need American Transit? Taxi Medallion Upside?

Finally, although Uber is suing ATIC, people must not forget the following NYC market dynamics.

“NYC is a very unique market for Uber and Lyft not only because of its size, but also due to drivers paying for commercial liability insurance (and needing a commercial driver’s license) when using “Uber X” (+ Lyft’s equivalent service offering).

For example, a driver servicing an Uber X trip in Miami does not need to have a commercial driver’s license or commercial vehicle plates, they can keep their “regular”, non-commercial Florida plates. How is that possible? What’s happening is Uber and Lyft are actually providing the commercial liability coverage while that Miami driver is logged into the app. This insurance dynamic is often cited as a justification for why Uber and Lyft might take 25%+ of a trip’s fare in markets outside of New York City.

In NYC, it appears Uber and Lyft have much lower operating costs because they are not directly paying for commercial liability insurance. In other words, NYC is not only a big revenue market, it’s likely an even bigger profit center for the rideshare companies. However, they are relying on commercial liability insurers that drivers use, such as American Transit and Hereford, to pay out claims in an efficient and proper manner. If this doesn’t happen, that’s a big problem. This is another way to frame why Uber is suing American Transit.”

- AutoMarketplace (July 8, 2024)

Firstly, if American Transit is not paying out claims, that’s obviously bad for Uber (& Lyft). However, if ATIC liquidates or goes through an operational restructuring, causing insurance prices that NYC drivers and fleets pay to spike, is that necessarily good for Uber (or Lyft)? Were “fake” insurance prices allowing Uber (& Lyft) to have access to an unnaturally large NYC driver base. Would a more limited, professional NYC TLC driver base actually empower drivers (“supply”)?

The downside of course, being thousands of drivers who might not make the “actuarial cut”, being permanently locked out of the apps and NYC for-hire transport market.

Finally, any loss of TLC Plates (FHV Licenses) related to the inability of a driver or fleet to qualify for insurance will likely decrease total for-hire vehicle (FHV) supply. This might benefit the yellow cab sector. The taxi medallion 🚕 could be viewed as an attractive, scarce asset that an individual or company cannot lose due to the inability to get insurance (in the same way a person might technically lose a TLC Plate).

TLC's reckless issuance of for-hire licenses to inexperienced new drivers is directly contributing to a surge in accidents. Requiring at least five years of driving experience for all new for-hire drivers is a crucial safety measure.

Those numbers are very scary, specially because of the amount of fleet owners and drivers that rely on this “Insurance Company” it sounds just like this: “Dear current and new customers, while you continue to make your payments on time, be aware that if something was to happen to any of your vehicles we would not be able to pay neither for your damages or any other third parties involved.” Moreover, like having a policy but not really having one.